During the whirlwind that COVID-19 has been, many of us have heard about the paycheck protection program but may not fully understand it.

A result of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the paycheck protection program’s goal is to help small businesses pay and retain their staff during COVID-19.

By offering 8 weeks of funding to small businesses through loans or grants, the paycheck protection program aims to keep people employed and small businesses afloat during this time.

The challenge, however, is the time it takes for small businesses to receive these government-backed loans through banks and the Small Business Administration (SBA).

With nearly 50% of American small businesses having a cash reserve that will last 2 weeks or less, fast access to aid relief and economic stimulus loans are crucial.

“50% of American small businesses have a cash reserve that will last them only 2 weeks.”

JPMorgan Chase, 2019

This is why companies like Intuit QuickBooks have stepped up to reduce the time it takes for small businesses to receive funds from the paycheck protection program.

QuickBooks was named as a direct lender by the SBA, giving them the power to accept, approve, and fund paycheck protection program applicants.

How the QuickBooks paycheck protection program works

The QuickBooks paycheck protection program is open to all QuickBooks Payroll and Self-Employed TurboTax customers. The program automatically processes the payroll information small businesses need to submit so the funding and application process is simpler and faster for small business owners.

How to prepare for the QuickBooks paycheck protection program

With funds for the QuickBooks paycheck protection program drying up fast, here’s what you can do to prepare for the next round of QuickBooks Capital loans.

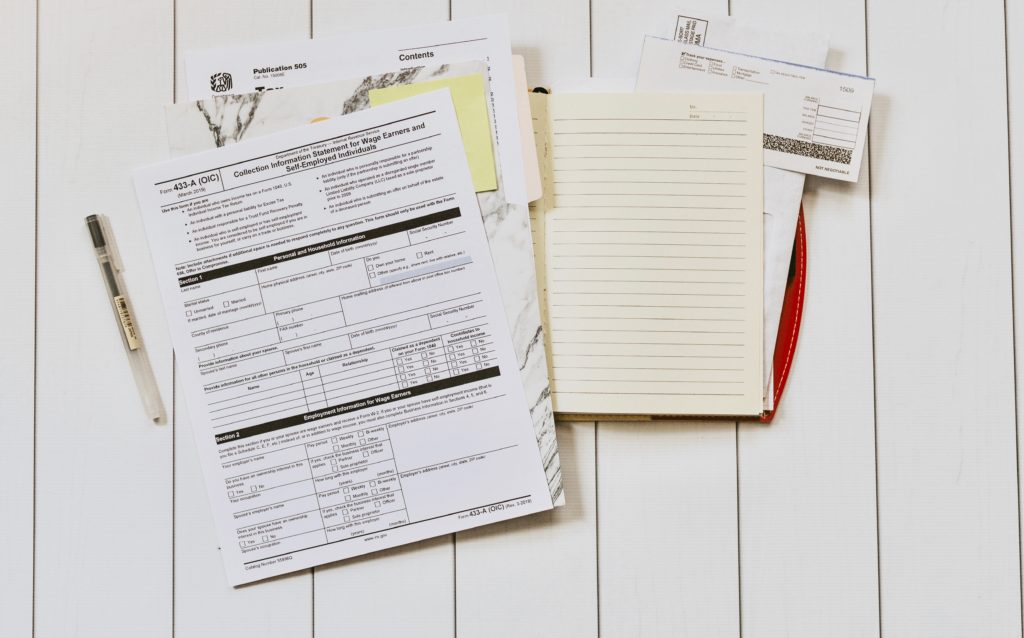

Get your documents in order

To apply for the QuickBooks paycheck protection program, you’ll need:

- Articles of incorporation and by-laws/operating agreements for all borrowing entities

- A list of stakeholders who own 20% or more of your business with a copy of each stakeholder’s driver’s license

- Proof of payroll including:

- Records to verify payroll expenses

- A payroll summary with corresponding bank statements

- IRS form 940: Employer’s Annual Federal Unemployment (FUTA) Tax Return

- IRS form 941: Employer’s Quarterly Federal Tax Return

- Summary of the benefits your employees receive such as vacation time, health insurance, and pension plans

- A list of your employees and their salaries

- You will need to indicate which employees live in the U.S. and provide proof of their residency

- A profit and loss statement for the 12 months before your application date

- A copy of your most recent mortgage/rent payments and utility bills

Create a business plan that lets your loan be forgiven

Under the paycheck protection program, certain expenses will allow your loan to be forgiven and converted into a grant. To make the most of the QuickBooks paycheck protection program, you’ll want to create a business plan that ensures as much as your loan is forgiven as possible.

To qualify for loan forgiveness, you’ll have to spend the funds you get through the QuickBooks paycheck protection program within 8 weeks of receiving them. While you can continue to use the funds after this period, you won’t be able to claim loan forgiveness on these expenses.

Where you spend your QuickBooks paycheck protection program money also matters when it comes to loan forgiveness. Use the funding for expenses in the following categories to ensure as much as your loan is converted into a grant as possible:

- Employee payroll

- Employee benefits such as healthcare and tuition

- Rent or mortgage interest payments

- Utility costs

It’s important to note that you can only spend 25% of the money you receive on non-payroll expenses such as rent and utilities if you want your loan to be forgiven.

Since the program is intended to stop people from losing their jobs, employee headcount and salaries also play a factor in loan forgiveness eligibility. As a result, your business plan will need to support the same number of staff you employed before COVID-19 at full pay.

Wrap up

As the #1 QuickBooks CRM in the Intuit app store, we’ll be following the QuickBooks paycheck protection program closely and will continue to update this post as new details become available.

While you work on your QuickBooks paycheck protection program application, here are some additional small business resources to help get you through COVID-19.

Learn how Method CRM helps businesses impacted by COVID-19 work from home with ease.

Image Credit: Kelly Sikkema via Unsplash