Deleting journal entries in QuickBooks is a straightforward process, but knowing the right steps can save you time and help you avoid mistakes.

In this article, you’ll learn how to delete journal entries in QuickBooks, whether you’re using the Online or Desktop version. You’ll also learn how to reverse an entry when it’s a more suitable option, along with tips for efficiently managing your journal entries.

Let’s get started!

Steps to take before deleting QuickBooks journal entries

Before we get into the step-by-step process of deleting journal entries in QuickBooks, here are some precautions you’ll need to take:

- First, create a backup of your QuickBooks data before making any changes to your records.

- Request “Full Access” (Desktop) or “Admin Access” (Online). You can only delete journal entries with full permissions.

- Review your company’s audit trail settings to ensure that you can monitor changes for compliance or reporting purposes.

- Review the impact of the journal entry you want to delete on your financial records. Ensure the deletion won’t lead to discrepancies or errors in your reporting.

- Consider reversing the entry instead of deleting it, especially if it was an error.

How to delete journal entries in QuickBooks Online

- Open QuickBooks Online and log into your company file.

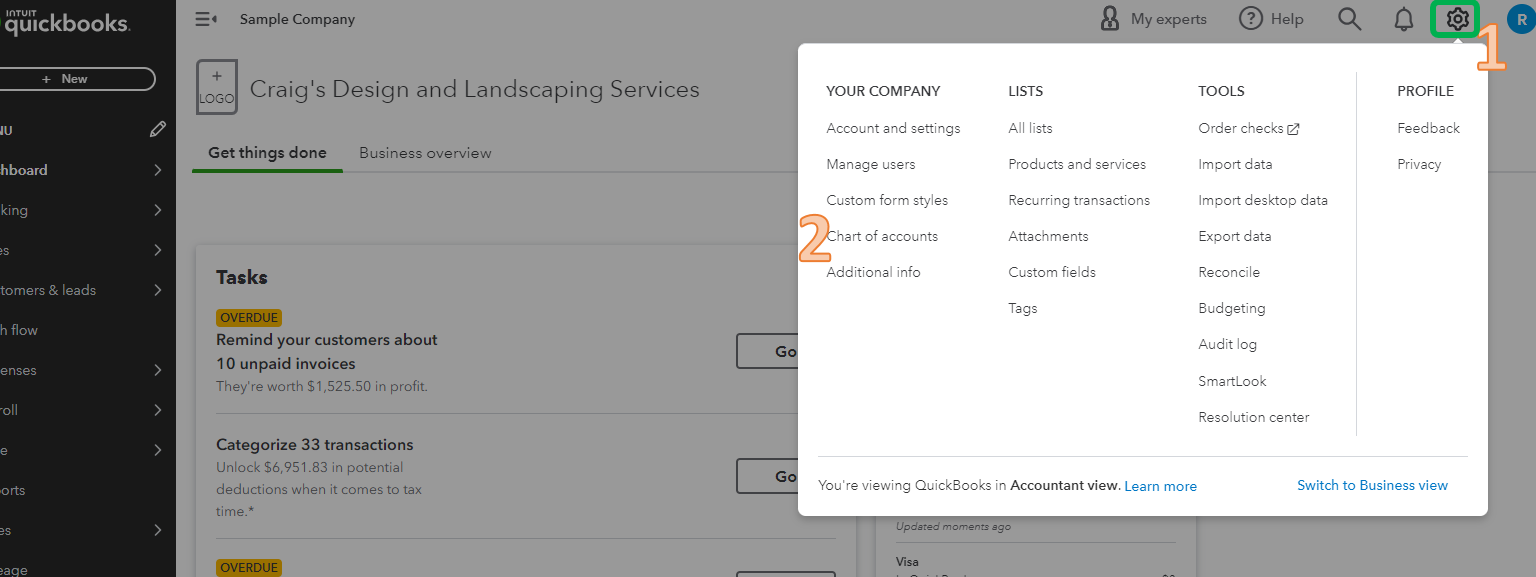

- Click on the gear icon in the upper right corner.

- Under “Your Company,” select “Chart of Accounts.”

Image credit: Intuit QuickBooks

- Find the account associated with the journal entry you want to delete.

- Click “View register” in the Action column for that account.

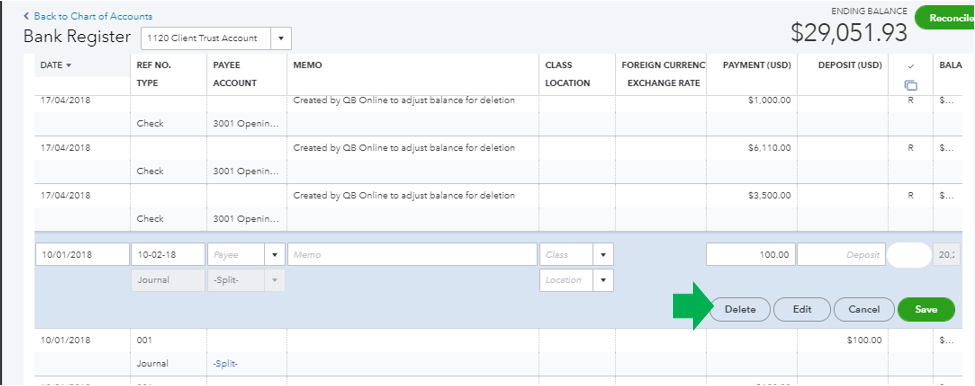

- In the account register, locate the journal entry. The word “Journal” should be in the “Ref No.” or “Type” column.

- Click on the journal entry to expand the view.

- At the bottom of the expanded transaction, select “Delete.” You can also do this from the individual entry by clicking “More,” and then “Delete.”

Image credit: Intuit QuickBooks

- A confirmation prompt will appear. Click “Yes” to proceed with deleting the journal entry.

- After deletion, review your financial reports to ensure that the deletion did not cause any issues or discrepancies in your balance sheet or profit and loss statements.

How to delete journal entries in QuickBooks Desktop

- Open QuickBooks Desktop and log into your company file.

- Navigate to the Chart of Accounts:

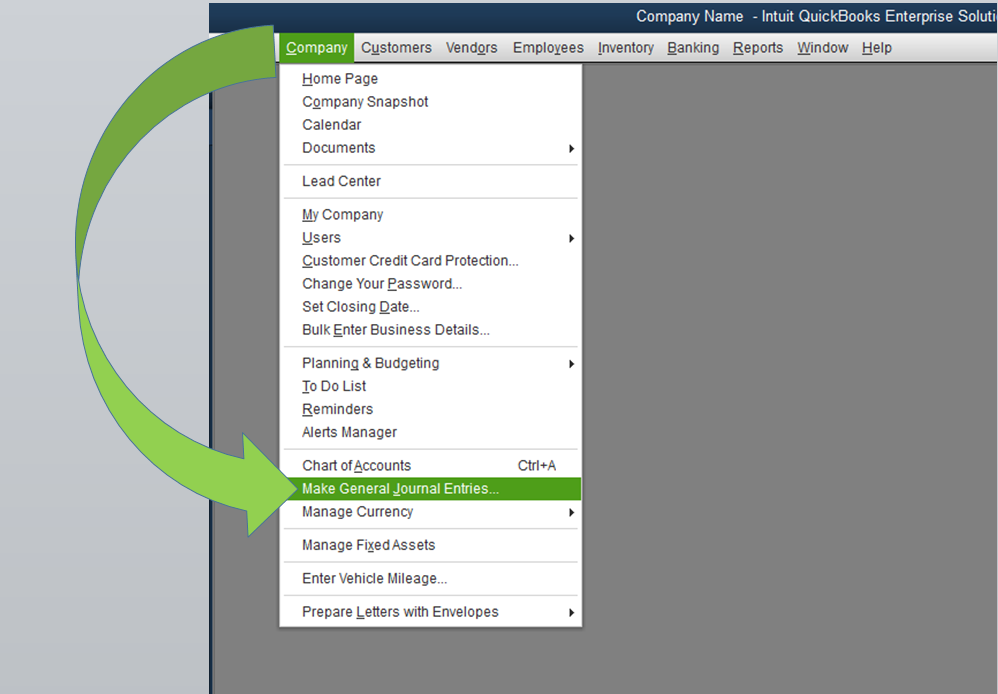

- From the top menu, select “Company”, then choose “Make General Journal Entries.”

Image credit: Intuit QuickBooks

- In the “General Journal Entries” window, select “Find” and enter the Name, Date, Entry No., or Amount—then click “Find.”

- Once you see your desired journal entry, double-click it.

- Select “Delete” or “Void.”

- A confirmation prompt will appear. Click “OK” to proceed with deleting the journal entry.

- After deletion, review your financial reports to ensure that the deletion did not cause any issues or discrepancies in your balance sheet or profit and loss statements.

Clear journal entries

You should clear entries when they are tied to processed transactions, like payments or receipts, that match your bank statement and need to stay in your records for reconciliation. On the other hand, you should delete entries when they contain errors, such as incorrect amounts or duplicate transactions, to maintain accuracy.

To make the right call, consider the context of each entry. Note that deleted entries require closer inspection to ensure their removal won’t disrupt your financial statements.

To clear a journal entry in QuickBooks, take the following simple steps:

- Perform the steps above to view your journal entries.

- Double-click on your chosen entry to open it.

- Ensure that the entry corresponds to a cleared transaction that has already been verified against your bank statement or credit account.

- Mark the entry as cleared by checking the box under the “Clr” column in QuickBooks Online or by changing the status from “N” (not cleared) to “C” (cleared) in the “Clr” column in QuickBooks Desktop.

- Click “Save & Close” or “Save & New” to update the transaction.

- If you’re reconciling your bank account, go to the “Reconcile” screen in QuickBooks and verify that the cleared journal entry is properly accounted for in the reconciliation process.

- Check your bank reconciliation and financial reports to ensure that the transaction appears correctly and the balances are accurate.

Reverse journal entries

Reversing a journal entry in QuickBooks is a simple way to correct an error while keeping your financial records transparent and intact. Instead of deleting the original entry, which removes it completely, reversing creates a new entry that cancels out the impact of the previous one. This approach is particularly useful for fixing mistakes like incorrect amounts or misclassified accounts while preserving your complete view of your transaction history.

To reverse a journal entry in QuickBooks:

- Follow the steps above to access your list of journal entries.

- Create the reversing journal entry:

- QuickBooks Online: Create a reversing journal entry by clicking “More” at the bottom of the journal entry window and selecting “Copy” to create a duplicate. Then, change the date and update the amounts so that the debit amount is in the credit field and vice versa.

- QuickBooks Desktop: Open the journal entry, go to the “Edit” menu, and select “Reverse Journal Entry.” QuickBooks will automatically swap the debits and credits.

- Double-check the reversed journal entry to ensure that the amounts and accounts are correct. Also, ensure that the date matches the intended reversal period.

- Click “Save & Close” or “Save & New.”

- Check your financial reports to ensure that the original and reversed entries are properly reflected.

When should you delete journal entries?

Delete journal entries only when they were made in error and don’t impact financial reporting. Common reasons include:

- Incorrect dates.

- Wrong accounts.

- Duplicates.

- Placeholders not meant for final records.

Proper deletions keep your books accurate, but removing the wrong entries can cause reporting discrepancies, reconciliation issues, and audit complications. To avoid risks, consider reversing entries instead of deleting them.

Deleting different types of journal entries

Not all journal entries should be deleted, as each type plays a key role in financial reporting. Here’s when deletion may be necessary and what to consider:

- General journal entries: Record adjustments, corrections, or transfers between accounts. Delete only if entered incorrectly, ensuring it doesn’t impact account balances.

- Adjusting journal entries (AJEs): Used at the end of an accounting period to update accrued expenses, depreciation, or prepaid assets. Deleting can distort financial reports, so reversing is usually the better option.

- Recurring journal entries: Automate routine transactions like rent or utilities. Delete if they’re no longer needed, but check for upcoming scheduled entries to avoid unintended gaps.

- Payroll journal entries: Track employee wages, taxes, and benefits. Deleting can cause payroll discrepancies and tax reporting issues; instead, make corrections through payroll adjustments.

- Closing journal entries: Finalize revenue and expense accounts at year-end, transferring balances to retained earnings. These should never be deleted, as they are crucial for accurate financial statements.

Before deleting any journal entry, confirm it won’t disrupt reconciliations, financial reports, or tax compliance. Again, when in doubt, reversing the entry is often the safer option.

Managing multiple journal entries

QuickBooks doesn’t allow batch deletion of journal entries—each must be reviewed and deleted individually to ensure accuracy. However, you can simplify the process using built-in tools:

- QuickBooks Online: Filter transactions by date, amount, or type for faster entry identification.

- QuickBooks Desktop: Use the “Find” feature to locate specific entries.

- Both platforms: Use bank feeds and reconciliation tools to identify entries needing deletion.

For frequent deletions, third-party apps offer batch deletion, but always review changes and back up data to prevent errors. These apps can be faulty, so taking these precautions is an absolute necessity.

Deleting a specific line in a journal entry

Sometimes, you may need to delete a single line in a journal entry instead of the entire entry in QuickBooks. Here’s how to do it:

How to delete a journal entry line in QuickBooks Online

- Go to “Accounting,” then “Chart of Accounts.”

- Click “View Register.”

- Locate and open the journal entry.

- Identify the line to delete, then click the trash can icon.

- Ensure the entry remains balanced and click “Save.”

How to delete a journal entry line in QuickBooks Desktop

- Go to “Lists,” then “Chart of Accounts.”

- Open the account register.

- Find and open the journal entry.

- Select the line, go to “Edit,” and choose “Delete Line,” or use Ctrl + Delete.

- Verify the balance and click “Save & Close.”

Note: Deleting a line in a journal entry can unbalance your records, as each line represents a debit or credit. QuickBooks won’t save the entry until the balance is restored.

Deleting a recurring journal entry

A recurring journal entry in QuickBooks automates routine transactions like rent, utilities, and accruals, reducing manual effort and errors. Before you delete anything, check the impact on future postings, adjust past transactions, and back up your data to prevent discrepancies.

If you’re certain about deleting a recurring journal entry, here’s how to do it:

How to delete a recurring journal entry in QuickBooks Online

- Click the gear icon.

- Select “Recurring Transactions.”

- Find your chosen journal entry.

- Click “Edit,” then “Delete.”

- Confirm the deletion.

How to delete a recurring journal entry in QuickBooks Desktop

- Go to “Lists,” then “Recurring Transactions.”

- Select the journal entry and open it.

- Navigate to “Edit” and choose “Delete.”

- Confirm the deletion.

Tips to follow to avoid journal entry deletion mistakes

Here are some practical tips and best practices to avoid common mistakes when deleting journal entries in QuickBooks:

- Back up your data before deleting any journal entries to prevent irreversible errors.

- Double-check entries to confirm they are mistakes and not essential records.

- Never delete reconciled entries, as this can cause discrepancies in your financial reports.

- Consider reversing instead of deleting if you need to correct an error while maintaining transparency.

- Review financial statements after deletion to ensure accuracy in your balance sheet and profit and loss reports.

- Keep a record of deletions for audit purposes and future reference.

- Delete only when necessary and during off-hours to avoid disrupting system users or ongoing reports.

Key takeaways

Deleting journal entries is sometimes your only option to put your financial records in proper shape. Remember to:

- Get “Full Access” (Desktop) or “Admin Access” (Online) to delete a journal entry.

- Back up your data before adjusting or deleting any journal entry.

- Ensure a reversal cannot fix an entry before deleting.

- Consider using a third-party tool if you need to delete multiple journal entries frequently.

- Consider the journal entry type, as different types may require slightly different considerations.

- Always double-check your records after deleting and entering to ensure things remain intact.

Tired of fixing errors and deleting journal entries in QuickBooks? Mistakes happen when you’re manually entering data, switching between systems, and juggling updates across platforms. Method eliminates those headaches by syncing with QuickBooks in real time—so every customer detail, invoice, and payment update is automatically reflected in both systems. No more duplicate entries, no more scrambling to fix mistakes. Just accurate, easy bookkeeping that saves you time and frustration. If you want to learn more about Method, check out the video below.

Ready to keep your QuickBooks data clean from the start? Try Method free for 14 days.

How to delete journal entries in QuickBooks FAQs

Can you mass delete journal entries in QuickBooks Online?

No, QuickBooks Online doesn’t allow mass deletion of journal entries. You must delete them individually, but filtering by date or amount can help speed up the process. Third-party apps may offer batch deletion.

Can I see deleted journal entries in QuickBooks Online?

No, once deleted, journal entries are permanently removed from your records. However, the Audit Log tracks deletions, showing who deleted an entry and when—but not the full details of the deleted transaction. To access it, go to the gear icon, click “Audit Log,” and filter by “Delete.”

Which accounts cannot be deleted in QuickBooks Online?

System accounts like Bank Accounts, A/R, A/P, Opening Balance Equity, and Retained Earnings cannot be deleted to maintain financial integrity. While you can deactivate unused accounts, deleting accounts with historical transactions could disrupt reports and compliance.