Accounting trends for QuickBooks Online in 2024

From new features to AI innovations, QuickBooks has big plans for 2024. However, the new year also brings challenges for small businesses.

In this article, you’ll learn:

- Upcoming accounting trends and challenges.

- The best QuickBooks practices for 2024.

- How to scale your small business with QuickBooks.

Let’s jump in!

Key accounting industry trends and challenges QuickBooks experts are anticipating in 2024

Here are some of the top accounting trends and challenges expected in 2024, as forecasted by QuickBooks experts.

No-code automation

No-code platforms are reshaping the future of accounting. They let you create custom applications without writing a single line of code.

No-code automation offers many benefits for your small business. It:

- Speeds up accounting processes.

- Simplifies complex workflows.

- Increases productivity.

Rise of AI

Artificial intelligence (AI) is evolving, and it’s packed with innovation for businesses of all sizes. It offers new efficiencies in client interaction and template creation.

A key player in AI is robotic process automation, which lets you:

- Analyze complex data with ease.

- Manage multiple tasks at the same time.

- Distribute information swiftly.

Although AI’s potential is enormous, note that it’s wise to remain cautious and double-check results for accuracy.

Data security

Data security is a top priority for any accounting process. As you lean more on digital solutions, your need for strong data security grows. Protecting financial information is crucial for legal compliance and customer satisfaction.

So, accounting firm owners must embrace the widespread adoption of robust security protocols and train their accounting teams accordingly to stay competitive.

Cloud technology supports a remote workforce

Cloud-based accounting solutions are paving the way for remote and hybrid workforces. While cloud-based solutions enhance teamwork across distances, it becomes a new challenge to manage collaboration and internal security with an online system.

So, you need to use cloud-based accounting software effectively to keep productivity up and security tight.

Harnessing data analytics

Embracing data analytics is key for accounting and finance professionals.

By leveraging data analytics, you can:

- Spot trends.

- Predict future performance.

- Offer advisory services to clients.

Rising interest rates

As interest rates climb, businesses face additional costs for new loans. Higher rates also squeeze profit margins as the cost of servicing existing debt goes up.

To navigate these challenges, focus on financial planning and seek fixed-rate borrowing options to lock in lower rates. You should pad your budget to account for rising rates and unforeseen circumstances.

Increasing productivity

Accounting professionals are embracing digital technologies to simplify operations and cut down on manual tasks.

By zeroing in on efficiency, you can work smarter, not harder. When you ensure every task adds value to your accounting department, you drive productivity for all your workflows.

Focusing on profits over revenue growth

An emphasis on profitability over revenue defines modern small business strategies. Accountants play a crucial role in helping clients understand which segments of their business are most profitable.

Robust financial tools are excellent for this, as they provide valuable insights and enable smarter decision-making.

Focussing on profitability helps frame your goals and gauge the success and health of your business. After all, you could bring in record-high revenue and still operate at a loss.

Employee retention

The accounting industry’s competitive nature makes holding onto top talent increasingly difficult. To retain the best employees, accounting companies must nurture a positive workplace and offer paths for career advancement.

Value-based pricing

Adopting value-based pricing models is becoming more common among accounting firms. This approach charges clients for accounting services based on perceived value, rather than hours invested.

Value-based pricing boosts profitability and increases client satisfaction. However, it requires a solid understanding of the client’s needs and clear communication about the benefits provided.

Top trends in accounting for QuickBooks users

Accounting industry trends also impact small businesses that use designated platforms like QuickBooks.

Here are steps you can take to navigate 2024’s top accounting trends:

Tap into small business automation

One way to keep up with accounting trends is to tap into small business automation.

Automation changes the way small businesses manage their operations. By automating repetitive tasks, you free up time for strategic planning and value-added activities.

What is small business automation?

Small business automation uses advanced technologies to perform routine tasks that you would normally do manually. This includes everything from invoicing to customer relationship management (CRM).

Why should you automate your processes?

Automation offers significant benefits for your business. It:

- Reduces operational and labor costs.

- Minimizes human errors.

- Improves customer experience.

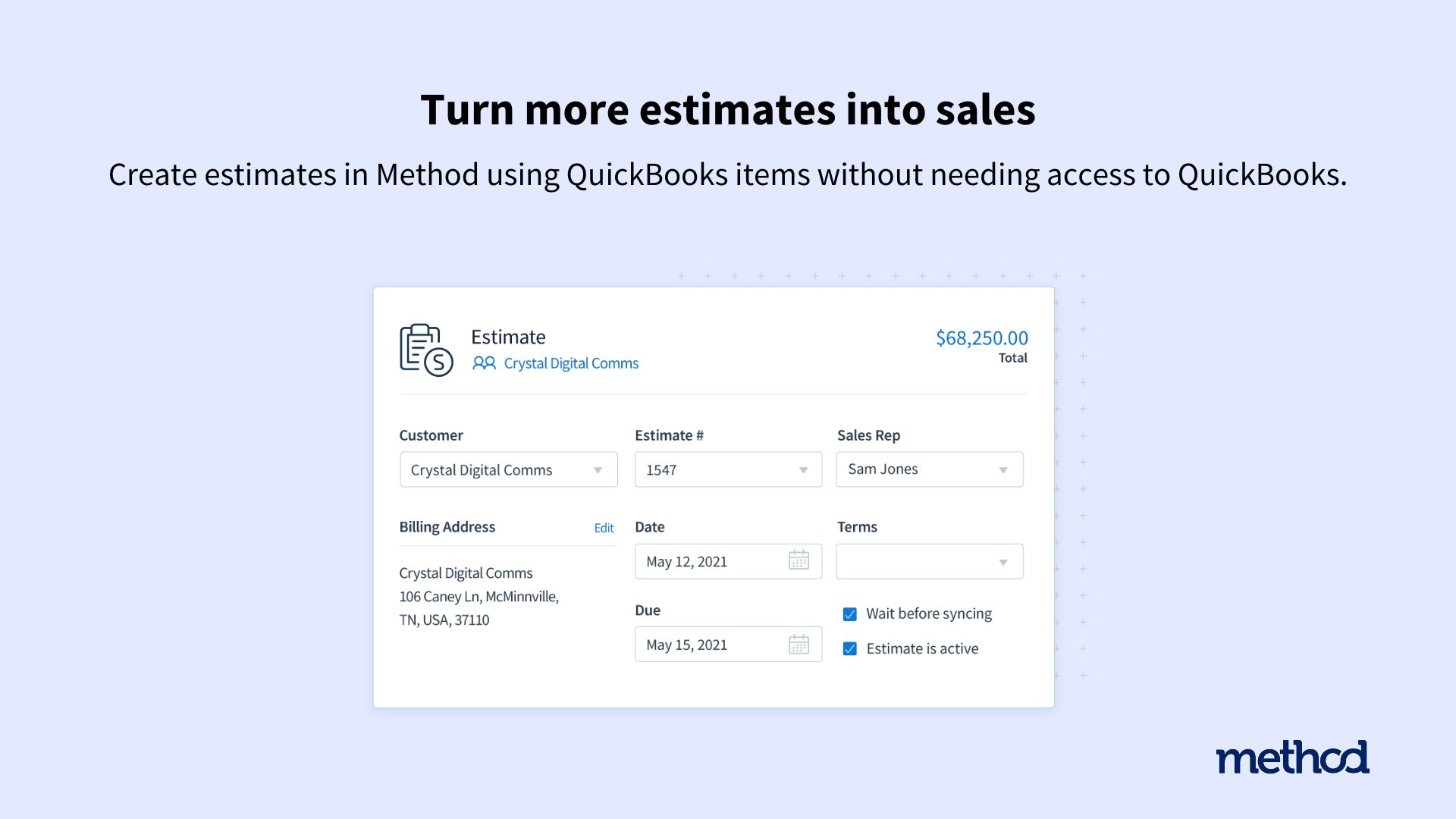

If you’re looking to automate custom workflows, Method is a top choice. It lets you easily automate your:

- Email campaigns.

- Lead generation.

- Payment collection.

- Reminders and follow-ups.

Use new QuickBooks Online features

Drawing from our experience, we recommend adopting the latest QuickBooks Online features to stay ahead of accounting trends.

Intuit is enhancing its e-commerce capabilities by introducing integrations with major platforms such as Amazon, Shopify, and eBay. These integrations let you:

- Import catalogs.

- Adjust stock levels.

- Match payouts.

In 2024, you can also expect to see inventory management updates, including new features to:

- Manage product and service items.

- Perform stock counts.

- Enhance reordering processes.

Use must-have QuickBooks Online features

We also recommend using QuickBooks’ tried and trusted features to keep ahead of trends in accounting.

One must-have feature is QuickBooks Payments, which simplifies how you manage financial transactions. It offers seamless invoicing and payment collection directly through QuickBooks for secure financial handling.

Equally valuable is the ability to mass-recategorize business transactions. This time-saving feature lets you organize your financial data by updating everything in bulk, from transaction locations to vendor details.

Follow these QuickBooks Online best practices

Stay ahead of accounting trends by following these best practices for QuickBooks Online.

Keep accounting data organized and up to date

Regularly review your accounting data to catch problems early. Also, use a checklist to ensure there are no errors or duplicate transactions.

Method is great at keeping your QuickBooks data up to date. Discover the impact firsthand from one of the platform’s many satisfied customers:

Use balance sheets

Use balance sheets to assess your business’ financial health and gather actionable insights.

Regularly clean up your QuickBooks file

Tidy up your QuickBooks files regularly and identify workflow improvements to boost your operational efficiency.

Get your transactions out of the bank feed and into your ledger

Don’t let uncertainty about transaction categorization slow you down. Place unclear transactions in an uncategorized account and refine them from there.

This ensures a complete view of your activities for accurate financial statements and reporting.

Tips for small business scaling with QuickBooks

Here are some ways to efficiently scale your small business with QuickBooks.

Use third-party integrations to grow your business

Using third-party applications like CRM integrations enhances functionality and efficiency for your small business.

These enhancements drive scalable growth through automation and improved workflows.

Tackle small business challenges in 2024 with Method

Sooner or later, every growing business hits the limits of QuickBooks. Method integrates CRM functionality with your accounting software to do what spreadsheets, sticky notes, and QuickBooks workarounds can’t.

Thanks to its two-way, real-time sync with QuickBooks, Method ensures a smooth and hassle-free process with zero double data entry. Better yet, the platform offers endless customization options to adapt QuickBooks to your unique needs.

Equip yourself with an automation tool that keeps up.

Start your free trial with Method today.