Accepting credit cards is not just a convenience — it’s a necessity. However, the fees associated with these transactions eat into your profit margins.

To counter this, you must integrate a top-notch credit card processor with Intuit QuickBooks. Implementing the best credit card processing for QuickBooks optimizes your financial management and protects your bottom line.

In this blog, you’ll tackle:

- Why you need a credit card processor.

- Key features that define the best credit card processing for QuickBooks.

- How to make the right choice for your business.

Let’s get started!

Benefits of using credit card processing integrations for QuickBooks

Before exploring the best credit card processing for QuickBooks, let’s highlight their integration benefits:

- Lower transaction fees: Third-party processors offer competitive rates, which reduces transaction costs and boosts your bottom line.

- Efficient reconciliation: Integrating with QuickBooks automates the reconciliation process to save time and reduce errors.

- Enhanced security: Processor features like tokenization protect against fraud and chargebacks.

- Improved cash flow: Faster credit card processing ensures quicker fund availability.

- Better reporting: Integration provides real-time transaction recording for informed decision-making.

What to look for in credit card processing integrations for QuickBooks

When choosing the best credit card processing for QuickBooks, here’s what to look for:

- Seamless integration with QuickBooks: Your credit card processor should automatically sync with QuickBooks to minimize manual data entry and boost efficiency.

- Transparent pricing: Look for providers with clear rates, like flat-rate or interchange fees to avoid unexpected costs.

- Flexible terms: Choose services with month-to-month agreements to avoid long-term contract penalties.

- Strong security: Your processor should be PCI compliant to protect customer data, minimize fraud, and stay within legal requirements.

- Reliable customer support: Ensure accessible in-house support for quick troubleshooting.

- Effective chargeback handling: A robust chargeback system is essential to handle disputes and fraud, especially for high-risk merchants.

Does QuickBooks charge for credit card payments?

As you search for the best credit card processing for QuickBooks, you may wonder: Does QuickBooks charge for credit card payments?

The answer is yes. QuickBooks Online charges credit card processing fees through QuickBooks Payments. Fees per transaction vary based on your:

- Pricing plan.

- Sales volume.

- Transaction volume.

So, those who don’t ask, “Does QuickBooks charge for credit card payments?” end up paying more than they expect.

Best credit card processing integrations for QuickBooks in 2024

Without further ado, here are your six best credit card processing for QuickBooks in 2024.

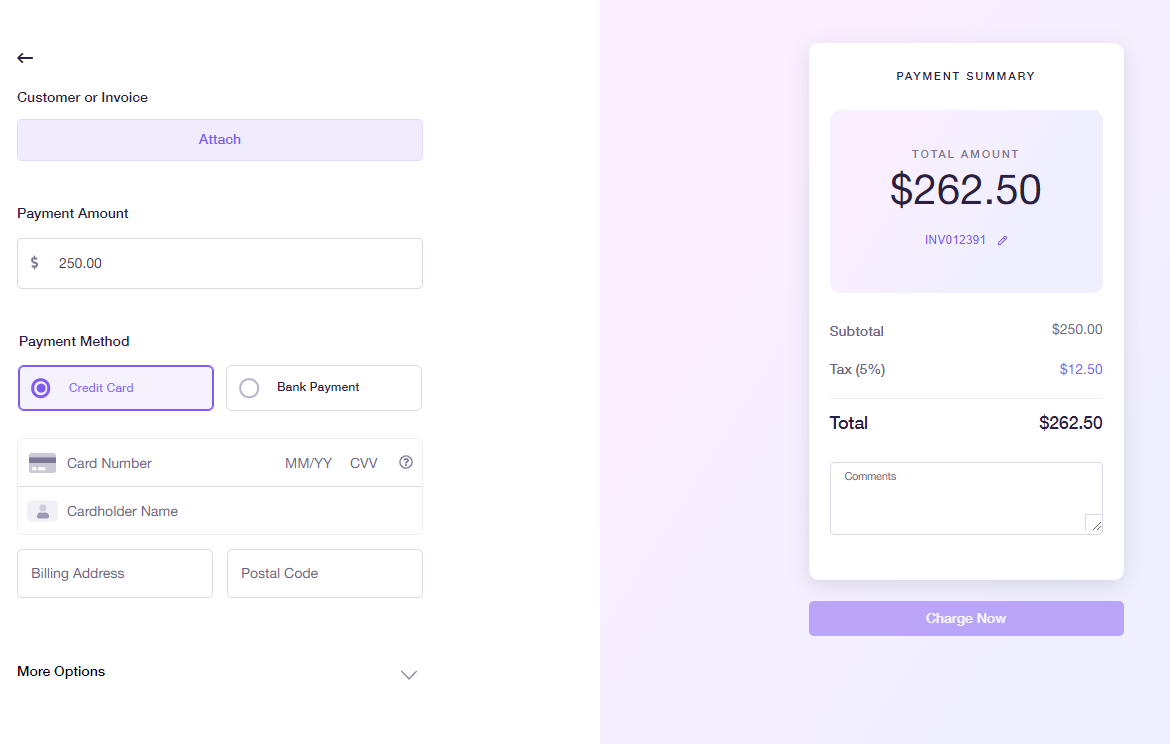

Method

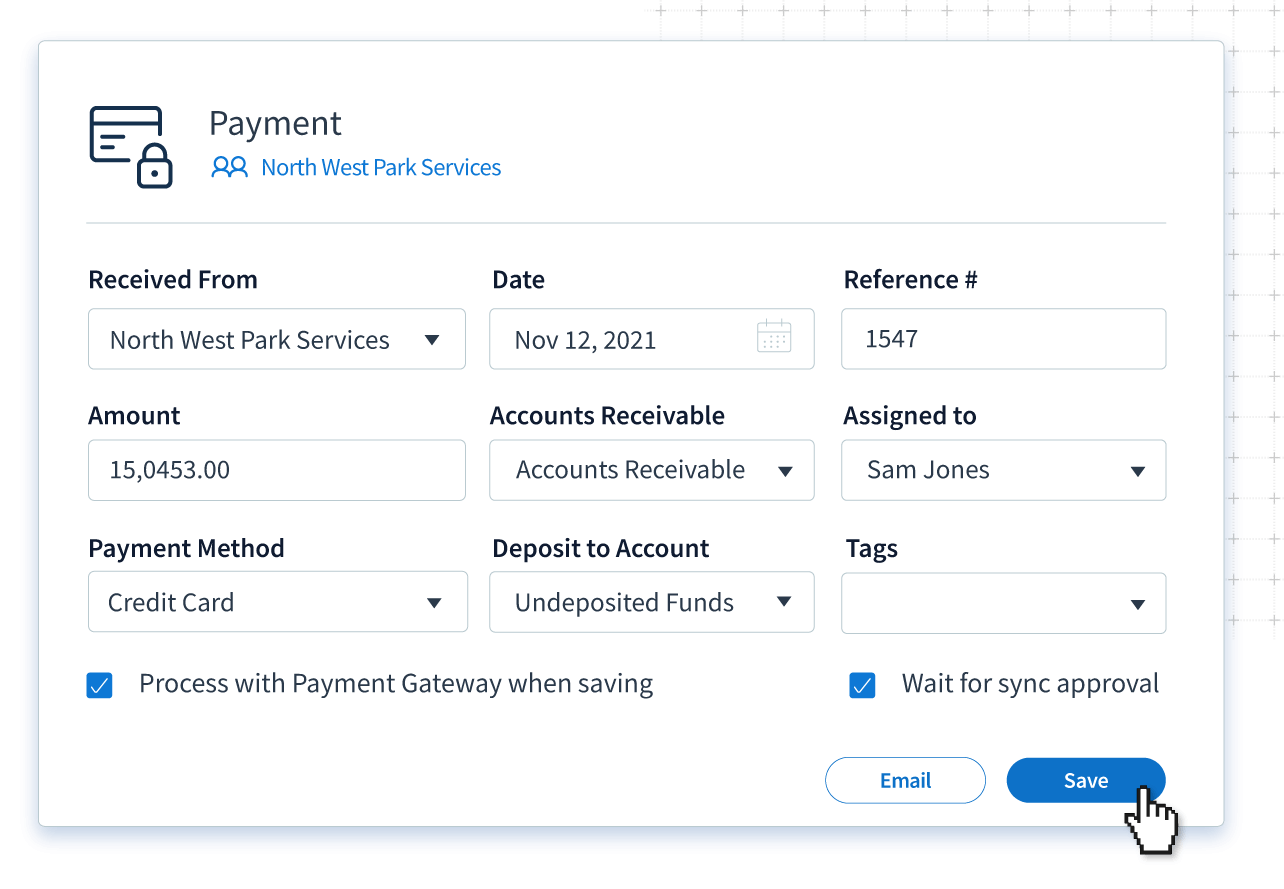

First on the list of best credit card processing for QuickBooks users is Method. As the #1 lead-to-cash automation tool for QuickBooks, Method enables credit card payments directly through your CRM. Its compatibility with various payment gateways ensures quick and hassle-free processing.

What’s more is that Method boosts accuracy and reduces payment errors with its real-time, two-way sync with QuickBooks.

Features

- Multi-payment provider support.

- Real-time credit card payment management.

- Secure transaction processing.

- Two-way sync with QuickBooks.

- Secure online invoice payments.

Pros

- Data security.

- Reliable customer support.

- Seamless third-party integrations.

- Customized, automated workflows.

Cons

- Only available in English.

- Limited to QuickBooks and Xero users.

Pricing

Method offers three pricing plans, charged per user:

- Contact Management: $25 per month billed annually, or $28 billed monthly.

- CRM Pro: $44 per month billed annually, or $49 billed monthly.

- CRM Enterprise: $74 per month billed annually, or $85 billed monthly.

There is also a 14-day, free trial with no credit card or contract required.

Stripe

Image credit: Stripe

Stripe is a leading name in credit card processing, known for its efficient payment handling. Its seamless APIs and robust functionality help users accept payments and transfer money globally.

Features

- Accepts all major debit and credit cards.

- Payment support in over 135 countries.

- Mobile-optimized checkout experience.

- Recurring payment management.

- Advanced fraud protection.

- Detailed reporting and reconciliation.

Pros

- Intuitive user interface.

- Diverse payment options.

- Customized payment automation.

Cons

- Clunky navigation.

- High processing fees.

- Slow search functionality.

- Limited merchant acceptance.

Pricing

Stripe follows a per-transaction pricing model:

- Domestic cards: 1.75% plus $0.30.

- International cards: 3.5% plus $0.30.

- Custom pricing is also available.

QuickBooks Payments vs. Stripe

When evaluating the best credit card processing for QuickBooks, a comparison between QuickBooks Payments vs. Stripe often comes up.

Here are the key differences between QuickBooks Payments vs. Stripe:

- Payment options: QuickBooks Payments focuses on bank transfers and credit cards. On the other hand, Stripe supports a wide range of options like digital wallets and international payments.

- User interface: QuickBooks Payments seamlessly integrates with QuickBooks, while Stripe has a more general, developer-friendly API.

- Pricing structures: QuickBooks offers competitive pay-as-you-go plans and a monthly subscription fee. Stripe is also pay-as-you go, but has no monthly fee.

- Reporting: While QuickBooks Payments offers simpler reporting features, Stripe stands out with its robust, real-time reporting.

- Security: QuickBooks Payments benefits from QuickBooks security through an all-in-one system. Stripe is also secure and offers advanced fraud detection.

In a nutshell, QuickBooks Payments is more integrated and cost-effective for QuickBooks users. In contrast, Stripe offers greater flexibility for diverse payments.

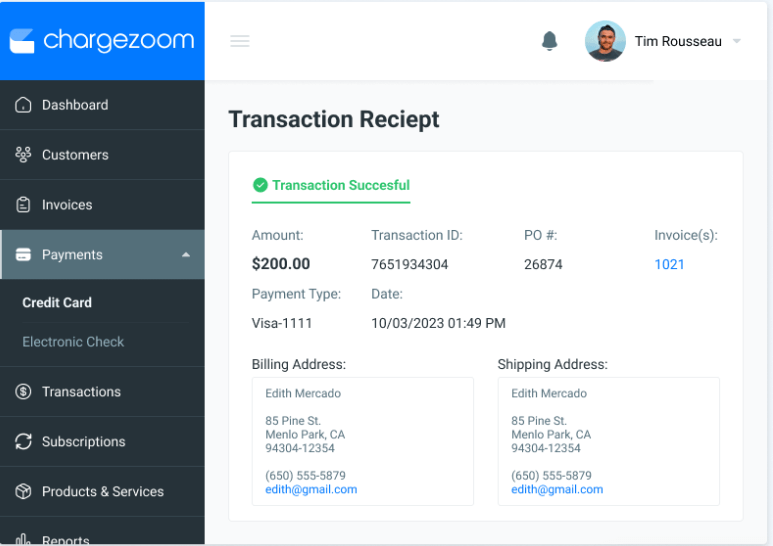

Chargezoom

Image credit: Chargezoom

Next up is Chargezoom. It’s a software that integrates digital payments and automates tasks. Its payment processor centralizes payment handling and minimizes payment friction.

Plus, adding new gateway connections is easy, so you can leverage as many as you want to secure the best rates.

Features

- ACH, debit, and credit card processing.

- Electronic and mobile payments.

- Payment fraud prevention.

- Integrations with accounting and payment platforms.

Pros

- Quick set-up and ease of use.

- Robust gateway support.

- Real-time, bi-directional syncs.

- Full suite of payment management tools.

Cons

- Limited customization features.

- Basic reporting tools.

- No mobile app.

Pricing

Chargezoom offers three pricing plans:

- Pro: $9 per month.

- Business: $29 per month.

- Plus: Over $59 per month.

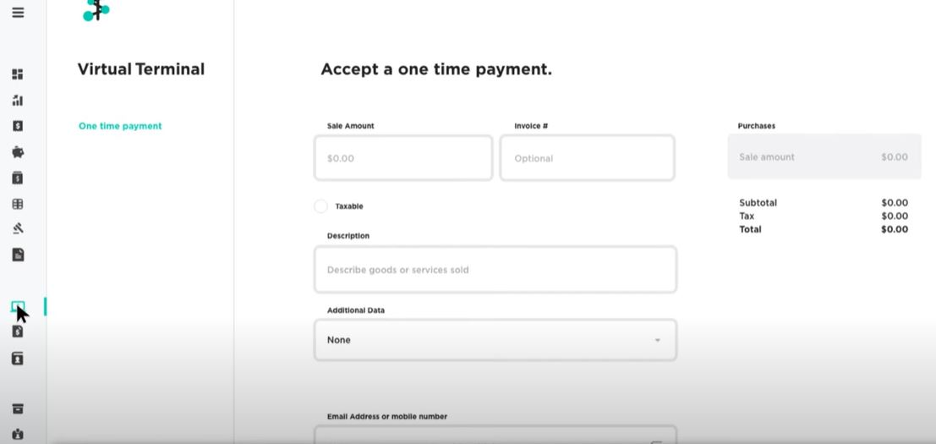

ProMerchant

Image credit: Payments Hub

ProMerchant focuses on credit card processing for:

- Retailers.

- Restaurants.

- E-commerce.

It emphasizes easy payment processing and exceptional service. Unlike others, ProMerchant outsources its software to two transaction processing platforms: Payments Hub and Authorize.Net.

Features

- Point-of-sale (POS) systems.

- Mobile payment processing.

- Virtual terminals.

Pros

- Month-to-month agreements.

- No set-up fees.

- Personalized support.

- Easy to use reporting tools and analytics.

Cons

- Additional fees for other payment types.

- No proprietary dashboard or mobile app.

- Limited online information.

Pricing

ProMerchant charges a monthly fee. To get a quote, you need to contact their sales department.

Helcim

Image credit: Helcim

Helcim offers credit card processing for new and experienced business owners. It supports in-person and online payments at competitive rates. Not to mention, Helcim simplifies credit card acceptance without additional fees or up-sells.

Features

- Zero-cost payments with Helcim Fee Saver.

- Quickbooks Online payments sync.

- Invoicing, recurring plans, and ACH payments.

- Contactless payment support.

- E-commerce website features.

Pros

- Affordable pricing.

- Secure payments.

- Multi-device access.

- Automatic volume discounts.

Cons

- High interchange rates.

- Frequent crashes and freezes.

- Limited back-office integration.

Pricing

Like Stripe, Helcim follows a per-transaction pricing model:

- In-person rate (average): 1.76% plus $0.08.

- Online and keyed transaction rate (average): 2.39% plus $0.25.

Rates also depend on factors like total monthly volume and average transaction size.

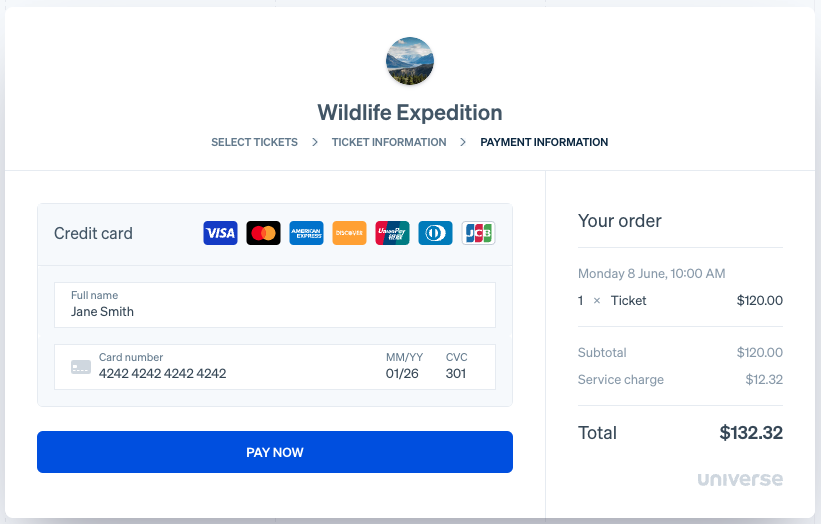

HoneyBook

Image credit: HoneyBook

Your final best credit card processing for QuickBooks option is HoneyBook. It’s a cloud-based CRM with easy-to-use online payment features. It supports all major credit cards, debit cards, and bank transfers to ensure a smooth client experience.

Plus, with its Instant Deposits feature, you get paid quicker and maintain steady cash flows.

Features

- Multi-payment options.

- Third-party app integrations.

- Automatic payment reminders.

- Competitive payment processing fees.

- Recurring payments and mobile invoicing.

Pros

- Intuitive and easy to use.

- All-in-one client management tool.

- Custom task automation and sales pipelines.

- Online payment acceptance.

Cons

- Limited reporting metrics.

- Lacks project pipeline customization.

- Limited customer management features.

Pricing

HoneyBook offers three pricing plans.

- Starter Plan: $19 per month, or billed annually at $16 per month.

- Essentials Plan: $39 per month, or billed annually at $32 per month.

- Premium Plan: $79 per month, or billed annually at $66 per month.

Recap: Best credit card processing for QuickBooks

In your search for the best credit card processing for QuickBooks, choosing the right option is a game-changer. Integrating credit card processing with QuickBooks improves your cash flow and financial management.

Tools like Method simplify payment processing with:

- Faster online transactions.

- A two-way data sync with QuickBooks.

- Multi-payment gateway support.

As you explore your options, consider your business’ unique needs and how each software caters to them. With the right choice, success is in your reach.

Find the perfect payment processor for your business. Start your free trial of Method.

Image credit: Pixabay via Pexels