Retained earnings are profits your company keeps to reinvest in growth rather than distribute as dividends. In QuickBooks, these earnings are automatically updated at the end of each financial year to reflect changes in income, expenses, and distributions.

However, users may need to manually adjust the account if discrepancies arise.

In this article, you’ll learn how to adjust retained earnings in QuickBooks Online and Desktop and better understand their importance in your financial strategy. Let’s dive in!

How to adjust retained earnings in QuickBooks Online

QuickBooks Online does not allow direct transactions to the Retained Earnings account, so adjustments must be made using an equity adjustment account via a journal entry. Make sure to do this with care and always back up your account before making changes.

Here are the steps to adjusting retained earnings in QBO:

- Open “Reports,” select “Balance Sheet,” set the date range, and locate “Retained Earnings” under “Equity.”

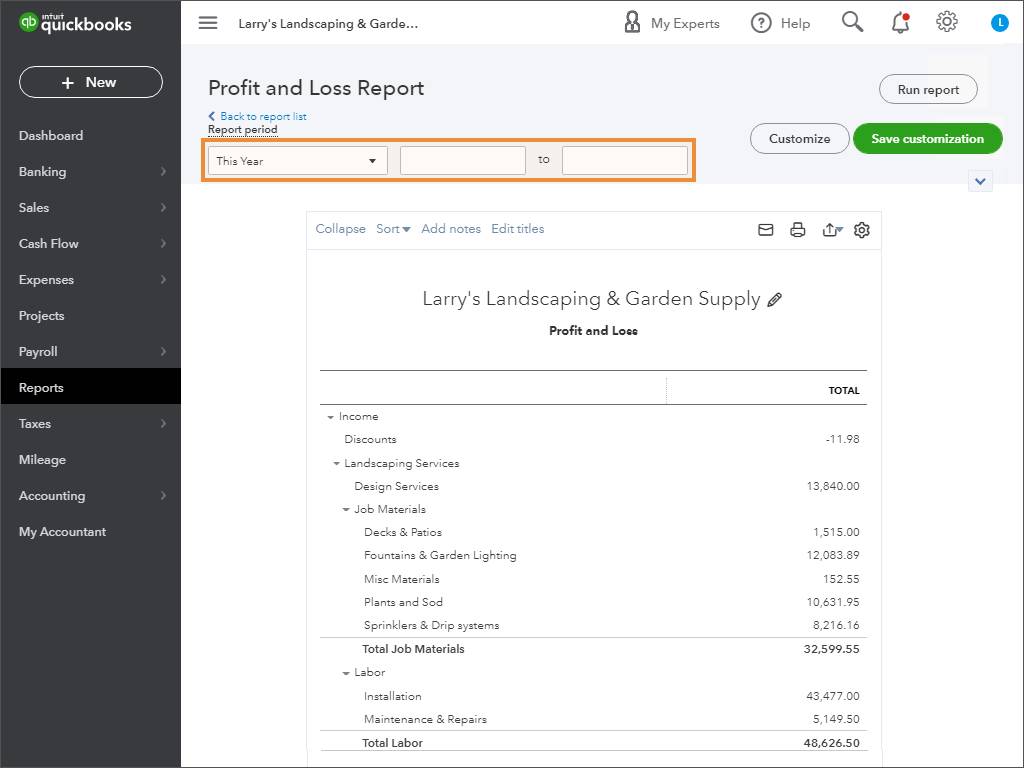

- Run a Profit and Loss Report to verify that net income correctly rolled into retained earnings.

Image credit: CustomGuide

- (Optional) Run the General Ledger Report, filter for Retained Earnings, and review related transactions.

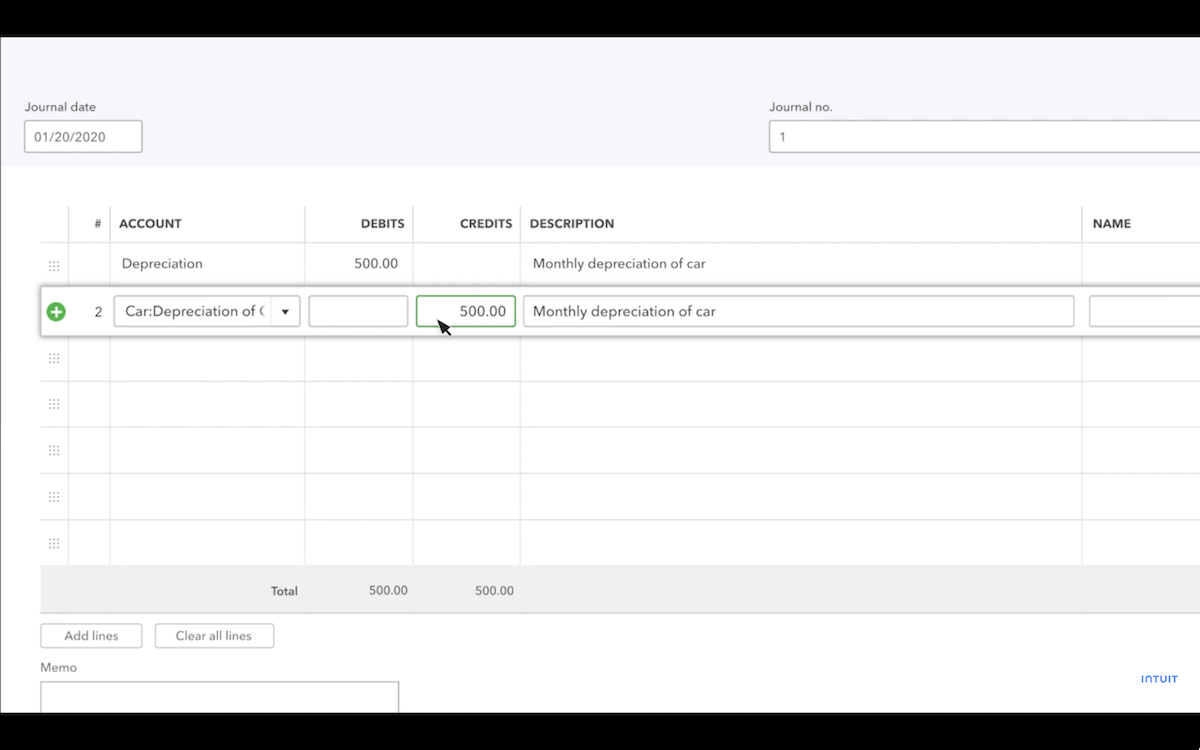

- Click “+ New,” select “Journal Entry,” and set the appropriate date.

- Choose an equity adjustment account (not Retained Earnings) in the “Account” field.

- Enter a debit if reducing retained earnings or a credit if increasing it.

- Add a memo for reference and attach supporting documents if necessary.

- Click “Save and Close” to record the journal entry.

Image credit: Intuit QuickBooks

- Re-run the Balance Sheet Report to confirm the updated Retained Earnings balance.

- Check the General Ledger for the recorded adjustment.

Tip: Avoid posting directly to retained earnings, document adjustments thoroughly, and consult an accountant if correcting prior-year financials.

How to adjust retained earnings in QuickBooks Desktop

Similarly to Online, adjusting retained earnings in QuickBooks Desktop is only possible through the use of journal entries.

Step 1: Create adjusting journals

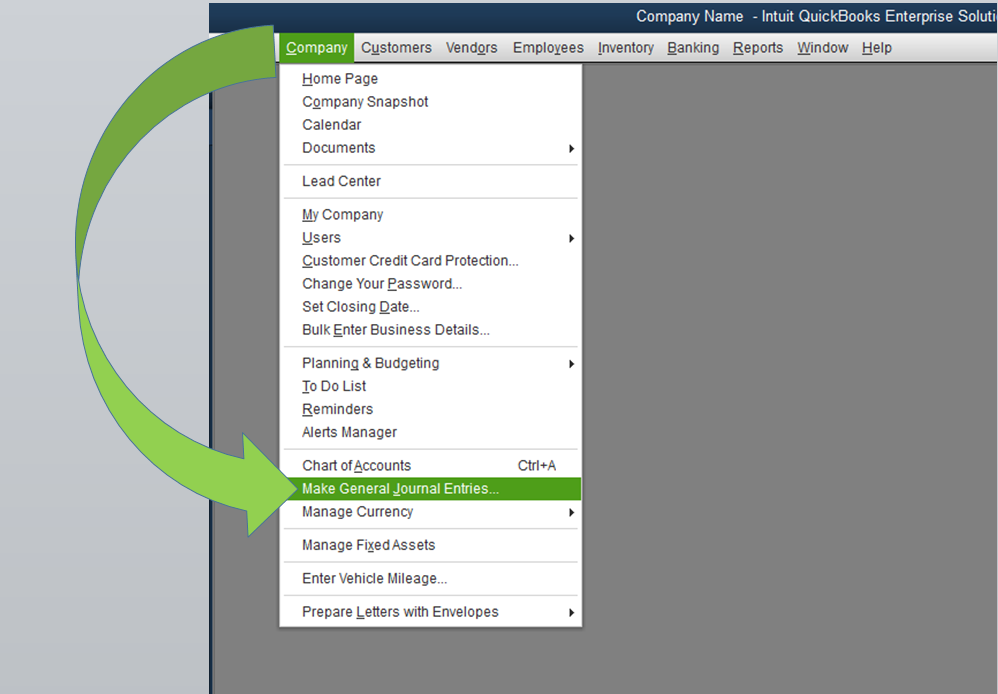

- Open QuickBooks Desktop and log in to your company file.

- Go to the “Company” menu and choose “Make General Journal Entries”.

Image credit: Intuit QuickBooks

- Set the appropriate date for the journal entry to ensure it aligns with the correct reporting period.

- In the “Account” field, select an appropriate equity adjustment account (such as an “Owner’s Equity” or “Prior Period Adjustment” account).

- Enter the necessary debit or credit amount to increase or decrease the retained earnings balance.

- Provide a brief memo explaining the reason for the adjustment for clarity and future reference.

- Click “Save & Close” to finalize the changes.

Taking these steps helps your business maintain clean, reliable financial records that are ready for audits and financial reviews.

Step 2: Editing the beginning retained earnings balance

Adjusting the beginning balance of retained earnings should only be done in specific cases, such as fixing an error from a prior year or aligning your records with audited financial statements.

To make this adjustment, create a journal entry that adjusts prior period accounts, such as income or expense accounts.

Thoroughly document the reason for the change to maintain a clear and accurate audit trail.

Step 3: Troubleshooting retained earnings discrepancies

Discrepancies in retained earnings can happen for various reasons, and identifying the root cause will help you resolve them. Below are some common issues that may impact retained earnings:

- Unrecorded transactions: Missing or incorrectly posted entries can alter net income, directly affecting retained earnings.

- Errors in prior period adjustments: Mistakes made during adjustments for previous periods can carry over, causing inaccuracies in current balances.

- Incorrect closing entries: Errors during the year-end closing process can result in skewed retained earnings figures.

- Misclassified accounts: Transactions assigned to the wrong accounts can disrupt the accuracy of financial records, and impact retained earnings calculations.

Carefully review your financial statements, run reports, and correct these issues to make sure that your retained earnings are accurate and aligned with your business’ actual financial position.

The importance of retained earnings in financial reporting

Retained earnings are the portion of a company’s profits that are not distributed as dividends but kept within the business. Retained earnings:

- Provide resources for reinvestment.

- Help stabilize operations.

- Increase investor confidence.

However, retained earnings can also be negative if a company has accumulated losses over time. This is known as an accumulated deficit and can indicate financial instability.

How retained earnings influence business decisions:

Supporting growth

Retained earnings allow businesses to invest in expansion, purchase equipment, and develop new products, helping them scale effectively.

Managing debt

Companies can use retained earnings to pay down debt, reduce financial liabilities, and improve their overall financial position.

Safeguarding stability

Retained earnings act as a financial buffer during tough times and against unexpected expenses, helping businesses remain resilient and maintain smooth operations.

Building stakeholder confidence

A strong retained earnings balance shows that your business is profitable and financially stable, which can attract investors, reassure lenders, and build trust with stakeholders.

Understanding how important retained earnings are for growth, stability, and trust helps you make smarter financial and strategic choices.

Calculating retained earnings in QuickBooks

Calculating retained earnings in QuickBooks is straightforward, thanks to the platform’s built-in features that automatically track and update this account. Follow these steps to understand and calculate your retained earnings:

- Run a profit and loss report:

- Navigate to the “Reports” menu in QuickBooks.

- Select “Profit and Loss” and set the date range to cover the relevant accounting period.

- Note the net income (or loss) for the selected period, as this directly impacts your retained earnings.

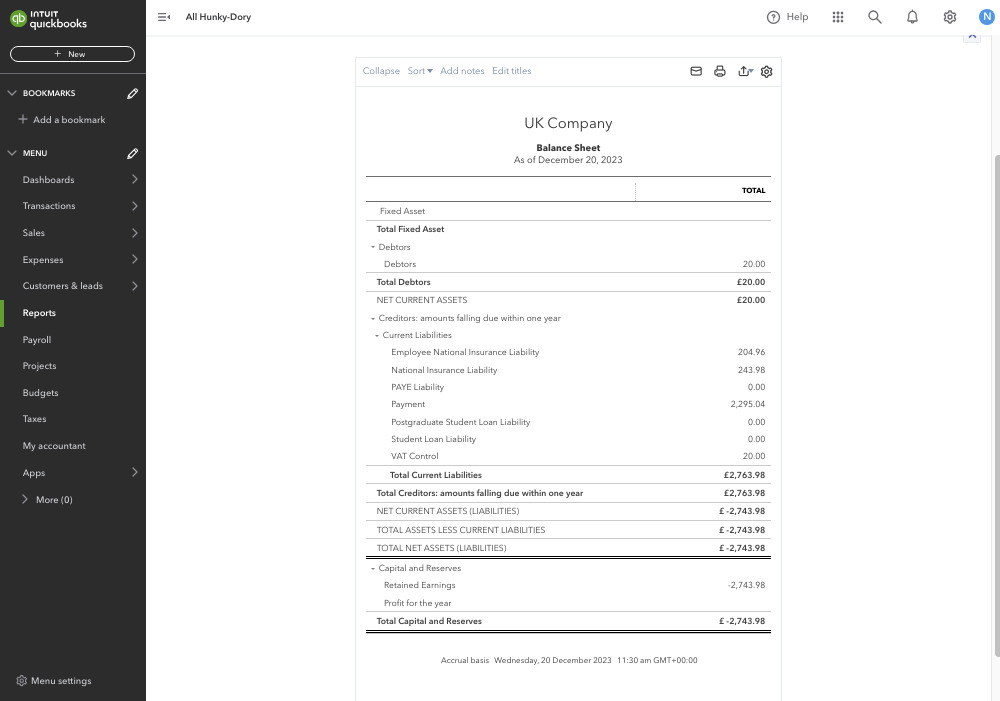

- Generate a balance sheet report:

- Return to the “Reports” menu and select “Balance Sheet”.

- Ensure the date is set to the current financial period.

- Locate the “Retained Earnings” account in the equity section to see its current balance.

Image credit: Intuit QuickBooks

- If an adjustment is required, enter a journal entry using an equity adjustment account:

- Add the net income (or subtract the net loss) from the profit and loss report.

- Subtract any dividends or owner distributions made during the period.

- Review the results:

- Cross-check the updated retained earnings balance with the balance sheet to confirm accuracy.

- If discrepancies exist, revisit the Profit and Loss and Balance Sheet reports to ensure no transactions were missed or misclassified.

Following these steps gives you a clear picture of your retained earnings in QuickBooks. But again, remember that QuickBooks automatically rolls net income into retained earnings, so you should not attempt to manually adjust the retained earnings balance unless correcting errors.

Retained earnings vs. net income in QuickBooks

Retained earnings and net income are both important to understanding your business’ financial performance, but they serve different purposes in accounting. Net income is the profit or loss your business earns over a specific period, calculated as revenue minus expenses. This is done at the end of an accounting period (e.g., monthly, quarterly, or annually).

Retained earnings, on the other hand, are the cumulative total of net income that your business retains or keeps after distributing dividends to shareholders or owners over multiple periods. These retained earnings are reinvested into the company to support growth, pay off debts, or serve as a financial buffer in case of an emergency.

In QuickBooks, net income flows into the retained earnings account at the end of each fiscal year. If dividends are issued, they reduce retained earnings but do not affect net income.

Differences and similarities between retained earnings and net income in QuickBooks:

| Feature | Net Income | Retained Earnings |

| Definition | Profit or loss earned during a specific period. | Cumulative total of profits reinvested in the business. |

| Timeframe | Calculated for a single accounting period. | Spans multiple periods, rolling over year after year. |

| Financial Statement | Appears on the income statement. | Listed under equity on the balance sheet. |

| Purpose | Shows profitability for the period. | Reflects how profits have been reinvested. |

| Relationship | Directly affects retained earnings. | Includes all net income after dividends. |

When you get a grasp of the differences and the relationship between the two terms, you can interpret your financial reports more effectively and make better-informed decisions about reinvesting profits or managing distributions.

How to manage retained earnings in QuickBooks efficiently

To review, accurate data entry, regular monitoring, and financial planning keep retained earnings up to date in QuickBooks. Use reports like the Profit and Loss Statement and Balance Sheet to track changes. Document any adjustments with clear memos for an audit trail, and review retained earnings annually to align with business goals.

Here are a few more best practices to manage QuickBooks retained earnings.

Regular reconciliation

Regular reconciliation of retained earnings helps you quickly identify and correct discrepancies by cross-checking your retained earnings account against your profit and loss statements and balance sheets.

This will keep the integrity of your financial statements and simplify audits and tax filings, giving you confidence that your records reflect your business’ actual financial position.

Annual analysis of ongoing trends

Review year-over-year retained earnings to assess the impact of:

- Reinvestments.

- Debt payments.

- Distributions.

This analysis helps you understand whether your retained earnings strategy aligns with your long-term goals, such as funding expansions or maintaining financial reserves for unexpected situations.

Setting benchmarks for optimal values

Define retained earnings benchmarks based on:

- Industry.

- Company size.

- Growth stage.

For example, startups may reinvest earnings for growth, while established businesses might prioritize maintaining financial reserves. Clear benchmarks help balance reinvestments and distributions for sustainable financial stability.

Key takeaways

- Retained earnings represent the cumulative profits reinvested in your business and are important for financial health and strategy.

- Adjusting retained earnings in QuickBooks involves creating journal entries and reconciling discrepancies.

- Regular reconciliation and analysis of retained earnings trends are essential for maintaining accurate records and making informed decisions.

- QuickBooks automatically calculates retained earnings during the year-end close, simplifying bookkeeping and reporting.

Keeping your retained earnings accurate means tracking data without the mess—or the guesswork. Method CRM syncs with QuickBooks in real-time, so your financials stay up to date without manual errors creeping in. Automated transaction tracking, custom workflows, and detailed reports help you stay organized, simplify reconciliations, and make smarter decisions about reinvestments or payouts. Whether you’re growing fast or keeping things steady, Method keeps your QuickBooks data clean, clear, and audit-ready. Check out the video below to learn more.

If you’re ready to give it a shot, start your free 14-day trial of Method today.

How to adjust retained earnings in QuickBooks FAQs

What should I do if the retained earnings in QuickBooks are incorrect?

If you’re retained earnings in QuickBooks are incorrect, first identify the discrepancies by reviewing your balance sheet and general ledger. Then, correct the errors by creating adjusting journal entries. As a final step, make sure to review your books and consider consulting with an accountant to ensure accuracy.

What is a correcting entry for retained earnings?

A correcting entry adjusts retained earnings to fix errors from prior periods or reflect changes in accounting estimates. These entries are typically recorded as journal entries.

How do you treat retained earnings in accounting?

Retained earnings are treated as part of a company’s equity and appear on the balance sheet. They are adjusted annually to reflect net income and dividends, supporting financial reporting and decision-making.