Tired of unpaid invoices piling up in your QuickBooks? Unpaid debts slowly create chaos in your accounts and put your business’ financial health at risk. Unfortunately, they’re the kind of problem that won’t go away on their own, and the longer you wait, the messier things become.

Thankfully, you can get your books back in order by writing off the debt. With this step-by-step guide, you’ll learn how to write off bad debt in QuickBooks in order to tidy up your accounts for a much sharper view of where your business finances stand.

What does writing off bad debt in QuickBooks mean?

Writing off bad debt is about accepting that a customer just isn’t going to pay their invoice — and then clearing that amount from your accounts receivable. It’s a way to make sure your records reflect the money you’re realistically going to collect, helping to keep your finances reliable and clear.

Unpaid debts unfortunately don’t just sit there harmlessly. The more bad debt you allow to pile up, the more it can mess with your business in ways you might not expect.

All those unpaid invoices can make it look as though you’re earning more than you actually are, giving a not-so-accurate profit forecast. Plus, chasing after debts that won’t get paid is a time sink and a waste of money, often resulting in nothing to show for it.

Worse still, you could end up paying taxes on income that never made its way to your account. Simply ignoring bad debt throws off your financial accuracy and can lead to decisions made based on bad data.

Take care of this debt head-on, and keep your accounts reflecting the position of your business much more clearly.

How to write off bad debt in QuickBooks in 5 steps

If you’ve decided it’s time to write off bad debt, there’s an easy and straightforward process to getting it done in QuickBooks.

Note: The process for writing off bad debts may vary depending on your region’s accounting standards or tax regulations (e.g., U.S. vs. U.K.). Consult with an accountant familiar with your local requirements.

Let’s take a look at how to write off bad debt in QuickBooks Online.

Step 1: Open up the invoice you want to write off

Start by pinpointing the invoice that’s been causing the issues.

- Open QuickBooks Online, go to “Accounts Receivable,” and find the invoice in question.

- Double-check the customer details to make sure it’s the correct invoice, and confirm you’ve done everything reasonable to collect the payment

If you’re unsure which invoices are outstanding, you can create a report that outlines them for you:

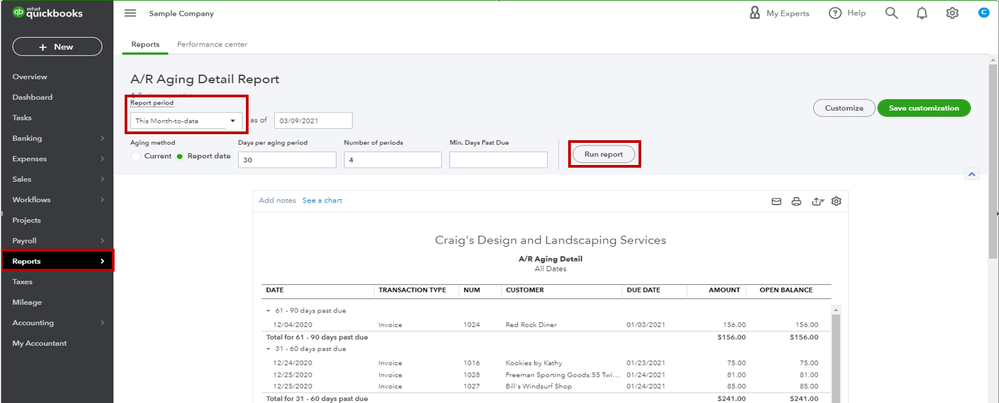

- Go to “Reports,” find and open an “Accounts Receivable Aging Detail” report.

- Check which invoices and accounts are currently outstanding.

Image credit: QuickBooks

Best practice is to review this report monthly or quarterly to identify overdue invoices that may need follow-up or write-off as bad debt. After writing off bad debts, consider running a Profit and Loss (P&L) statement to ensure your financial records reflect accurate income and expenses.

Step 2: Set up a bad debt expense account

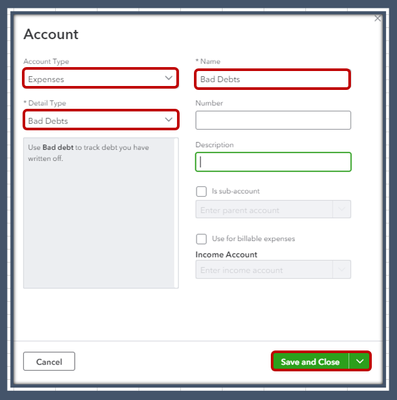

If you don’t have one already, you’ll need a specific account to keep track of uncollectable debts.

To set one up, go to your “Chart of Accounts,” click “New,” and then select “Expenses” as the account type. Name the account “Bad debts,” then save and close it.

Image credit: QuickBooks

Why this matters: This account will let you organize and track all of your bad debts in one place, so your financial statements stay clean and easy to understand at a glance.

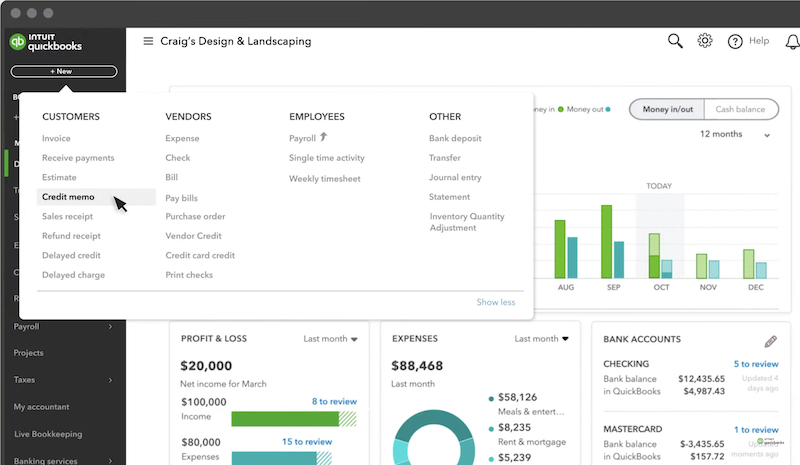

Step 3: Create a credit memo

A credit memo helps balance out the unpaid invoices on your books. Using a credit memo ensures that your accounts receivable records remain accurate and provides an audit trail for tracking bad debts.

- Generate the memo: Select “+ New” and then select “Credit memo.”

Image credit: QuickBooks

- Go to the “Customers” menu and select “Bad debts” from the “Product/Service” section. Choose the customer you want to link to the bad debt.

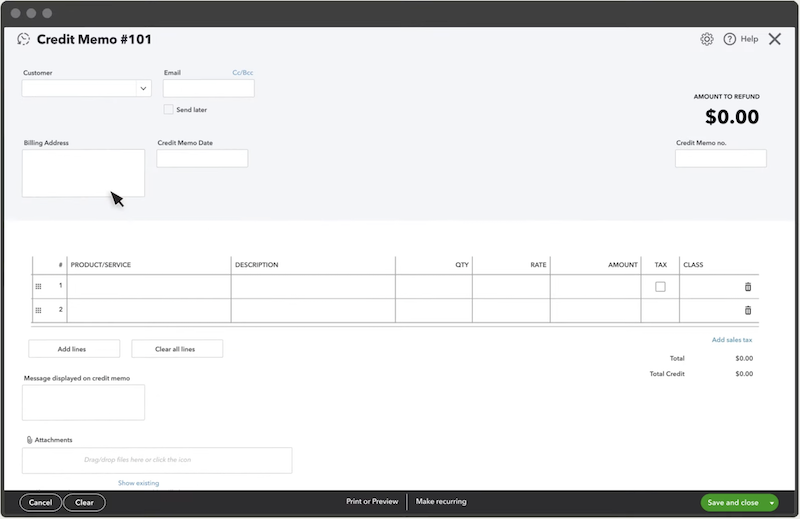

- In the “Amount” column, enter the exact amount you need to write off.

- Ensure that the sales tax is included in the credit memo if applicable. This prevents overpaying taxes on income that was never received. You’ll need to reconcile sales tax reports after creating credit memos for bad debts.

- Add the details: In the “Message displayed on statement” box, you can simply enter “Bad Debts.” This will appear on your balance statements.

Image credit: QuickBooks

- Save and close and your credit memo is created.

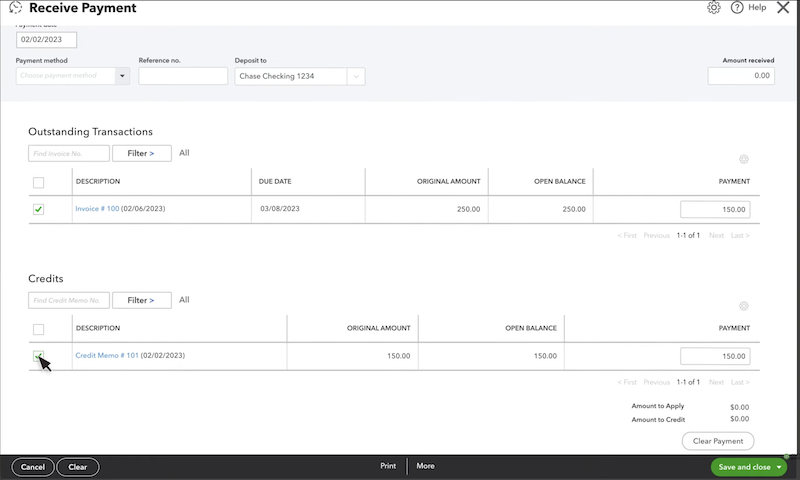

Step 4: Apply the credit memo to the invoice

Here’s where you can clear that unpaid invoice for good.

Go to “Receive Payments” under the “Customers” menu, select the customer, and check both the unpaid invoice and the credit memo to apply the credit. QuickBooks automatically selects the credit memo and the oldest open invoice, but make sure to double-check that this is the correct one. If it’s wrong, you’ll have to deselect the defaults and select the correct ones manually.

Image credit: QuickBooks

Step 5: Update your records

Finally, it’s time for you to wrap things up to ensure your financial records reflect the change.

- Click “Save and close” to record the transaction and update your QuickBooks account.

- Run the “Aging Accounts Receivable” report again to verify the invoice is no longer listed as outstanding.

And that’s how to write off bad debts in QuickBooks — you’re all done! Follow these steps for each of your outstanding invoices and you’ll get a much cleaner view of your company’s financial standing.

Why should you write off an invoice?

Unpaid invoices sit firmly in the “quiet but harmful” category. They can distort your financial reports and leave you with a misleading picture of your business’ performance.

Writing them off in QuickBooks helps make sure that your records reflect reality and not just wishful thinking.

As painful as it is to finally accept an invoice isn’t getting paid, taking this step does have several real advantages for your business:

- Smarter cash flow management: Once you acknowledge that certain debts just won’t get paid, you can manage your budget, investments, and spending far more effectively.

- Potential tax relief: Writing off your debts and thus reporting the correct cash flow to the IRS means you’ll be reducing your overall taxable income — significantly reducing your tax burden.

- More accurate bookkeeping: Removing uncollectible bad debts makes reconciliation of your accounts much simpler.

What about underpayment?

When a customer pays less than the invoiced amount, that’s what we refer to as an “underpayment.” These still constitute an unpaid amount and can have the same effect on your accounts as bad debt.

Handling these in QuickBooks is quite similar to writing off a bad debt:

- Update the original invoice to match the real amount received is your first step.

- If you do ultimately decide to stop pursuing the remaining balance, issue a credit memo for the unpaid portion.

- Allocate the unpaid amount to the bad debt expense account using the same steps as writing off an entire unpaid invoice.

Understanding and managing bad debt

The difference between just plain old debt and “bad debt” is simply that bad debt refers to any money you’re owed but can’t recover. Beyond the initial effects of hurting your revenue, bad debt clouds your understanding of how your business is performing.

Here’s how to tackle bad debts and minimize their impact:

- Run credit checks: Before executing a contract with any new customers or vendors, perform a basic credit score check. Contacting one of the three main credit agencies in North America can help you with this. These are Equifax, TransUnion, and Experian.

- Set clear terms: Be upfront with what you expect in terms of payment deadlines. Set these expectations early on, before it becomes a problem, not after.

- Follow up quickly: Don’t let any overdue invoices linger. Send reminders and follow up consistently to encourage payment.

- Use software: If you’re reading this, you’re already using QuickBooks, but integrating your accounting systems with a platform like Method means you’ll have a better picture of your customers and automated routines to remind you when invoices are up for payment.

Just like taxes and depreciation, bad debts are unavoidable in business. But unlike your customers who don’t pay their invoices, you do have control over how you manage them.

Writing these off can make a huge difference in how your business copes with bad debtors.

Avoid these common mistakes when writing off bad debt in QuickBooks

Even with all the best intentions in the world, mistakes do happen when writing off debt in QuickBooks. Here’s how to steer clear of them and leave no gaps in your financial history.

Mistake 1: Losing valuable information

Yes, we know it’s tempting to just hit the delete button on bad debt, but doing so wipes out essential transaction history. This will disrupt and corrupt the audit trails and leave a lot of “please explain” gaps in your records.

How to protect your data:

- Always use a credit memo to write off bad debts to keep them visible.

- Avoid deleting invoices entirely so your transaction history stays complete.

- Regularly back up your QuickBooks data for restore points before making significant changes, such as writing off bad debts.

Mistake 2: Items marked as unbilled

If the worst should happen and an invoice does get deleted, any items or services that were associated with it will automatically revert to an “unbilled” status. This leads to a snowball effect, creating more inaccuracies in your accounts receivable.

What to do instead:

- Stick with creating credit memos rather than deleting invoices.

- Review your “unbilled items“ after writing off a debt to make sure nothing is left floating.

- Update the billing status for all items or services to keep your records accurate.

Mistake 3: Overpaying on sales tax

Of all the mistakes, this one probably hurts the most. If you forget to record your sales tax after writing off bad debt, you could end up overpaying your tax. Essentially, you would be paying taxes on income you never received — you can see why it hurts.

How to avoid overpaying:

- Always include the correct sales tax on all credit memos.

- After making write-offs, immediately double-check and reconcile your sales tax reports.

- If in doubt, get your accountant to look over everything. A fresh set of professional eyes can catch mistakes that have been staring you in the face and get everything back on track.

Key takeaways

There you have it, a definitive guide to writing off bad debt from those invoices that have caused havoc on your books. Let’s do a quick recap:

- Stay on top of your receivables by regularly monitoring unpaid invoices to keep potential debts firmly under control.

- The steps for how to write off bad debts in QuickBooks are simple and easy to follow. Remember to create a memo and assign the correct customer invoice to the newly created bad debts expenses account.

- Use the tools QuickBooks gives you, like credit memos and reports, to keep your bookkeeping accurate and your accountant happy.

- Keep your records spotless by following this step-by-step guide to writing off bad debts in QuickBooks. You’ll have a more consistent and reliable dataset on which to base the future direction of your business.

Ready to make financial management easier?

Take things a step further by integrating QuickBooks with Method CRM. With an unbeatable two-way sync with your accounting software, Method ensures that your QuickBooks data stays untouched, up-to-date, and error-free. All changes you make in one platform instantly and securely reflect in the other.

One of Method’s standout benefits is how it simplifies managing overdue invoices and identifying bad debt. While the process of writing off bad debt is completed in QuickBooks, Method makes it easier with tools to track unpaid invoices and customer payment histories in one centralized platform. This makes it easier to identify problem accounts and take action without disrupting your financial records.

The best part? Give your team full visibility into key contact details, including:

- Lead, customer, and vendor information.

- Payment histories.

- Your business interactions.

This complete view means you can make informed decisions — whether it’s adjusting credit policies or following up on overdue payments — while reducing the risk of costly mistakes caused by manual processes.

By automating data synchronization between Method CRM and QuickBooks, you can ensure that your financial records remain clean, compliant, and error-free. Check out the video below to see just some of what Method makes possible.

If you’re ready to simplify your QuickBooks, give Method a try today.

How to write off bad debt in QuickBooks FAQs

What is bad debt in QuickBooks?

Bad debt in QuickBooks refers to money that’s owed to you (generally via an unpaid invoice) that, despite all efforts, you have determined won’t be paid.

QuickBooks allows you to write off these unpaid invoices as “bad debt expenses.” Recovering bad debt involves reversing the write-off by applying the payment to the previously written-off invoice and adjusting accounts accordingly.

The process removes the amount from your accounts receivable, ensuring that your financial reports reflect only the amount that you’re likely to collect.

Can I recover a bad debt after writing it off in QuickBooks?

Yes, bad debts can still be recovered even after they have been written off in QuickBooks. If a customer does end up paying their invoice after the fact, you can record the payment and reverse the bad debt write-off.

This process automatically updates your accounts receivable and financial statements to show the amount that has been recovered.

How frequently should I review my accounts receivable for bad debts?

Get in the habit of creating an “Aging Accounts Receivable” report to check your accounts receivable for bad debts at least once a month.

Regular checks help you catch unpaid invoices and increase the chance that you may be able to recover the debt before having to write it off. Pop it in your schedule to make sure your financial statements at months-end reflect an accurate cash flow.