If you own a business and use QuickBooks, you can probably appreciate how easy ACH payments are. However, have you considered the fees that come with them? Understanding these fees is crucial for your business. It helps you manage cash flow and budget more effectively.

In this article, you’ll answer: how much does QuickBooks charge for ACH payments? This way, you can make smart choices about how to handle payments. Whether you’re a small business owner or a seasoned accountant, knowing the ins and outs of ACH payment fees can help you save money, reduce unnecessary charges, and simplify your financial operations.

What are ACH (automated clearing house) payments?

ACH stands for Automated Clearing House, a network that facilitates electronic bank payments. When you make an ACH payment, the money is withdrawn directly from your checking account and deposited into the recipient’s account. This process is usually faster and more secure than writing a check and is often less expensive than using a credit card.

ACH payments are so popular because they’re incredibly convenient. Many businesses use them to pay their employees, vendors, and suppliers. It’s also an excellent way for customers to make recurring payments, like monthly subscription services or utility bills.

ACH payments are also relatively inexpensive. Unlike credit card transactions, which often come with hefty processing fees, ACH payments typically have lower costs, making them attractive for businesses with high-volume transactions. In addition to being convenient and cost-effective, ACH payments are also highly secure. The ACH network has robust security measures to protect transactions and prevent fraud, giving businesses and individuals peace of mind when making electronic payments.

Why does QuickBooks charge for ACH payments?

QuickBooks charges a small fee for ACH (Automated Clearing House) transactions for a few reasons:

- Operational costs: QuickBooks needs money to keep its systems running smoothly. This includes paying for secure servers, software updates, and staff to handle transactions.

- Service enhancements: QuickBooks uses the money to improve ACH services. This could mean adding new security features or creating tools that simplify your accounting tasks.

- Bank and network fees: QuickBooks pays banks and the ACH network to process these transactions. These costs usually fall on customers.

- Compliance and regulatory costs: QuickBooks must comply with rules to prevent issues like money laundering. The fees help cover the costs of adhering to those regulations.

- Customer support and education: QuickBooks aims to ensure users get the most out of their services by offering training and support.

Overall, QuickBooks’ fees for ACH transactions are usually in line with what other accounting services charge.

How does QuickBooks handle ACH payments?

QuickBooks handles ACH payments through a systematic process involving the following stages:

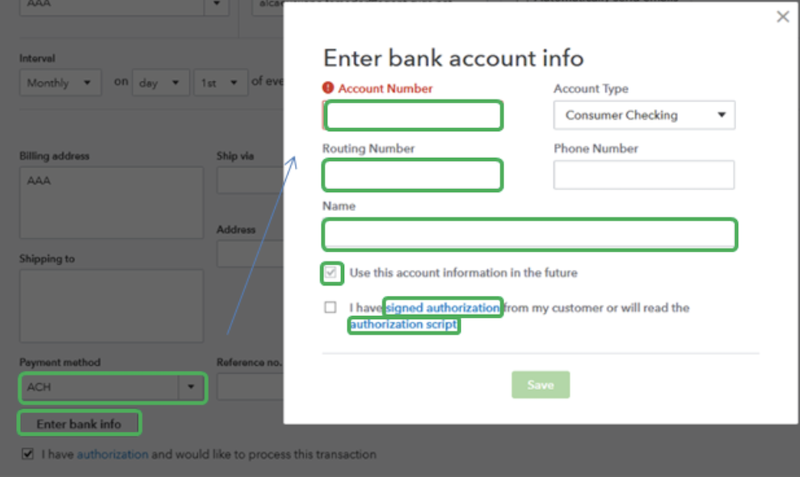

- Initiation: A user starts an ACH payment in QuickBooks. They choose the payee, payment amount, and payment date.

- Payment data collection: QuickBooks collects essential payment details. This includes the payee’s name, account number, and routing number.

- Payment data verification: QuickBooks checks the payment info to ensure everything is correct.

- File creation: QuickBooks creates an ACH file with all the payment details. This file is sent to the ACH network.

- Network processing: The ACH network processes the ACH file. It checks the payment info and ensures it complies with ACH regulations.

- Bank processing: The payee’s bank receives the ACH file and processes the payment, debiting the payee’s account.

- Payment settlement: The payment is settled. Money moves from the payee’s account to the recipient’s account.

- Payment confirmation: QuickBooks gets payment confirmation from the ACH network and updates the user’s account accordingly.

- Payment reconciliation: QuickBooks matches the payment with the user’s account to ensure everything is accurate.

- Completion: At this stage, the ACH payment process is complete. The user can check the payment status in QuickBooks.

Image credit: Intuit QuickBooks

QuickBooks ACH payment fees

QuickBooks charges a flat fee of $1 per transaction, with a maximum monthly payment of $10. This means that if you process multiple ACH transactions in a month, you’ll only pay a maximum of $10 in fees. Additionally, QuickBooks may also charge a small percentage-based fee for certain types of ACH transactions, such as payments to vendors or contractors.

However, this fee is typically waived for employee payments or other types of transactions. Note that these fees are subject to change, so it’s always a good idea to check the QuickBooks website or consult a QuickBooks representative for the most up-to-date pricing information.

Standard ACH payment fees

Here are the standard fees associated with ACH payments: $0.25-$1.50 per transaction (baseline rate), 0.5%- 1.5% of the transaction amount (percentage-based fee), $5-$30 per return or rejection (return fee), $10-$50 per month (monthly minimum fee), $0.10-$0.30 per transaction (micro-deposit verification fee), and $5-$20 per failed or rejected payment (NSF fee).

Note that these fees are subject to change and may vary depending on the payment processor, the type of transaction, and other factors.

Instant deposit fees

The instant deposit service for ACH payments through QuickBooks allows users to deposit funds into their bank account immediately rather than waiting for the standard ACH processing time. However, this expedited service comes with an additional fee. The instant deposit fee is typically a flat rate of 1% of the deposit amount, with a minimum fee of $0.25 and a maximum fee of $10.

This fee is in addition to the standard ACH payment processing fee. The additional cost factors contributing to the instant deposit fee include the expedited processing time, the increased security measures required for instant deposits, and the costs associated with facilitating immediate access to funds.

For more information on QuickBooks payment fees, check out our video below.

Factors influencing QuickBooks ACH payment fees

The fees for QuickBooks ACH payments can vary based on a few things. First, it matters what kind of transaction you’re doing. Are you paying employees, vendors, or contractors? The number of transactions you make matters, too. If you do a lot, you might pay more or even get discounts. How fast you want the payment to go also counts.

If you choose instant deposits, expect higher fees. The payment method you pick, like ACH debit or credit, can also change the costs. Lastly, your QuickBooks plan affects what you’ll pay. Some plans have better prices or extra features.

QuickBooks subscription plan

Here’s a breakdown of how different QuickBooks subscription plans influence the fees charged for ACH payments:

- QuickBooks Online Simple Start: 1% per transaction (max $10) for ACH payments, with no monthly minimum fee.

- QuickBooks Online Essentials: 1% per transaction (max $10) for ACH payments, with no monthly minimum fee. However, users can access additional features, such as multiple-user access and time tracking.

- QuickBooks Online Plus: 1% per transaction (max $10) for ACH payments, with no monthly minimum fee. This plan also includes features like inventory management and budgeting.

- QuickBooks Online Advanced: This plan charges 0.5% per transaction (max $5) for ACH payments and has no monthly minimum fee. It includes advanced features like customized reporting and workflows.

- QuickBooks Payments: Offers discounted ACH payment rates (0.5% per transaction, max $5) for high-volume users, with a monthly minimum fee of $20.

- QuickBooks Pro/Premier: 1% per transaction (max $10) for ACH payments, with a monthly minimum fee of $10.

Note that these fees and plans are subject to change. For the most up-to-date pricing information, check the QuickBooks website.

Volume of transactions

The number of transactions you make affects the ACH payment fees in QuickBooks. The more transactions you make, the lower the fees usually are. That’s because QuickBooks gives discounts for high volumes. For instance, if you handle more than 500 monthly transactions, you might get a reduced fee of 0.5% per transaction instead of the usual 1%. If you really go big and have over 5,000 transactions monthly, you might even get special pricing with lower fees.

These discounts can help businesses save money on ACH processing fees, making it more affordable to manage finances through QuickBooks.

Negotiated rates for high-volume users

If your business does a lot of transactions, you might get better rates for ACH payments with QuickBooks. QuickBooks has different pricing plans, often giving lower rates to those who bring in high volumes.

To negotiate first, check your current pricing and see how many transactions you do. Then, reach out to QuickBooks’ customer support or sales team. Explain what your business needs and ask for a custom quote. Ensure to share details about your transaction volume, average amount per transaction, and how often you make payments. This shows them you’re a high-volume user.

QuickBooks might give you a better rate, a flat fee, or a special plan just for you. Be ready to negotiate and also mention any better offers you might have from other B2B payment companies to strengthen your case.

Benefits of using ACH payments in QuickBooks

Using ACH payments with QuickBooks has several benefits that can help businesses improve their payment process, save money, and manage their finances better.

Lower transaction fees compared to credit card payments

When you look at ACH fees versus credit card fees, ACH is way cheaper. Credit card fees usually hit you with 2.5% to 3.5% of the sale amount. Plus, there’s an extra fee of $0.10 to $0.30. That can add up fast!

On the flip side, ACH fees through QuickBooks are much lower. You’re looking at only 0.5% to 1% of the sale and a flat fee of $0.25 to $1.00. Think about it. If you make a transaction of $1,000, credit card fees would be around $25 to $35. But for ACH, you’d pay only about $5 to $10. In short, using ACH can save businesses up to 75% on fees.

Improved cash flow and payment speed

ACH payments can really help businesses manage their money better. They speed up the process of getting paid. Instead of waiting for paper checks, businesses receive the money directly in their bank accounts, allowing them to access their funds much faster.

When businesses get paid quicker, they can reduce the time it takes to collect money from customers. This means more cash on hand for other needs. They can buy more inventory, pay their suppliers promptly, and invest in new ideas.

In short, using ACH payments makes it easier for companies to keep their cash flowing smoothly. It helps them work better and make smarter money choices.

Enhanced security and reduced risk of fraud

ACH payments have several security features to help prevent fraud. First, they use strong encryption, such as SSL/TLS, to keep sensitive payment information safe while transacting between banks and the ACH network.

In addition, ACH payments require clear permission from the payer. This can be a signed agreement or an electronic authorization, which prevents unauthorized transactions. The ACH network also checks account and routing numbers to ensure that payments go to the right place and that accounts are real.

There are also strict rules, like the Nacha Operating Rules. These rules guide how ACH transactions work and ensure secure payments. Together with QuickBooks’ own security, these features protect businesses and individuals from losing money to fraud.

Are there any hidden fees associated with ACH payments?

A lot of people worry about hidden fees with ACH transactions. The good news is that QuickBooks is upfront about its fees. When you use QuickBooks for ACH transfers, there’s a flat fee for each transaction. You can find this fee laid out in the QuickBooks pricing plan.

QuickBooks also tells you about any extra fees. This includes charges for returns, rejected payments, NSF fees, or instant deposits. You can see all these in QuickBooks’s terms of service right on the platform.

QuickBooks also provides detailed invoices and statements, making it easy for businesses to keep track of their ACH fees and avoid surprises. By being transparent about fees, QuickBooks helps businesses feel confident in their payment choices.

Key takeaways

Understanding the fees associated with ACH payments in QuickBooks can help you make informed decisions about your business’ payment processing needs. Bear the following in mind:

- ACH fees can add up: QuickBooks charges a flat fee per ACH transaction, ranging from $0.25 to $1.00, depending on your subscription plan. If you’re processing a high volume of transactions, you can incur significant fees.

- Bulk discounts are available: QuickBooks offers tiered pricing for ACH payments, with lower rates for higher transaction volumes. You may be eligible for discounted rates if your business processes many ACH transactions per month.

- Negotiating fees is possible: You can negotiate ACH fees with QuickBooks, especially if your business has a high transaction volume or is willing to commit to a minimum transaction volume or term length.

- Financial impact: Understanding ACH fees in QuickBooks can significantly impact your business finances as you can save hundreds or even thousands of dollars per year.

If you’re already using popular payment gateways like Stripe, Authorize.Net, or PayPal, Method CRM works directly with these platforms. You also gain access to self-serve customer portals for 24/7 invoice payments, automated administrative workflows, personalized templates, and more—all while ensuring every payment and customer detail is synced with QuickBooks.

What’s even better is that Method’s customer portals are fully customizable, which means you can design the experience to align perfectly with your branding and business processes.

It’s not just about offering more payment options—it’s about creating a polished experience that makes your business stand out. Check out the video below to learn more about what Method makes possible.

Ready to give it a try? Start your free trial today—no credit card or contract required.

How much does QuickBooks charge for ACH payments FAQs

How long does it take to process an ACH payment in QuickBooks?

In QuickBooks, ACH payments typically take 1-3 business days to process. However, weekends, federal holidays, and bank holidays may delay the processing time. Additionally, some banks may take longer to process ACH payments, so it’s always a good idea to check with your bank or the recipient’s bank for specific processing times.

Can I negotiate ACH payment fees with QuickBooks?

You can negotiate ACH payment fees with QuickBooks, especially if your business has a high volume of transactions. Although QuickBooks has set prices, it might offer discounts or special rates for loyal customers or businesses with high transaction volumes.

To start negotiating, you’ll need to share details about how many transactions you make, the average amount, and how often you process payments. It helps if you’re ready to agree to a minimum number of transactions or a contract length to get the best deal.

When you negotiate, you can get lower rates, cheaper monthly fees, or custom pricing plans. For instance, if your business handles over 1,000 monthly transactions, you could receive a discount of 0.25% + $0.25 per transaction instead of the regular 0.5% + $0.50.

Just remember, your negotiation results will depend on your business needs and how QuickBooks sets its prices.

Does QuickBooks offer discounts for bulk ACH payments?

Yes, QuickBooks offers discounts for ACH payments made in bulk. To qualify for a bulk discount, businesses must agree to a minimum number of monthly transactions, sign a contract for a set time, such as 6 to 12 months, and pay a fee monthly or once a year.

That said, it’s best to contact QuickBooks directly. They can help you determine whether you qualify for those ACH payment discounts.