Understanding the difference between a quote and an estimate is crucial in financial transactions. Both play distinct roles in the business world and impact decision-making significantly.

While they may seem similar at first glance, understanding their distinctions is vital for effective financial management and client communication. QuickBooks, a leading accounting software, offers robust features to handle these documents efficiently, allowing for better account management and record tracking.

This guide provides insights into the importance of distinguishing between the two and how QuickBooks facilitates their access and usage.

Importance of understanding the difference

It’s essential to differentiate between a quote and an estimate to ensure clear communication and accurate financial planning. A quote and an estimate serve different purposes and understanding their disparities can streamline financial transactions, leading to better decision-making and customer satisfaction.

What is an estimate?

An estimate provides a rough approximation of the costs involved in a particular project or transaction. It helps in forecasting expenses and plays a crucial role in budgeting and resource allocation.

It is typically used in scenarios where the exact amounts cannot be determined upfront due to variable factors. Common scenarios where estimates are used include:

- Construction and contracting projects.

- Service-based businesses that depend on varying labor and materials costs.

- Manufacturing and production planning.

- Initial project consultations.

What is a quote?

A quote represents a firm price for a specific set of goods or services. It is a formal offer that gives clients a clear and final price for specific services or products. Once accepted, a quote is legally binding, and its billing information and due date are set in stone.

Characteristics that differentiate a quote from an estimate include its:

- Binding nature.

- Designated validity period.

- Specific pricing for defined goods/services.

- Formal acceptance process.

What is the difference between a quote and an estimate in QuickBooks?

The main distinction between quotes and estimates in QuickBooks lies in their legal implications and the firmness of the pricing provided.

Here is an example that highlights the difference between the two.

- Estimates: An interior design firm uses estimates to give an initial price range for room renovations, which can change once the actual work begins.

- Quotes: A web development company provides a quote for the total cost of a website build after the requirements are fully defined.

When to use: Quote vs. estimate

Here’s a scenario-based guide to help you decide between the two:

- Use a quote for formal price offers. Quotes are only useful when project details are clear and the client expects a guaranteed price.

- Use an estimate when project specifics have yet to be determined or when costs are likely to vary. Estimates are used to project project costs and initiate discussions.

In a nutshell, you should use quotes for formal offers with specific pricing for goods and services. On the other hand, you should use estimates to approximate costs and build opportunities.

How do you give an estimate and quote?

Here’s how to create and send an estimate in QuickBooks:

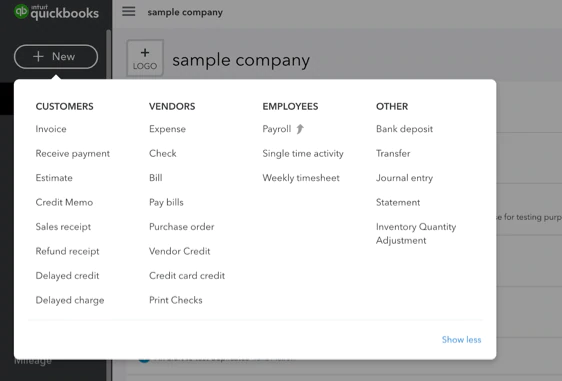

1. In QuickBooks, navigate to the “Estimates” section:

- For QuickBooks Online, click on the “+ New” button at the top of the left sidebar.

- For QuickBooks Desktop, go to the “Customers” menu and select “Create Estimates.”

Image credit: Intuitive Accountant

2. Choose the customer you want to send the estimate to, or create a new customer:

3. Enter the estimate details, including:

- Product or service details (i.e., quantity, work being done, etc.).

- Estimated rates and taxes.

- Date.

- Estimate ID number (typically done automatically).

4. Customize your estimate layout and add custom fields if needed.

5. Review and double-check all the details.

6. Send the estimate:

- For QuickBooks Online, you can send the estimate directly from the platform via email. Click on “Save and send” to email the estimate to the client. You can also save it as a draft or print it out for manual delivery.

- For QuickBooks Desktop, it’s easiest to print out the estimate and mail it to the client. But if you’ve set up email services in QuickBooks, you can email it directly from the software.

The steps to create and send a quote in QuickBooks are very similar to the estimate process:

1. In QuickBooks, you can’t directly create quotes. Instead, you need to use workarounds:

- For QuickBooks Online, click on the “+ New” button, then select “Invoice.”

- For QuickBooks Desktop, you can navigate through “Customers” to “Create Estimates” or “Create Sales Orders” depending on your setup.

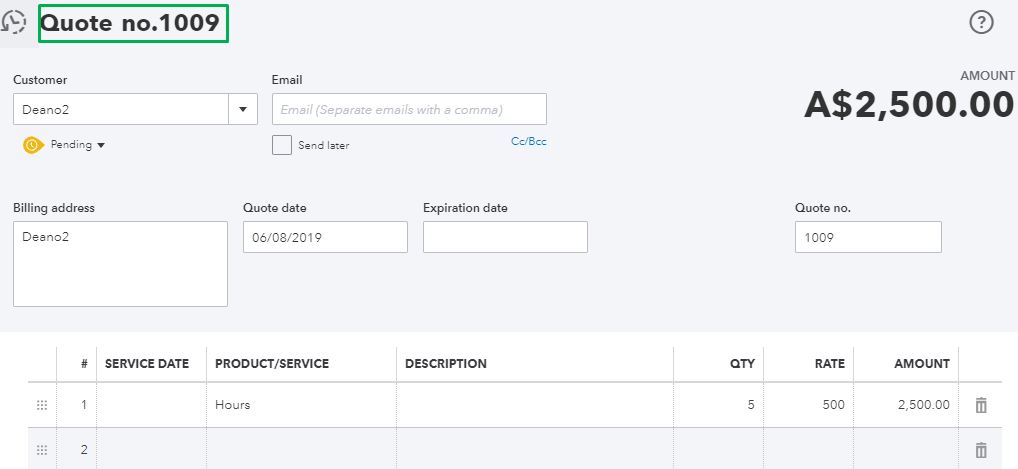

2. Set up your financial document as a quote:

- You can modify your invoice, sales order, or estimate template to serve as a quote. Rename the title in the template from “Invoice” or “Estimate” to “Quote.”

Image credit: QuickBooks

3. Select the customer or add a new one.

4. Enter quote details (see steps above).

5. Customize the layout, add branding, and include additional necessary details.

6. Review and double-check the quote.

7. Send the Quote:

- For QuickBooks Online, you can directly email the quote to the client by selecting “Save and send.” This will send an email to their inbox with the quote attached as a PDF.

- For QuickBooks Desktop, you can print the quote to mail or hand over physically. If you have email set up, you can send it directly from the program.

What should be included in a quote and estimate?

Essential elements for every quote and estimate include:

- Itemized list of services or goods with detailed descriptions.

- Breakdown of costs.

- Terms and conditions.

- Contact information.

Providing accurate and detailed quotes and estimates not only reflects professionalism, but also prevents disputes and misunderstandings to ensure client satisfaction and trust.

How do you estimate a quote?

Step 1 of estimating a quote involves carefully considering the:

- Costs.

- Pricing strategy.

- Market competitiveness.

Balancing competitive pricing with profitability is key to successful quoting. To accomplish this, make sure that you:

- Research market prices.

- Consider all costs involved.

- Offer value-added services.

Key takeaways

In summary, here’s what you need to know about the QuickBooks estimate vs. quote distinction:

- Understanding the difference between the two is crucial for accurate financial planning.

- Estimates are general cost and project scope approximations.

- Quotes are formal and legally binding once approved.

- QuickBooks provides effective features for managing quotes and estimates.

For a better way to handle your QuickBooks quotes and estimates, consider integrating with third-party software like Method:Field Services. Tools like Method let you create quotes and estimates instantly, then convert them to invoices in a matter of seconds.

QuickBooks estimate vs. quote: Frequently asked questions (FAQs)

Can I customize the estimate form in QuickBooks?

Yes, you can customize the estimate form in QuickBooks to include:

- Your branding.

- Specific terms.

- Other custom fields.

This ensures a professional and personalized representation of your business.

What are the types of estimates in QuickBooks?

QuickBooks offers various types of estimates, such as:

- Standard estimates.

- Progress invoicing estimates.

- Time and costs estimates.

Each of these estimates is suited for a different project scenario.

Are estimates and quotations legally binding?

Estimates are not legally binding and serve as approximations. In contrast, quotations, once accepted, become legally binding contracts, outlining the terms and pricing for specific goods/services. Understanding the legal implications of each is vital for clear and transparent business dealings.

See how Method supercharges your QuickBooks estimates and invoices.

Image credit: pressfoto via Freepik