Are you tired of manually managing quotes, orders, and invoices? Do you struggle with delayed payments and revenue recognition? You’re not alone.

For many businesses, the quote-to-cash (Q2C) process is a cumbersome, error-prone journey. But what if you could end this complex sales cycle, reducing friction and boosting efficiency?

In this article, you’ll discover the ins and outs of the Q2C process, learning expert tips and strategies to help you:

- Automate manual tasks.

- Simplify complex pricing and contracts.

- Speed up payment processing.

- Gain real-time insights into sales performance.

Let’s dive in and get you from quote to cash faster.

What is the quote-to-cash process?

Quote to cash refers to the complete sales cycle that businesses undergo, starting from a customer’s initial request for a quote to the moment that payment is received.

It’s essentially the entire roadmap of your sales funnel, outlining the process of:

- Generating a personalized quote for the client.

- Negotiating terms.

- Closing the contract.

- Delivering the product or service.

- Billing and payment collection.

In other words, when a prospective customer shows interest in your offering, you provide them with a detailed quote outlining the pricing and conditions. If they accept, they sign the agreement, and you proceed with fulfilling the order and issuing an invoice. This is your quote-to-cash process — defining it clearly ensures efficient sales management and is crucial for maintaining healthy cash flow and revenue optimization.

Why is defining a quote-to-cash process important?

Our research indicates that around 70% of consumers tend to switch brands because of a complex buying journey.

The entire process of going from quote to cash involves multiple steps, where too many things could go wrong and cost you the customer if not well managed.

Defining that process helps you standardize your interactions while making a sale, resulting in positive customer experiences. With a well-defined Q2C process, you can:

- Drive clarity about the terms and conditions of the sale.

- Reduce operational costs by minimizing errors and increasing efficiency.

- Ensure accountability.

- Simplify your reporting process.

- Get more accurate forecasting.

Ultimately, a clear quote-to-cash process improves your business processes and leaves your customers happy and satisfied.

What are the steps involved in the quote-to-cash process?

Step 1: Configure, price, and quote (CPQ)

CPQ refers to the first three steps your sales team must take to kickstart the quote-to-cash process. Let’s take a close look at each of those steps.

Configure

Here, sales reps determine the specifications of the product or service a customer requested using all available information. A CPQ software tool makes product customizations easy, significantly reducing the chances of wrong configuration.

Price

This step involves setting the price for the configured product. Make sure to factor promotions, discounts, and other add-ons into the pricing.

Quote

With the product price set, your sales team then creates a detailed quote to send to the customer. Care must be taken to present a professional and accurate quote.

Step 2: Proposal and approval

After generating a quote using the CPQ method, the next step is for your sales team to prepare a formal proposal. This document includes:

- Pricing.

- Terms of service.

- Delivery timelines.

- Any additional relevant information to help the customer decide.

For example, a software company might create a proposal for a potential client that outlines the features of a software package, pricing options, and support services included in the deal.

Once the customer receives the proposal, they can review it and negotiate terms, which may involve requesting price adjustments or additional features.

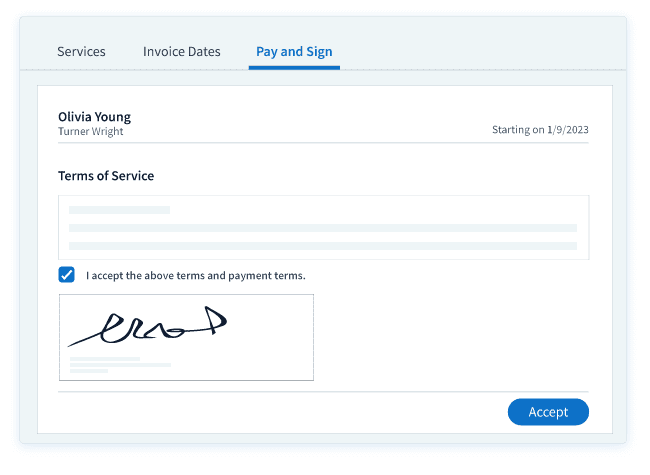

As soon as both parties agree on those terms, you can adjust the proposal in line with the new terms and have the customer approve it. Platforms like Method come with built-in proposals and approvals that make this process a breeze.

Even when signed, the proposal agreement you have isn’t necessarily legally binding (although it can be). A proposal typically neither obligates the customer to purchase nor you to provide the goods or services as outlined. And that takes us to the next step.

Step 3: Contract management

After your proposal has been approved, you can prepare a contract. The contract is a legally binding document outlining all the terms and conditions of your agreement with the customer. Both parties must sign the contract to validate it.

Proper contract management involves:

- Monitoring both parties to ensure they are following the terms.

- Making amendments when and where necessary.

- Tracking performance metrics as stipulated in the contract.

- Starting renewal discussions before contract expiration.

Effective contract management ensures that both parties are protected and that expectations are met throughout the entire lifecycle of the agreement.

Step 4: Order fulfillment

This step is where you deliver the product or service to the customer after the sale has been finalized. Make sure you deliver according to the terms of your agreement with the customer.

Order fulfillment typically includes the following key aspects:

- Order processing to input relevant details into your system.

- Inventory management (for physical products) to ensure items ordered are in stock.

- Shipping and delivery to get the goods or services to the customer.

- Communication to keep customers in the loop throughout the process.

If customers receive their orders on time and in good condition, they’re more likely to return for more deals in the future. Conversely, delays or issues can lead to frustration and lost business. So, getting this step right is key to maintaining healthy customer relationships.

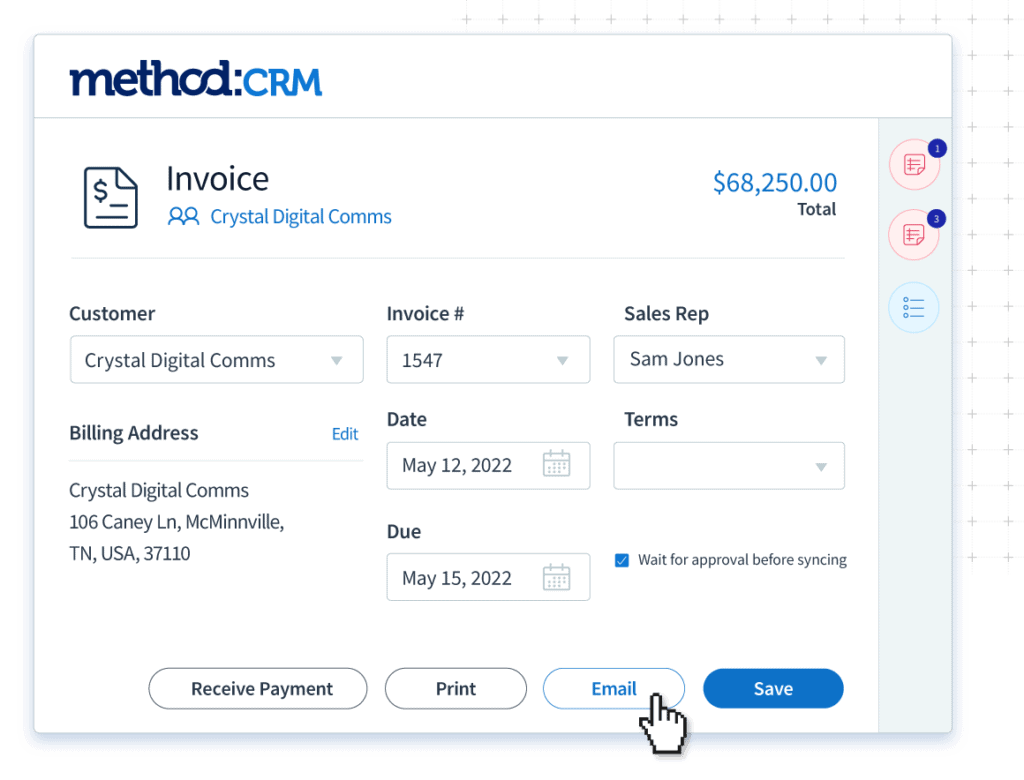

Step 5: Invoicing and payment processing

Now that the customer has received their order, it’s time to generate an invoice to send to them. The invoice will outline the:

- Products or services delivered.

- Amount due.

- Payment terms and options.

It should be recorded as an accounts receivable asset, reflecting the amount owed to your business.

While you can choose digital, chequing, cash, or credit solutions, you want to ensure your payment options are easy and convenient for your customers. This will improve customer satisfaction and drive sales.

CRM platforms like Method have several features that make payment processing easier, including:

- Built-in invoicing tools.

- Self-service customer portals.

- Integrations with popular payment processors.

Step 6: Revenue recognition

Revenue recognition is the final step of the quote-to-cash process and is crucial to a business’ cash flow. It involves steps like:

- Collecting relevant information about the sale and agreed-upon pricing.

- Recording the revenue in the accounting system.

- Keeping track of payment terms like schedules and delivery milestones.

Through automation and payment capabilities, CRMs make this step a walk in the park. For example, you can integrate QuickBooks or Xero with Method to track each step of the Q2C cycle and update funds in your accounting software directly from your CRM platform.

Common Q2C challenges

As you move forward and hone your Q2C process, it’s important to be aware of a few common challenges that could arise along the way.

Uncompetitive quotes

You risk losing customers if your sales quotes aren’t as competitive as others in your industry. Invest time in researching standard pricing and terms to ensure your quotes meet or exceed industry expectations. Once you’ve aligned with these standards, focus on speeding up your quote delivery process to stay ahead.

Delayed payments

Sometimes, payments just won’t come in soon enough. You want to make sure your sales team isn’t contributing to the delay in payments by getting rid of issues like:

- Billing or invoicing errors.

- Rigid payment policies.

- Inefficient or unreliable payment processing.

Inaccurate data

A misspelled product name here, a wrong figure there, and inaccurate details in your invoices and other sales documents can throw all sorts of clogs in the wheel of your Q2C process. Take the time to double-check everything to drive professionalism and ensure you get paid fairly and as expected.

Complex pricing

A complex pricing model leaves people confused. And confused people rarely act. If your pricing is not clear and easy to understand, your customers may get frustrated and turned off of your product or service.

Missed opportunities

Missed opportunities are the damning evidence of a faulty Q2C process. Your chances of cross-selling or upselling to a frustrated customer are almost zero. Consider using CRM software to track all your opportunities and their deal stages, so nothing ever falls through the cracks.

Lack of visibility

When customers can’t see the progress of quotes, orders, and invoices, they might find it hard to trust your business. This is where implementing tracking and technologies in various stages of the Q2C process can really help.

Key quote-to-cash metrics to track

Tracking performance is crucial to optimize your quote-to-cash process. Quote-to-cash metrics provide valuable insights into the effectiveness of your sales cycle and overall marketing efficiency. These metrics can be categorized into three main buckets:

Sales metrics

Sales metrics are key measurements that help businesses track and evaluate their sales performance. They provide insights into how well a sales team is doing and highlight areas for improvement. Keep an eye on the following metrics to make informed decisions for your business:

- Conversion rate: The percentage of leads that turn into customers.

- Sales revenue: The total income from sales over a certain period.

- Average deal size: The average value of each closed sale.

- Sales cycle length: The average time it takes to close a deal from initial contact to final sale.

Order metrics

Order metrics are used to measure how well a business is managing and fulfilling customer orders. They tell how efficient and accurate your order management process is. Track the following metrics to evaluate your process:

- Perfect order rate: The percentage of orders that are delivered on time, damage-free, error-free, and with proper documentation.

- Order fulfilment cycle time: How much time it takes from placing an order to when the customer receives it.

- Average order value: The average amount spent per order.

- Order accuracy rate: How often orders are filled correctly.

- Customer return rate: The percentage of orders that customers return.

Revenue metrics

Businesses use revenue metrics to measure how well they are generating income. Here are some revenue metrics to track:

- Customer acquisition cost (CAC): How much it costs to get a new customer.

- Customer lifetime value (CLV): The total revenue you can expect from a customer over their entire relationship with your business.

- Monthly recurring revenue (MRR): How much revenue to expect from subscribers each month. You can also look at annual recurring revenue (ARR).

- Revenue growth rate: The percentage increase in revenue over a specified period.

- Churn rate: The percentage of customers who stop using your product or service in a specified period.

How to improve your quote-to-cash process

The quote-to-cash process is crucial to a business’ survival. That’s why business owners must continually improve the process to ensure it consistently serves their needs and those of their customers. Here are a few strategies you can use to strengthen your quote-to-cash process:

- Automate the quoting process.

- Standardize your contracts’ format and messaging.

- Establish a clear communication line between your sales and finance teams.

- Simplify billing to hasten payments.

- Monitor performance and adjust.

- Used dedicated Q2C software.

Quote-to-cash software

Quote-to-cash software is a comprehensive tool designed to enhance your entire sales process — from the moment a customer expresses interest in a product to when the payment is finally collected. Think of it as your business’ all-in-one solution for managing everything related to sales transactions. A typical Q2C software has several key features, including:

- Configure, price, and quote (CPQ) tools.

- Contract lmanagement.

- Order management and fulfillment.

- Billing and invoicing automation.

- Revenue management, recognition, and compliance.

- Integrated payment gateways.

Among the best quote to cash solutions, Method is the #1 CRM for QuickBooks and Xero users. It offers all these features with a user-friendly interface for easy navigation. Want to learn more? Check out the video below.

Quote to cash FAQs

What is quote-to-cash automation?

Quote-to-cash automation involves using technology to remove manual tasks from the Q2C process. It automates all the steps from quote configuration and generation to revenue recognition.

What is the quote-to-order process?

The quote-to-order (Q2O) process is a critical part of the broader quote-to-cash (Q2C) cycle. It covers all the steps that occur from generating a quote to placing an order.

Who owns the quote-to-cash process?

Different departments of a business own and manage different parts of the quote-to-cash process. Each team plays a specific role in ensuring that the process runs smoothly from start to finish.