Credit card payment fees are sneaky, and sometimes feel as though they’re chipping away at your hard-earned profits.

If your business uses QuickBooks, you’ll be happy to know that the platform doesn’t make these fee structures overly complicated.

In this guide, we’re breaking down exactly where and when QuickBooks payment processing fees occur and which transactions you can expect to be charged a little extra for.

Keep reading to learn once and for all: how much does QuickBooks charge for credit card payments?

What are QuickBooks credit card processing fees?

No one enjoys hidden fees that pop out of nowhere, but thankfully, QuickBooks is quite transparent when it comes to what transaction types they process and how much they charge to process them.

Here’s a detailed rundown on the types of fees you’re likely to encounter when using QuickBooks credit card processing. Exact transaction fees are below.

Invoicing and quick request rates

- Cards: Fees apply whenever customers use Visa, Mastercard, or American Express to pay an online invoice or quick payment request.

- Digital wallets: You can accept payments via Apple Pay, Google Pay, PayPal, and Venmo. As these are typically connected to credit and debit cards, expect those same transaction fees to apply when customers settle invoices using digital wallets online (2.5%).

- ACH bank payments: These are electronic bank transfers that move funds straight from your customer’s account to yours.

Card reader rates

- In-person card payments: For face-to-face transactions, or when customers tap, swipe, or insert their cards into a reader, charges and processing fees apply. This applies to any accepted payment cards such as MasterCard, Visa, and American Express.

- In-person digital wallets: You can also accept payments through Apple Pay, Google Pay, PayPal, and Venmo using a card reader during in-person transactions.

Keyed-in payments

Processing fees of 3.5% per transaction also apply when you need to manually type in your customer’s card details to process a payment. This includes all major credit cards.

Payment dispute protection

QuickBooks offers automatic protection for credit card and debit card disputes and is an optional extra that attracts processing charges on top of the ones listed above. They’ll cover up to $25,000 per year, with an individual dispute limit of $10,000.

Breaking down QuickBooks credit card processing fees

Now you’ve got a handle on what you’re being charged for when processing credit card payments, let’s look at the percentage deduction for each type of transaction. Knowing what you’re charged upfront makes it easier to budget and keep expenses in check.

So, how much does QuickBooks charge for credit card payments? Here’s a quick breakdown of what you can expect to pay per transaction based on how your customers choose to pay:

- Online invoices and quick requests (cards and digital wallets): 2.99% per transaction, but this varies based on factors such as transaction type and volume.

- In-person payments (using a physical card reader): 2.5% per transaction.

- Keyed-in card payments (manual entry): Flat rate for keyed entries at 3.5% per transaction.

- ACH bank payments: Fee of 1% per transaction, but this fee is capped at $10 for transactions exceeding $1,000.

- Instant deposits to QuickBooks and external accounts: 1.75% fee (or free with QuickBooks Checking accounts.

- Payment dispute protection: Starts at 0.99%.

These rates cover transactions made using Visa, MasterCard, Discover, American Express, Apple and Google Pay, PayPal, and Venmo.

Importantly, take notice that manually keyed-in payments attract higher fees than swiping and tapping, and it’s important to record accurately all of these transaction fees when it comes time to reconcile.

How to record credit card processing fees in QuickBooks

Tracking fees isn’t exactly the highlight of running a business, and you might be wondering why you even need to do it, given that fees are deducted automatically.

The reason why it’s good practice to keep track of all these fees is because it provides both justification for the final invoice and accounts for any discrepancies come reconciliation time.

The good news is that QuickBooks makes this process easier than you think. Let’s walk through it step-by-step:

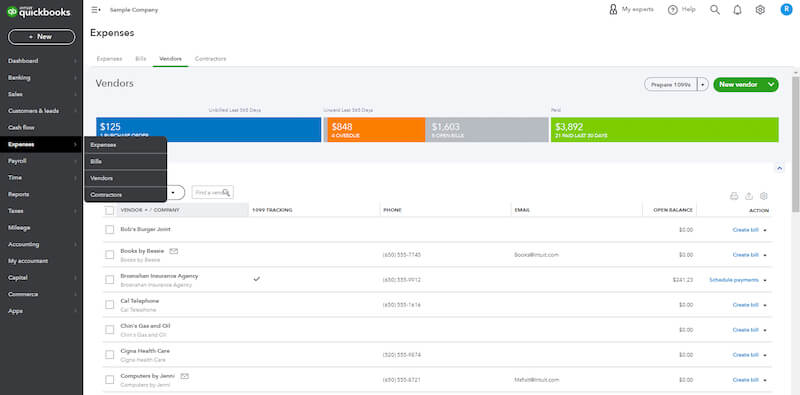

Step 1: Access your expenses

Log into QuickBooks and click on the “Expenses” tab on the left-hand menu (then click “Expenses” in the drop-down). This section of the platform is basically your command center for keeping tabs on where your money goes.

Image credit: Gentle Frog

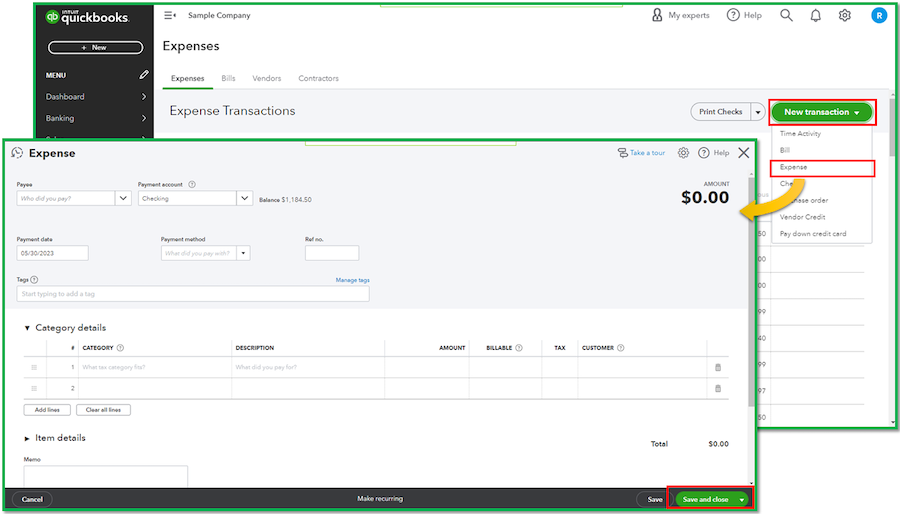

Step 2: Log the fee

Click on “New Transaction” and then select “Expense.” Now it’s time to officially put that fee on the record.

At a minimum, fill in these key details:

- Payee: Type in “QuickBooks Payments” or just the name of your payment processor.

- Payment account: Pick the bank account where the funds from your customer payments end up getting deposited after the credit card payment.

- Date: Enter the exact date when the transaction fee was charged.

- Amount: Record the processing fee according to the invoice. Be precise here, you’ll thank yourself later when sorting out reconciliation discrepancies.

Image credit: QuickBooks

Step 3: Categorize smartly

Under “Category,” choose “Bank Charges” or create a meaningful custom label like “Credit Card Processing Fees.” Organizing it this way makes it a whole lot easier to track down later.

Optionally, you can add a memo if you want to include any extra details about the fee.

Step 4: Save and reconcile

Hit “Save and Close.” Just like that, you’re one step closer to a picture-perfect ledger. When it comes time to reconcile your bank statement, make sure this entry matches up.

Pro tips to stay on top of it all

- Double-check the numbers, then check them again. Before hitting save and closing it off, give a few extra seconds to make sure you’ve got everything right.

- It’s painful, we know, but you should regularly reconcile your accounts. Think of it like a financial tune-up. Once a month is a good practice.

- Keep statements and records from QuickBooks handy. At some point, you’ll need them for quick reference, and exporting takes time you may not have.

For more information on QuickBooks payment fees, check out our video below breaking down everything you need to know.

Why use QuickBooks for online payments?

This is an important question, especially in light of some of the more expensive transaction fees. Understand that there are several benefits to keeping everything, including online payments, under one roof:

- As a user-friendly platform, once you’re used to using QuickBooks, you’ll never look back. Everything is placed intuitively, and all aspects of accounting, tracking, and invoicing are integrated into one platform.

- You can access your money faster. Payments in QuickBooks generally hit your account within one business day. While it’s not quite a “real-time” payment platform, it’s close enough to keep your cash flow steady.

- The team at Intuit is always ready to help when you run into issues. Their knowledge base and help center articles are also easy to go through when you’re in a rush, and if you can’t find what you need there, the community is ready to help.

- There are lots of payment options for customers. QuickBooks accepts all major credit and debit cards plus popular digital wallets. Essentially, more payment options mean it’s easier for your customers to work with you.

Why you might not want to use QuickBooks for online payments

Using QuickBooks for online payments makes sense if you’re looking to combine everything into an easy-to-use and comprehensive platform. But it’s not without its limitations, which is where integrating tools with the platform you know and love goes a long way.

Here are a few drawbacks to keep in mind, not only for QuickBooks but most small business accounting platforms:

- Fees add up: When you’re using QuickBooks for online payments, you’re not just paying for the processing fee. You’re paying for the convenience of having everything all in one place, and these fees can really start to add up.

- Occasional software issues: Like any online platform, QuickBooks can have the occasional glitch. If it happens at just the wrong moment, it can leave customers pretty frustrated.

- Customization sometimes isn’t really that custom: QuickBooks is known for its lack of “uniqueness” in some areas, like tailored invoicing and payments. You can also face issues integrating it with your existing systems.

- Locked-away features: A lot of the more useful features, like multi-currency and budget management, are only available on higher-paid tiers. For some small businesses, access to these features might come at a cost you can’t afford.

None of these drawbacks are real deal-breakers, and the good news is using a platform like Method negates most of them anyway. Method integrates perfectly with QuickBooks, giving you more control over your customer payments while also providing access to more useful reporting and lead generation features than are available on the native QuickBooks platform.

How to cut down on credit card processing fees

Want to keep using QuickBooks and hold onto more of your hard-earned money? There are a few practical ways to cut down on those processing fees.

First, you can incorporate those processing fees into your final invoices. Most vendors and customers understand that covering the processing fees is all part of the business—and they probably already do it themselves.

Picking the plan that best fits your business can also help. Some plans offer better value than others, especially if you’re paying for services you don’t actually use. Tapping or swiping cards for payment also typically costs less than a manual key-in. For digital wallets, swiping and tapping costs you less in fees than paying online.

Finally, try and convince your customers to pay using ACH rather than a card. If they’re QuickBooks users, they can deposit money using the platform instantly for a much smaller fee of 1% per transaction (capped at $10 for transactions over $1,000).

Key takeaways

Here is a quick recap to help you stay on top of those credit card processing fees:

- Get familiar with fees and understand what QuickBooks is charging you for, it’s the first step in managing costs and avoiding surprises.

- Keep track of those fees by logging them in QuickBooks, it keeps your ledger clean and makes reconciliation much easier.

- Keep looking at the bigger picture, QuickBooks payments, accounting, and financial management all under one roof make sense for small businesses.

- Integrate your existing CRM and QuickBooks with Method and experience simplified operations, better invoicing management, and a better chance at helping your business grow.

If you’re already using popular payment gateways like Stripe, Authorize.Net, or PayPal, solutions like Method have those integrations built right in. Plus, you get:

- 24/7 self-serve portals for easy invoice payments.

- Automated workflows to cut down on admin tasks.

- Templates you can make your own.

And yes, everything syncs back to QuickBooks without you lifting a finger.

But here’s the best part: you can tailor the experience to match your branding and processes, so you look as polished as you are.

This isn’t just about payment options. It’s about giving your customers a smooth, professional experience that sets your business apart. Check out the video below to see more of what Method makes possible.

Ready to see for yourself? Try Method free for 14 days—no credit card required.

How much does QuickBooks charge for credit card payments FAQs

What is a reasonable credit card processing fee?

Credit card processing fees typically hover around the 1.5% to 3.5% mark per transaction, depending on the provider and method of payment.

QuickBooks falls within that range, typically charging between 2.5% and 3.5%, so their rates are what is considered “reasonable.”

What counts as reasonable to you usually depends on your business priorities, whether you’re okay with paying a little extra for the convenience of having everything done under one roof.

How can I avoid QuickBooks fees?

You can accept cash and checks as payment, but you will end up paying for it in other ways like time spent manually processing and entering payment details plus a trip to the bank.

Another option is to use another payment processor, but it might not integrate with QuickBooks, leading to more manual work.

Does QuickBooks charge fees for credit card refunds?

Unfortunately, yes. You can issue refunds to customers, but QuickBooks keeps the transaction fees from the original transaction. Depending on your pricing plan, you could also be charged extra to refund the money. Consumer law also dictates that you cannot deduct this extra processing fee, you must provide a full refund of the customer’s invoice.