Managing finances effectively relies heavily on maintaining accurate journal entries. They’re the backbone of financial recording, reconciliation, and reporting.

Luckily, with QuickBooks Online, you can effortlessly record, edit, and review journal entries to ensure your finances are spot-on and compliant.

Want to tap into this powerful feature? Read on to learn how to view journal entries in QuickBooks Online—and discover specific types of journal entries and relevant tips to help you manage journal entries effectively.

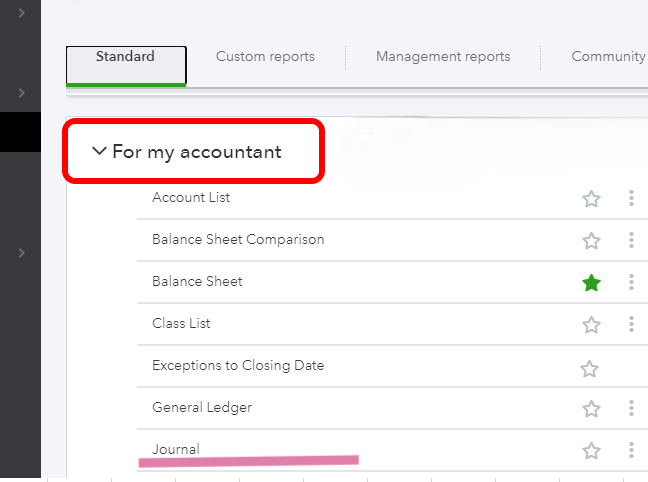

Where to view journal entries in QuickBooks Online

Here’s how to view journal entries in QuickBooks Online:

- Log in to QuickBooks Online.

- Click on the Navigation Bar on the left-hand side of your screen.

- Select “Reports.”

Image credit: Coupler

- On the “Standard” tab, scroll down to the “For my accountant” section.

- Select “Journal” to open the list of your journal entries.

Image credit: Intuit QuickBooks

The journal entries page is straightforward. It displays all existing entries in organized columns, including the:

- Date.

- Description

- Debit amounts.

- Credit amounts.

To locate specific entries, you can filter by: To edit or review individual entries, simply click into them from this page. To locate specific entries, you can filter by:

- Date range (e.g., “Last Month,” “This Year”).

- Specific accounts (e.g., “Bank Accounts,” “Accounts Receivable”).

- Other parameters like “Reconciled” or “Unreconciled.”

Additionally, you can customize the columns to display only the information you need, making it easy to find and review your entries.

Remember that regularly reviewing journal entries is essential for accurate financial reporting. Think of it as balancing your checkbook—when you review journal entries, you can catch mistakes and prevent errors from compounding.

Viewing specific types of journal entries

There are multiple types of journal entries, each providing valuable insights into various aspects of your business, such as:

- Revenue.

- Expenses.

- Assets.

- Liabilities.

- Equity.

Here’s a closer look into the most common journal entry types.

General journal entries

A general journal entry records financial transactions that impact your company’s accounts. It acts as a digital ledger entry containing key details such as the date, account names, debit/credit amounts, and a brief description. General journal entries serve various purposes, including:

- Adjusting account balances.

- Recording transactions that aren’t automatically captured by other QuickBooks features (e.g., non-cash transactions like depreciation or accruals).

- Correcting errors in previously recorded transactions.

- Allocating expenses or transferring funds between accounts.

Note that these entries can involve multiple accounts. Users can also attach supporting documents or notes (depending on their plan), ensuring records are comprehensive and easy to review.

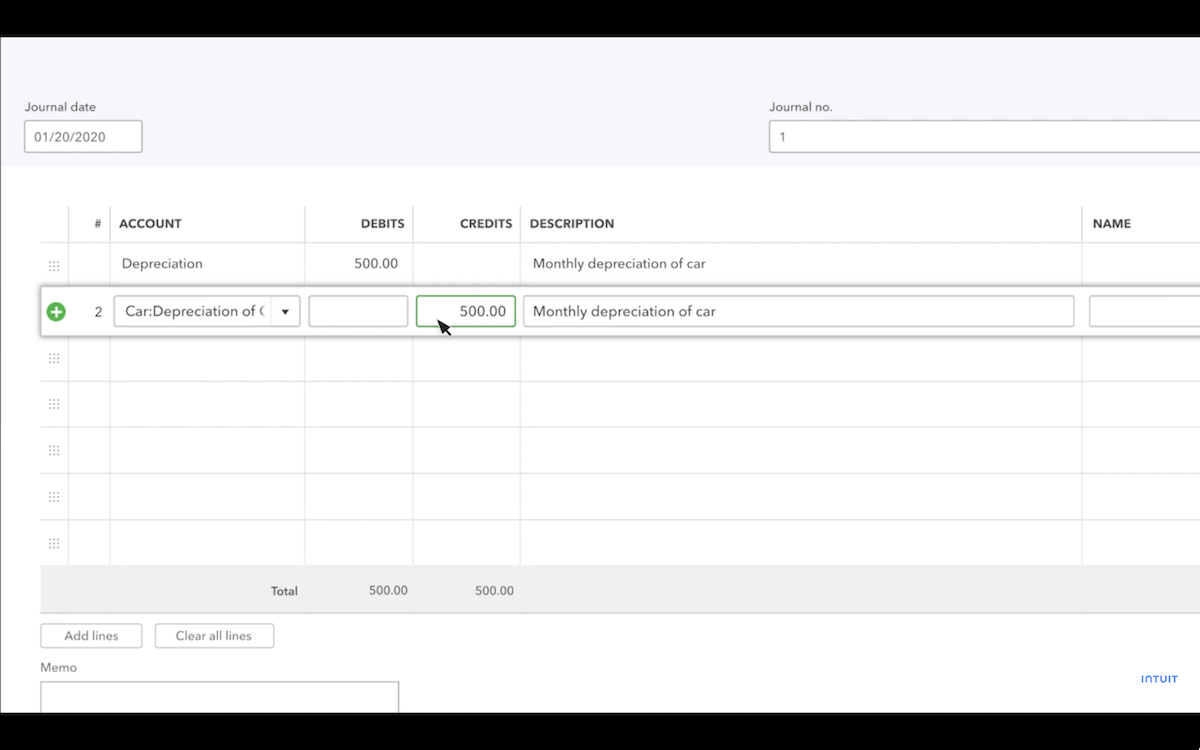

Manual journal entries

Manual journal entries in QuickBooks Online are like financial adjustments, where you can record unique transactions, correct errors, or allocate expenses. They’re handy for:

- Correcting mistakes.

- Handling complex transactions.

- Making accounting adjustments like accruals and depreciation.

Take the following steps to create manual journal entries in QuickBooks Online, remembering to be careful in your approach:

- Log in to QuickBooks Online and navigate to the main dashboard.

- Click on the “+ New” button at the top left corner of your dashboard.

- Select “Journal Entry” from the dropdown menu.

- Enter the date, journal entry number (auto-populates), and description.

- Choose accounts involved in the transaction from the dropdown menu.

- Enter transaction amounts in the debit and credit columns.

- Add attachments or notes in the description column (optional).

- Review and save.

Image credit: Intuit QuickBooks

Adjusting journal entries

Adjusting journal entries are updates that you make to your general ledger at the end of an accounting period to record any unrecognized income or expenses for the period.

These entries refine your financial records to reflect the true financial position of your business. They account for transactions such as:

- Accrued revenues.

- Prepaid expenses.

- Depreciation.

- Other items that haven’t yet been recorded.

These types of journal entries are crucial in driving financial accuracy as they let you reconcile differences between your initial records and actual financial realities.

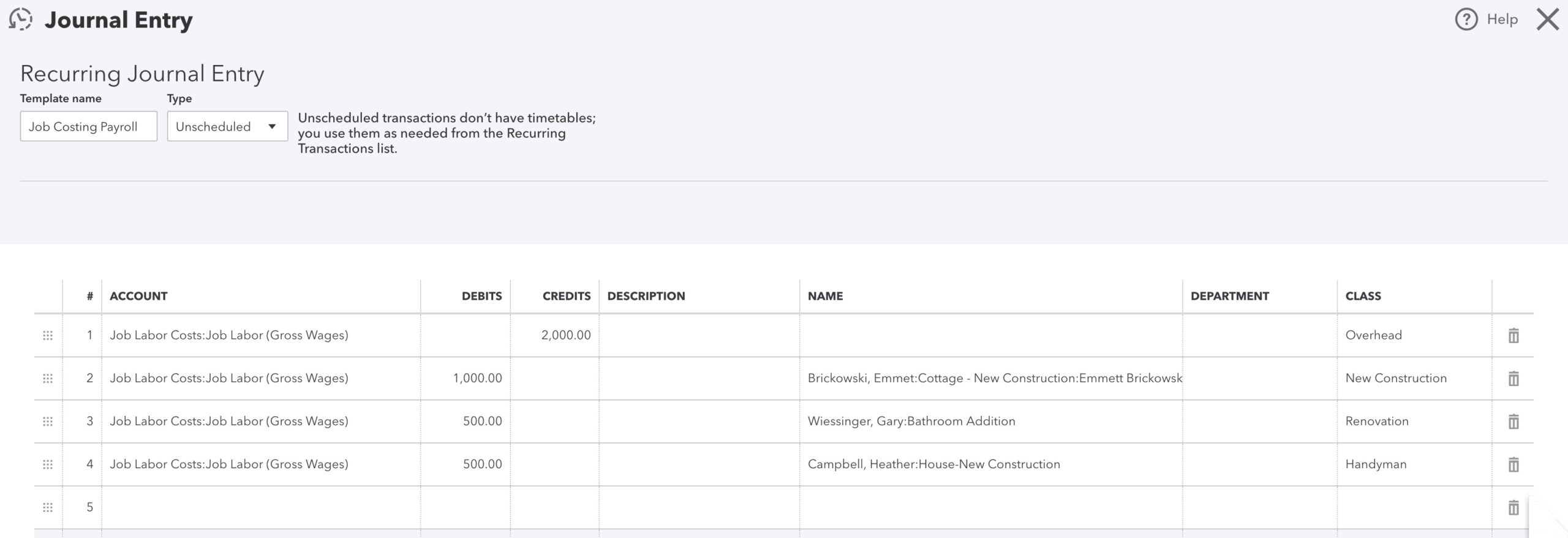

Recurring journal entries

Recurring journal entries are a game-changer for routine financial transactions. Essentially, they’re pre-scheduled journal entries that automatically repeat at set intervals, eliminating manual entry hassles and saving your team tons of time.

QuickBooks Online lets you create recurring journal entries for regular transactions, such as monthly rent, salary accruals, or depreciation. Here’s how to set them up:

- Follow the standard steps outlined above for creating a journal entry in QuickBooks Online. If you already have the journal entry prepared, simply open it.

- Once you’re in the entry, click “Make Recurring” at the bottom of the journal entry form.

- Choose a frequency, such as weekly or monthly, and review the details to confirm.

- Click “Save,” and QuickBooks will automatically generate future entries based on this template.

Image credit: Firm of the Future

Benefits of recurring journal entries

Recurring journal entries offer several advantages, including:

- Simplified financial management: Automate routine transactions to minimize manual data entry and simplify processes.

- Enhanced productivity: Save time by reducing reconciliation issues, allowing you to focus on strategic financial planning.

- Improved compliance: Ensure accuracy and consistency with QuickBooks’ built-in audit trail, promoting transparency and accountability.

- Better budgeting and forecasting: Facilitate precise financial projections and simplify the budgeting process with reliable recurring entries.

Tips for efficient journal entry management

Here are seven practical tips to enhance financial accuracy and efficiency:

- Categorize transactions: Group entries by type (e.g., income, expenses) for better organization.

- Use filters: Apply filters like date range or account to quickly find specific entries.

- Review regularly: Periodically check entries for accuracy, completeness, and duplicates.

- Reconcile accounts: Verify account balances align with journal entries to ensure accuracy.

- Investigate discrepancies: Address errors or anomalies promptly to maintain data integrity.

- Export data: Download entries to CSV or Excel for advanced sorting and analysis.

- Document corrections: Log all changes and corrections for transparency and audit purposes.

By applying these strategies, you’ll make this entire process easier while also gaining better insights into your journal entries and finances as a whole.

Using the search bar to find specific journal entries faster

The search bar in QuickBooks Online is a quick and helpful way to locate specific journal entries quickly.

To make the most of it, enter keywords like entry numbers, dates, account names, or transaction types to search for specific transactions.

You can also click on “Advanced Search” to apply filters, such as date ranges, transaction types, accounts, and reconciliation status.

To best refine your results, combine keywords with filters, such as searching for journal entries from a specific month or payments to a particular vendor.

Note that QuickBooks Online does not support wildcard characters or advanced phrase matching, so using precise terms will give you the best results.

Key takeaways

Now that you’ve learned how to view journal entries in QuickBooks Online, here are a few key things to remember when managing journal entries:

- You can view journal entries in QuickBooks Online by following five easy steps.

- Different types of journal entries give you insights into various aspects of your business, such as revenue, expenses, assets, liabilities, and equity.

- Always document corrections made in journal entries for audit purposes.

- The search bar can help you find specific journal entries quickly.

If you’re sick of wrestling with repetitive data entry and endless tweaks in QuickBooks, Method CRM’s got your back. Built to sync perfectly with QuickBooks, it pulls customer management, communication, and invoicing into one easily manageable place. No more system-hopping or copying the same info twice—Method updates QuickBooks in real time. You make a change, it’s reflected instantly. That means your journal entries and financial records stay spot-on, minus the extra hassle. To find out more about Method, check out the video below.

Ready to give it a go? Try Method free for 14 days—no credit card required.

How to view journal entries in QuickBooks FAQs

Can I view all journal entries in QuickBooks at once?

Yes, you can, and it’s a huge time-saver. Fortunately, QuickBooks Online makes it easy. To access all journal entries, navigate to the Accounting menu and select “Journal Entries.” Click the “Filter” button and choose “All Journal Entries.” You’ll see a comprehensive list of every journal entry, including manual, recurring, and adjusting entries.

Can I edit journal entries in QuickBooks after viewing them?

Editing journal entries in QuickBooks Online is possible but requires caution, as changes can affect your financial statements and reconciliations. All you have to do is click “Journal” in the “Reports” section, find the entry you want to edit, and click the pencil icon (Edit). You should avoid editing reconciled entries and always document any changes, as this can disrupt your financial records.

Is there a shortcut to view journal entries in QuickBooks?

No, QuickBooks Online does not have as many keyboard shortcuts as the Desktop version, so you’ll have to navigate through the interface rather than use quick keystrokes.