Maintaining strong accounting practices is essential for QuickBooks Desktop users. Implementing effective accounting practices:

- Ensures accuracy.

- Enhances decision-making.

- Supports business growth.

So, let’s have a look at the latest accounting best practices and trends to help your business stay ahead.

Top accounting trends for QuickBooks Desktop in 2025

QuickBooks Desktop stop-sell

One of the significant changes in 2025 is the QuickBooks Desktop stop-sell, affecting all Desktop versions except for Enterprise. This transition means that to ensure minimal disruption to their operations and financial processes, businesses must prepare for the shift and:

- Stay on their existing Desktop solution, sacrificing ongoing support.

- Upgrade to QuickBooks Enterprise.

- Migrate to QuickBooks Online.

- Explore alternative accounting software options.

By doing so, these companies can manage their expenses and maintain a solid financial status.

New QuickBooks Enterprise features

QuickBooks Enterprise has introduced several new features this year, designed to streamline accounting functions. Examples include:

- Prepayment tracking: Track customer prepayments (Customer Deposits) on sales orders. Easily apply these credits when converting sales orders to invoices.

- Optimized item management: Leverage enhanced category management to efficiently organize and maintain your product catalog and inventory. Set pricing rules by categories to ensure consistent pricing across related items.

- Comprehensive inventory reporting: Gain valuable insights into your sales and inventory performance with detailed reports at the category level. Make informed decisions based on granular data, enabling better inventory management and strategic planning.

- Batch/Lot Inventory Tracking: Stay on top of your inventory with a dedicated report on Inventory Stock Status by Lot Numbers. Plus, monitor and manage products developed in batches or lots.

These features:

- Enhance financial reporting.

- Reduce manual errors.

- Improve overall efficiency.

With this in mind, Enterprise is a crucial tool for accounting teams and professional accountants.

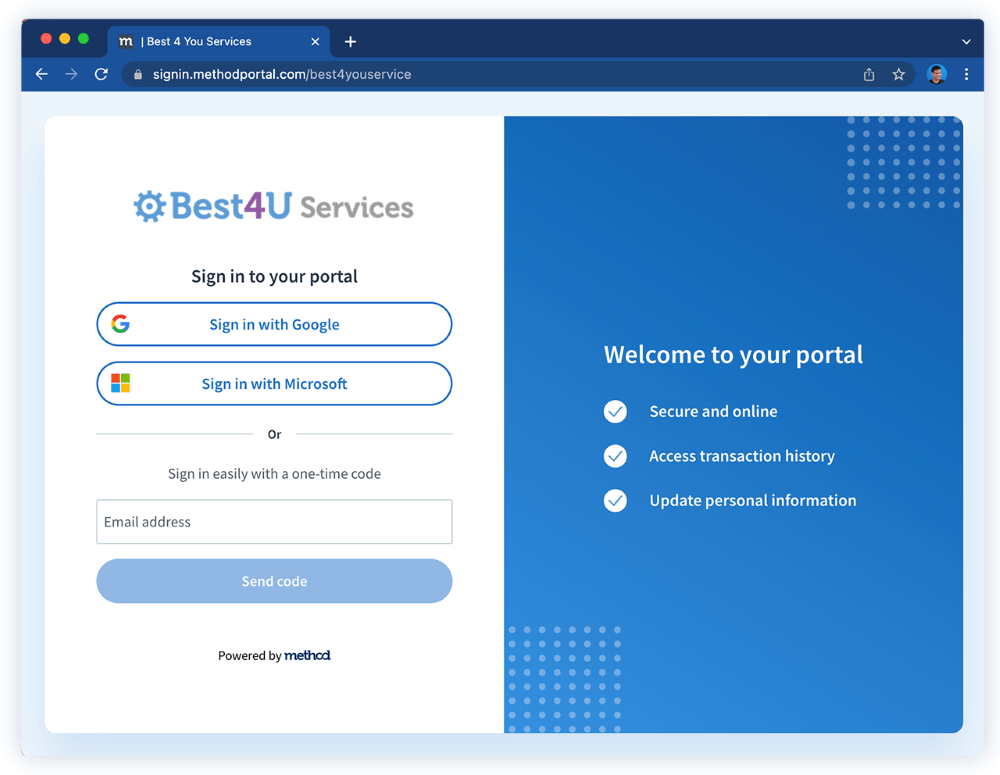

Customer portal implementation

Another trend is the implementation of customer portals. These portals:

- Facilitate better customer interactions.

- Streamline payments with multiple gateways and options for credit cards.

- Provide real-time access to financial records.

This integration enhances the customer experience and supports accurate reporting of financial transactions and cash inflow. See an example of Method’s customer portal integration with QuickBooks below.

Importance of accounting best practices for businesses

Adhering to the best practices for accounting is vital for maintaining accurate financial records, ensuring compliance with accounting standards, and supporting strategic decisions. Implementing these practices helps your company avoid legal consequences and maintain a solid financial position. Proper budgeting and forecasting are also essential for business growth.

Best practices in accounting for QuickBooks Desktop

Establish internal controls

Internal controls are essential for preventing fraud and ensuring accounting accuracy. By establishing robust internal controls, businesses can safeguard their financial assets and ensure the integrity of their financial statements and balance sheet. This includes setting up a comprehensive chart of accounts to track all financial activities accurately.

Record transactions promptly

Timely recording of transactions is a fundamental accounting principle. It helps in maintaining up-to-date financial records, reducing the risk of errors, and supporting accurate cash flow tracking and forecasting. This also aids in preparing accurate cash flow statements and financial accounting reports.

Implement bill automation tools

Automation tools can significantly enhance the efficiency of accounting processes. Implementing bill automation tools:

- Reduces manual entry.

- Minimizes the risk of errors.

- Ensures timely payments.

Document and organize your records

Proper documentation and organization of records are critical for accurate financial reporting. You should establish a system for organizing financial documents, such as bank statements, credit card statements, and invoices, to ensure easy access and compliance with accounting policies. This helps in managing expenses and supporting the overall accounting process.

Reconcile your accounts regularly

Regular account reconciliation is a best practice for maintaining accurate balances and identifying discrepancies. This process helps you ensure the accuracy of the financial position and fill your tax returns on time — and accurate tax filing is one of the most important parts of passing audits and keeping finances healthy. Accurate reconciliation also helps you track expenses and manage your accounting department efficiently.

Take proactive steps to ensure accuracy

Taking proactive steps to ensure accounting accuracy involves regular training for the accounting team and staying updated with the latest accounting standards and practices. This includes adopting both the cash basis and accrual accounting methods as necessary to reflect the true financial status of the business.

Best accounting practices for data security

Limit your access

Restricting access to financial data is essential for protecting sensitive information. Limiting access to only those who need it reduces the risk of unauthorized access and potential financial fraud, ensuring compliance with accounting standards.

Exercise caution with links

Accounting professionals should be cautious when clicking on links, especially in emails. Phishing attacks are common, and exercising caution can prevent data breaches and protect the integrity of financial records.

Backup data regularly

Regular data backups are crucial for ensuring the security of financial information. Businesses should implement a robust backup strategy to safeguard against data loss and ensure business continuity. This practice also supports efficient financial forecasting and reduces the risk of errors.

Wrap-up: Overcome QuickBooks growing pains with Method

By following these accounting principles and best practices, you can ensure your accounting systems are robust, accurate, and secure.

Implementing these strategies supports long-term growth and enhances the overall efficiency of your accounting functions. Tracking expenses and understanding the basis for financial decisions will also help you maintain a strong financial position over an extended period of time.

That said, as QuickBooks evolves, you may face challenges in adapting to new features and processes. Method CRM offers solutions to overcome these growing pains, providing tools that integrate seamlessly with QuickBooks Desktop to expand and simplify your processes.

Method’s integration supports:

- Efficient bookkeeping.

- Accurate reporting.

- Streamlined financial operations.

See how you can master your accounting processes with Method.