As a contractor, you know it’s a struggle to stay organized and make informed financial decisions, all while finding the time to run your business.

That’s where QuickBooks Online comes in as a great resource for contractors. From small handymen companies to large commercial projects, the software has a range of intuitive features to make your business run efficiently.

But, you might be wondering, is QuickBooks Online good for contractors?

In this article, you’ll learn

- How to use QuickBooks for general contractors.

- The accounting software’s limitations.

- If QuickBooks Online is ultimately a good solution for contractors.

What is QuickBooks Online?

QuickBooks Online by Intuit is an accounting software with cloud-based technology that can be accessed on-the-go, which is especially beneficial for on-site contractors.

It’s a popular choice for construction businesses of all sizes, as it lets you track sales, expenses, payroll, and inventory from anywhere and at any time.

This gives QuickBooks Online more functionality than a program like Excel. A business or accountant might prefer this software because it:

- Offers a user-friendly interface for non-accountants.

- Simplifies payroll for subcontractors and employees.

- Can operate through cloud-based access.

- Doesn’t require a lot of time to learn or instruct employees.

- Is inexpensive to buy.

Get started with your free trial of QuickBooks Online here.

Can you use QuickBooks Online for construction?

If you’re in the construction business, you know how specific your work processes need to be. With the amount of attention and detail you need to dedicate to each process, you may wonder, “Is QuickBooks online good for contractors in the construction industry?”.

The answer is yes.

QuickBooks Online is recommended for construction companies because it lets you simplify your workflows with features like:

- Job costing.

- Scheduling.

- Invoicing.

With QuickBooks Online, you have the flexibility to choose between four different subscriptions:

- Simple Start.

- Essentials.

- Plus.

- Advanced.

As long as you have a secure login and internet connection, you can access QuickBooks from anywhere. Plus, you’ll never have to back up your file.

The software will integrate seamlessly with your construction management platform, so choosing QuickBooks for general contractors is ideal.

Start your free, 30-day QuickBooks Online trial and get 30% off your subscription during your first year.

Is QuickBooks Online good for contractors?

Business owners might be wondering, is QuickBooks Online good for contractors?

The answer is yes, QuickBooks Online is a great option for any contractor or construction company and has received positive reviews from construction professionals. Many users rate the software highly and leave a good review.

A major reason that QuickBooks Online is recommended by many construction industry experts is that it integrates seamlessly with construction management tools like Method.

Method is a CRM (customer relationship management) platform that manages your customers and how they interact with your business. Its third-party apps integration streamlines expense tracking for construction projects and supports customized reporting for construction metrics.

This functionality allows contractors to monitor their financial health while saving time for everyone in the business.

Benefits of using QuickBooks Online for contractors

When asking “is QuickBooks Online good for contractors?” there’s many reasons why the answer is yes:

Streamline accounting processes

QuickBooks Online meets the specific needs of contractors by simplifying day-to-day bookkeeping tasks. It is cost-effective compared to other industry-specific solutions.

Because QuickBooks Online has a user-friendly interface, it’s easy to train your employees to use its payroll features and navigate its reporting options. That’s less time needed to familiarize yourself with the software or educate new staff, and more time spent on value-added tasks.

Integrating QuickBooks Online with Method offers features tailored for construction businesses. Method provides easy invoicing for contractor services and lets you oversee and forecast project profitability. Also, you get automation tools that help you avoid errors while you maintain control over your time.

Automate payments

QuickBooks Online ensures cash flow remains steady as it facilitates efficient project budgeting and forecasting.

It lets you:

- Set up recurring bills for regular clients.

- Automate payment reminders.

- Leverage web-based invoicing capabilities that can be paid from anywhere.

- Add on a third-party integration with banking platforms.

This minimizes the hassle of chasing payments and maximizes your cash flow efficiency.

Job costing management

Being able to judge profitability is crucial. QuickBooks Online offers costing tools that let you evaluate job expenses and see exactly where you’re making money — and where you’re not.

Integrating with Method gives real-time insights into project profitability. This will guide you to assess decisions about pricing and resource allocation.

Manage subcontractors

We advise integrating QuickBooks with Method, which enables contractors to manage multiple projects simultaneously. It also comes with time tracking functionality.

Time tracking is available with QuickBooks Online when you subscribe to QuickBooks Time. The lowest price for QuickBooks Time is $40 per user a month with an extra $10 for additional users. This adds up quickly for multi-user access.

In contrast, Method:Field Services starts at $45 per month to acquire a dispatcher account. Not only does it measure time tracking, but it also offers a suite of other benefits:

- Create and map the most efficient route to a job site.

- Instant data sync with QuickBooks to assist in admin work.

- Ability to approve estimates and pay a deposit at the click of a button.

- Time tracking visibility on an invoice document attachment.

- Advanced customization options.

Method updates regularly with features beneficial for contractors and comes with dedicated support for contractor queries. This customer support helps you handle the questions and complications that come with multiple ongoing jobs.

When you invest in Method, you gain a lot more value for your purchase. And when asking, “Is QuickBooks Online good for contractors?” this integration is one of the best reasons to choose it.

Be ready for tax season

QuickBooks makes tax preparation easier for contractors. It categorizes transactions and can calculate reports needed for tax filing, making it easier to maximize deductions and maintain compliance. You can utilize tax tracking and bank reconciliation data to be prepared for tax season.

Integration with Method gives you a complete overview of all your data. Information from emails to accounting and other platforms is centralized, making it easy to collect everything you need come tax season.

Free from data loss or error

With QuickBooks Online, your information is stored in the cloud with encrypted data security.

This ensures secure data storage for contractor businesses, as it keeps sensitive information safe from system failures.

Run construction finances remotely

QuickBooks Online’s mobile app capabilities mean that you can manage your finances on the go, whether you’re at the job site or on the move. This anytime, anywhere access to your information ensures you’re always at the helm of your business operations.

How to use QuickBooks for general contractors

Now that you’ve answered the question, “Is QuickBooks Online good for contractors?” let’s get more specific.

In this section, you’ll see how to use QuickBooks for general contractors.

Job costing

Every construction contractor knows how critical job costing is to determine profitability. That’s why many choose to use QuickBooks for general contractors.

Several features in QuickBooks let you keep track of labor costs, time, and expenses for efficient job costing, including:

- Dashboards and reports to decide if your revenue exceeds your costs.

- Automatic updates when you connect with QuickBooks Payroll and Time to see profitability insights.

- Visual charts to analyze where profit is trending in projects.

- Cost-tracking calculator to adapt to your budget.

Job scheduling

One of your challenges as a contractor is trying to organize the endless dates, times, and clients.

But using QuickBooks for general contractors helps. You can also take things to the next level with the QuickBooks Time job scheduling software.

With the application, set multiple schedules on the go for your team to stay on track at all times.

Jobs can be created in minutes and then assigned to employees. Alerts then notify employees of new jobs or modify schedules in real-time.

Repeating last week’s schedule? No fuss, just drag and drop schedules from previous schedules to finish your tasks in seconds.

So going back to the question of “is QuickBooks Online good for contractors?” The answer is it’s perfect for crews on the move.

You can even see GPS points for clocked-in employees when you open the Who’s Working windows.

The best part? Store everything in the cloud and track insights about hours worked and estimated for future job costing.

Billing and invoicing

One of the biggest struggles of a general contractor is getting paid on time. Every contractor has at least one horror story about getting paid six months after completing a job.

Or even worse — not at all!

By using QuickBooks for general contractors, you won’t run into that problem as the software creates your invoices and quotes.

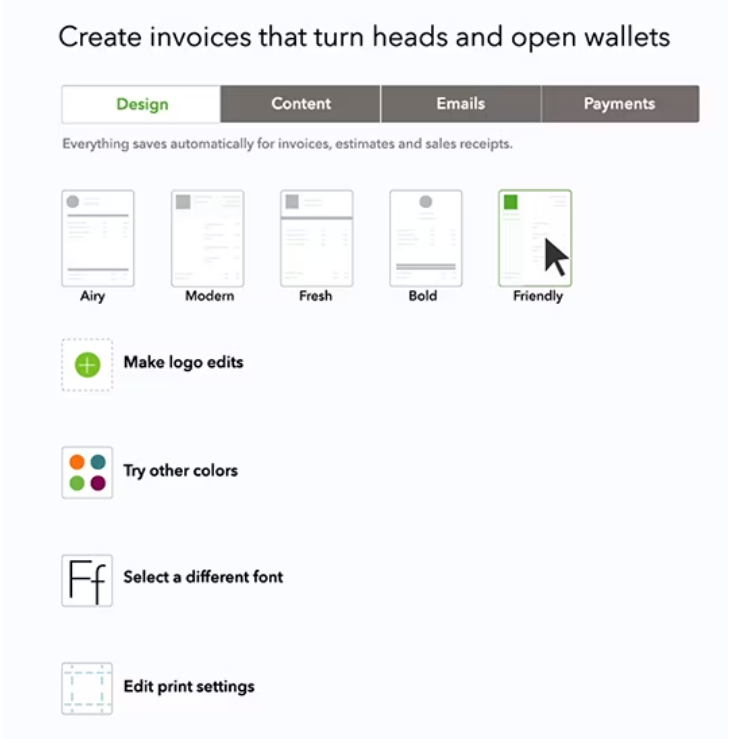

The best part is that the professional look of the invoices that make your business look good and impresses potential customers.

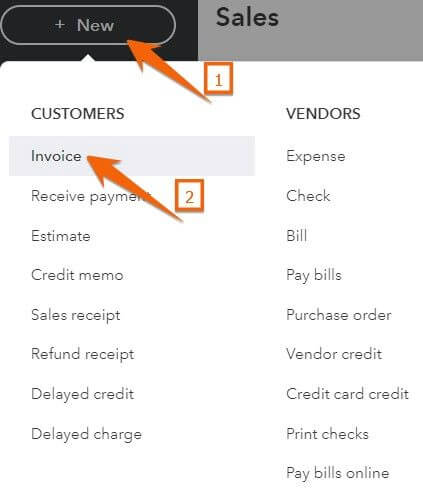

Here’s a simple breakdown of how you can create an invoice in QuickBooks Online:To start, select +New and click on Invoice in the drop-down menu.

- You’ll see an invoice form with contact information for your company. Make changes as needed.

- Next, click Add customer from the drop-down menu and select your customer if you’ve already saved their information previously. Otherwise, input the correct information for a new customer.

- Add notes and attachments, customize the design or font until you’re ready to send your invoice!

That’s it! Now you know how to easily create invoices for your customers to get paid faster.

What QuickBooks Contractor Edition is best for

There is no shortage when it comes to software for the construction industry, and you may wonder which one fits you the best.

QuickBooks Contractor Edition is a special version of QuickBooks tailored for the construction industry. However, the software is limited to computers on which the software is installed.

Its capabilities account for the cost of large jobs. It’s best for contractors:

- With several crews.

- On a smaller budget as QuickBooks Contractor Edition has the same inventory functionality as QuickBooks Premier’s base edition. So, unused materials from a job site can be reused on the next job, rather than ordering unnecessary materials.

QuickBooks Contractor Edition pricing

A QuickBooks Enterprise annual subscription is a total of $380.00 billed monthly with the ability to customize your package for additional features here.

Limitations of QuickBooks Online for construction

While the answer to is QuickBooks Online good for contractors is still a yes, it isn’t without its shortfalls. Here are some limitations when considering QuickBooks Online for construction:

- Lacks construction and business-specific features, unlike the Contractor Edition on QuickBooks Desktop.

- You cannot allocate indirect costs to jobs automatically.

- Projects can only belong to a customer or sub-customer, rather than a sub-project.

- Reports such as job costs by vendor are not available in QuickBooks Online.

- Maintaining and adding features is expensive.

QuickBooks Online vs. QuickBooks Desktop for contractors

The main difference between QuickBooks Online and QuickBooks Desktop for contractors is the Online version lets you access your information while mobile. This is especially beneficial for contractors that are on the move.

Simplify your construction workflows with Method:Field Services

As today’s business environment becomes increasingly complex, construction companies are focusing on customer retention.

An effective CRM solution simplifies your construction workflows. And it’s even better if your CRM integrates with QuickBooks to manage transactions and construction project progress in one place.

Method CRM streamlines every part of the building process, from tracking bids to managing documents. Below is a preview of its benefits.

Its two-way QuickBooks sync allows you to create estimates on the fly, convert it to a work order and issue an invoice in either program without needing to re-enter data. The data automatically reflects in your QuickBooks account.

Syncing with QuickBooks also allows your customers to pay invoices online without needing to rekey this data into QuickBooks.

Instead of cluttering your accounting data in QuickBooks with leads, you can manage your information in Method CRM. Then, have leads sync to your accounting software when they become customers.

Method CRM also makes it easy to access client history anytime. You get a centralized view of past interactions, project details, and QuickBooks transactions. This makes it easy to maintain a shared list of bids to deliver exceptional service to customers.

Bottom line

When considering which accounting software to go for, you need to know: Is QuickBooks Online good for contractors? And the answer is yes!

QuickBooks for general contractors is a great choice if you need help tracking your invoices, purchase orders, and payments.

With the ability to generate quick reports and create custom invoices easily, it’s clear why QuickBooks Online is ideal for busy contractors.

The software doesn’t come without its limitations though. For example, its reporting capabilities are limited and you can’t allocate indirect costs to jobs automatically. If these features are important to you, you’ll need to find an alternative.

When pairing QuickBooks Online with a powerful solution such as Method CRM, you enhance the power of your accounting tool. This combo automates your workflow and takes your construction business to the next level.

QuickBooks Online for contractors FAQs

Does QuickBooks Online have a contractor edition?

QuickBooks Online does not have a contractor edition but the QuickBooks Desktop version does. It provides you with tools to:

- Track job costs.

- Monitor profitability.

- Complete accurate tax filing.

- Process payroll.

- Generate invoices.

- Manage customer accounts.

What is the best software for a general contracting business?

QuickBooks Online is one of the best accounting software programs for general contractors.

When comparing QuickBooks to other options such as Xero, you’ll find they both provide powerful features such as job costing, progress billing, and inventory management.

However, QuickBooks offers distinct advantages, such as the ability to customize a report easily.

So, is QuickBooks Online good for contractors? The answer is yes! However, if you want a version of QuickBooks that’s especially for contractors, go with QuickBooks Contractor Edition on Desktop instead.

Either way, research all your options and consider your business needs before making a decision.

Can I use QuickBooks as an independent contractor?

If you’re considering QuickBooks for general contractors, then QuickBooks Online is a great choice. It allows you to easily track expenses and access your data on income. Additionally, it provides support for payroll, job costing, invoicing, payments, and more.

So, is QuickBooks Online good for contractors? Absolutely!

However, it does come with some limitations. For example, you won’t be able to add new custom fields or reports unless you upgrade to pricier versions of the software.Also, if you have multiple locations or manage a large number of contractors, then QuickBooks Online may not be the best option as it only supports one location per user at a time.

Watch our demo to get started with Method CRM!

Image credit: Shutter B via Adobe