You’ve probably seen it in the headlines: “QuickBooks Desktop discontinued!” It’s no longer a question of “Will QuickBooks Desktop be discontinued?” Instead, everyone is now asking: “When will QuickBooks Desktop be discontinued?”

The short answer is that after September 30, 2024, Intuit will no longer be selling QuickBooks Desktop.

But what does that mean, and what are the specific details Intuit has provided so far? And most importantly, where do you go from here?

This article will guide you through everything you need to know about the QuickBooks Desktop discontinuation and your options moving forward.

Let’s get started!

What does service discontinuation mean?

Is QuickBooks Desktop being phased out? Yes, service discontinuation means that Intuit will no longer provide updates, support, or sales for specific versions of QuickBooks Desktop. This includes critical security patches and updates, making it essential for users to consider their next steps.

Is QuickBooks Desktop going away?

You may be wondering: is Intuit discontinuing QuickBooks Desktop in its entirety, or does QuickBooks still have a desktop version? While QuickBooks Desktop will no longer be sold or supported for certain versions in the near future, QuickBooks Desktop Enterprise products will remain available as Intuit’s sole desktop accounting solution.

That being said, for all intents and purposes, QuickBooks Desktop as it’s evolved over the years will soon be obsolete. Since December 10th, 2021 — when Intuit switched Desktop to a subscription-only service and did away with one-time purchases — QuickBooks Desktop’s days have been numbered.

To learn more, keep reading or check out our video below.

What led to QuickBooks Desktop being discontinued?

QuickBooks discontinuing Desktop is part of Intuit’s broader strategy to focus on cloud-based solutions. The reasoning for this is driven by several factors:

- Technological advancements: By focusing on newer versions and cloud-based solutions, Intuit can offer more advanced capabilities and ensure compatibility with modern operating systems and hardware.

- Resource allocation: Intuit is prioritizing fewer versions of its products to dedicate resources to enhancing features, improving security and compliance, and providing timely support for the most current versions.

- Cost savings and profitability: Maintaining older, one-time purchase software versions is costly, and shifting to cloud-based solutions like QuickBooks Online provides a more predictable and stable subscription-based revenue stream. Cloud solutions also offer higher profit margins, easier updates, and better opportunities for upselling premium features.

When does QuickBooks Desktop service discontinuation take effect?

But exactly when is QuickBooks Desktop going away? Initially set for July 31, 2024, the discontinuation date has been extended to September 30, 2024 and only applies to US subscribers. This gives QuickBooks Desktop customers a bit more time to plan their transition.

What specific products will Intuit no longer be selling/supporting?

The discontinuation affects most QuickBooks Desktop versions, including:

- QuickBooks Desktop Pro.

- QuickBooks Desktop Premier.

- QuickBooks Desktop Mac.

- QuickBooks Desktop Enhanced Payroll.

Will current subscriptions to QuickBooks Desktop be discontinued?

While new customers cannot purchase these versions after the cut-off date, existing QuickBooks Desktop subscriptions will not be discontinued.

This means those who have already subscribed to QuickBooks Desktop Pro Plus, Premier Plus, Mac Plus, and Desktop Enhanced Payroll can continue to maintain and renew their subscriptions beyond the cut-off date of September 30, 2024. Intuit will continue to provide security updates and support for these existing subscriptions.

Keep in mind that down the road, current subscriptions can and likely will be discontinued eventually.

Is QuickBooks Enterprise affected by this change?

QuickBooks Enterprise will continue to be supported and sold. Both new and existing customers can continue to purchase and renew QuickBooks Enterprise subscriptions after the date of discontinuation.

QuickBooks Desktop sunset: What’s next?

As we approach the QuickBooks Desktop end of life period, you need to prepare for the future. Here’s a detailed guide with your three primary options to help you navigate this transition smoothly.

Option 1: Upgrade to QuickBooks Desktop Enterprise

Users of QuickBooks Desktop Pro, Premier, Mac, and Enhanced Payroll can consider upgrading to QuickBooks Desktop Enterprise.

This version offers enhanced features, such as the ability to handle larger data files and support for up to 30 simultaneous users.

QuickBooks Desktop Enterprise also includes advanced reporting capabilities and customizable dashboards for all of its Gold, Platinum, and Diamond versions. It also fully includes QuickBooks Desktop Payroll options if you’re worried about losing access to Enhanced Payroll.

To upgrade, ensure your systems meet the necessary requirements and consider consulting an IT professional for network setup or a QuickBooks ProAdvisor for assistance with data migration.

Option 2: Switch to QuickBooks Online

For those ready to move to the cloud and discover the latest critical security patches and updates from Intuit, you can move from Desktop to QuickBooks Online. Intuit offers a seamless transition with these four steps:

1. Prepare and export your data

Back up all your data to ensure nothing is lost during the transition. Here’s how:

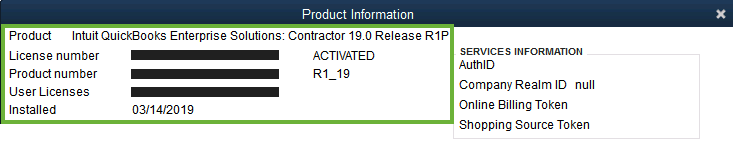

- Ensure your QuickBooks Desktop software is up to date. Press F2 to check your current version.

- Look for your product name, product number, and license number in the Product Information window.

Image credit: QuickBooks

- Update your QuickBooks version if necessary (while on the “No Company Open” screen, find the “Help” menu and select “Update QuickBooks Desktop”).

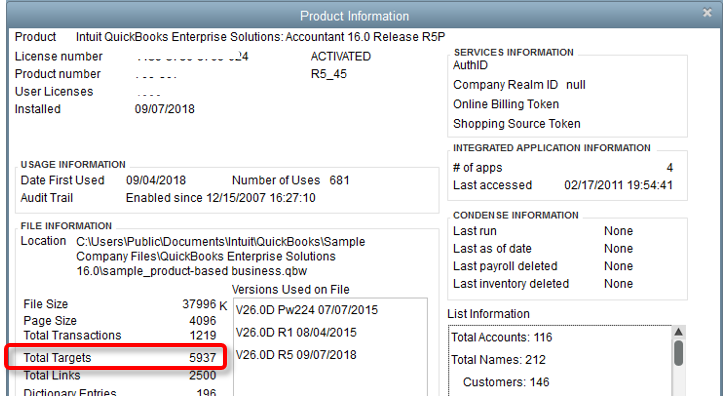

- Press Ctrl+1 to check the total targets. If your file exceeds 750,000 targets, you may need to reduce the file size by condensing data or start fresh in QuickBooks Online.

Image credit: QuickBooks

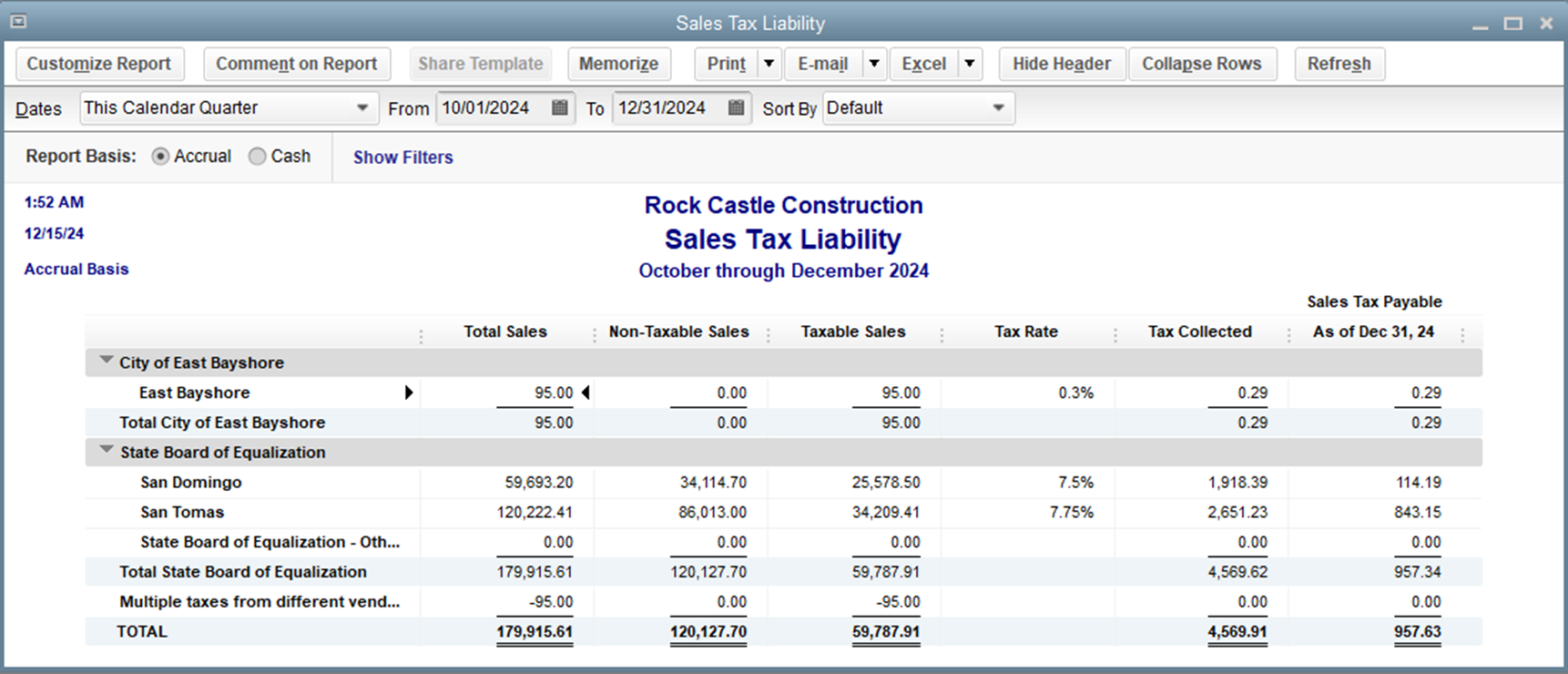

- Print a copy of your Sales Tax Liability report. Go to Reports > Vendors & Payables > Sales Tax Liability, select All Dates, and save it as a PDF.

Image credit: QuickBooks

- To prepare payroll data, terminate or deactivate employees who are no longer working for you and ensure all recent payroll data is transferred by waiting 2-3 days after running payroll before moving your data.

2. Plan the migration

Create a detailed migration plan to minimize disruption to your business operations when you move to QuickBooks Online.

Choose a time for the migration that minimizes business disruption, preferably after-hours or on a weekend.

If necessary, consult an IT professional for network setup and a QuickBooks ProAdvisor for data migration assistance.

3. Choose a payment plan

Select a payment plan that fits your business needs.

QuickBooks Online offers several plans:

- Simple Start: $30 per month.

- Essentials: $60 per month.

- Plus: $90 per month.

- Advanced: $200 per month.

Compare the features and pricing to determine the best fit for your business needs.

You can either sign up for a 30-day free trial or take advantage of any promotional discounts. Visit the QuickBooks Online website or contact their sales team for assistance.

4. Convert your data

The last step is to export and convert your data. Here’s how:

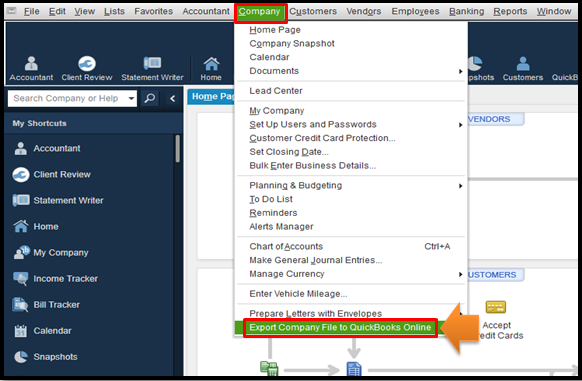

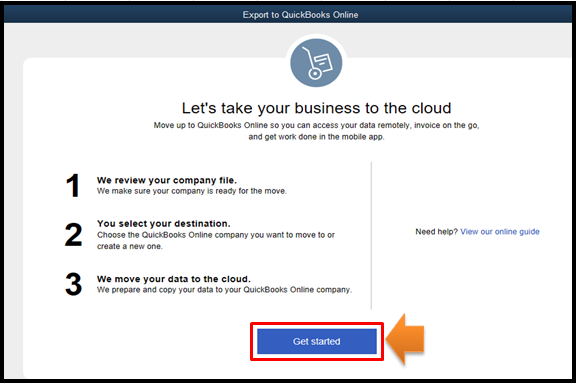

- Log in as an admin, go to Company > Export Company File to QuickBooks Online.

Image credit: QuickBooks

- Select “Get Started,” and then click “Start export” when prompted.

Image credit: QuickBooks

- Sign in to QuickBooks Online as an admin and choose the company to replace in the “Choose online company” drop-down menu.

- Click “Continue” and enter “Agree” in the text field.

- Choose “Replace” and confirm by clicking “Yes, go ahead and replace the data.”

- If you track inventory, select “Yes” to carry that data over, then specify the “as of” date. Or, select “No” if you want to set up items later (only available in Plus and Advanced).

- Connect your bank accounts and set up any additional features required for your business operations.

QuickBooks Online vs. Desktop: What’s the difference?

QuickBooks Online offers cloud-based accessibility, automatic updates, and real-time collaboration. On the other hand, QuickBooks Desktop provides a more traditional, standalone software experience.

QuickBooks Online’s advantages include:

- Cloud-based accessibility for access anywhere, any time.

- Ease of use.

- Over 750 third-party supported integrations.

- A mobile app.

- Automatic updates and security.

That said, it also has its disadvantages:

- Limited advanced features (i.e., advanced inventory management and job costing).

- User limitations (25-user maximum).

In contrast, QuickBooks Desktop strikes a different balance of pros and cons. Here are some of its advantages:

- Advanced features for inventory management, job costing, and industry-specific reporting.

- Local installation, which can be preferable for businesses that require more control over their data and/or do not always have reliable internet access.

- Detailed, customizable reporting tools (i.e., the QuickBooks Statement Writer for GAAP compliance).

Its disadvantages include:

- Lack of accessibility.

- Integration limitations.

- Discontinuation for new users.

- Higher cost.

What if QuickBooks Online doesn’t meet all my needs?

If QuickBooks Online doesn’t meet all your needs, don’t worry — you have other options. Evaluate your specific requirements, such as:

- Advanced inventory management.

- Industry-specific features.

- Particular integrations that you need.

You might find that QuickBooks Desktop Enterprise suits your needs better. Or, you might consider other accounting platforms outside the QuickBooks ecosystem. Consider consulting with an accounting professional to help identify the best solution for your business.

Option 3: Migrate to another accounting platform, like Xero

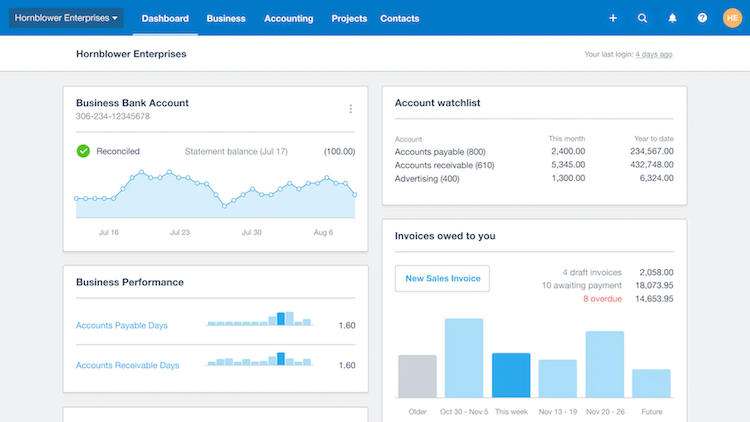

You may choose to switch to a bookkeeping or accountant software not associated with Intuit. If you’re considering alternatives to QuickBooks, Xero is a robust accounting platform worth exploring.

Image credit: Xero

Xero offers a range of features, including:

- Real-time financial data.

- Comprehensive reporting.

- Seamless integrations with numerous third-party apps.

Its user-friendly interface and cloud-based accessibility make it an excellent choice for businesses looking for flexibility and scalability.

Is QuickBooks Desktop still available before the sunset period?

Yes, QuickBooks Desktop is still available for purchase before the sunset period. Intuit will continue selling new subscriptions for QuickBooks Desktop Pro Plus, Premier Plus, Mac Plus, and Enhanced Payroll until September 30, 2024.

How do I purchase QuickBooks Desktop Plus (Pro, Premier, or Mac) or Desktop Enhanced Payroll before the cut-off date?

If you need to purchase these products before the cut-off date, you can contact Intuit’s sales team or call them at 1-888-829-8589. You can no longer purchase them online the traditional way.

If you are looking to purchase an older version of Desktop, be aware that the QuickBooks 2021 end of life date has passed (May 31, 2024). Because QuickBooks Desktop 2021 discontinued before the cut-off date, you can no longer purchase or find support for any versions from that year.

The future of QuickBooks Desktop

The future of QuickBooks Desktop will focus primarily on supporting existing subscribers rather than attracting new ones as Intuit further stresses cloud-based solutions and a SaaS (software-as-a-service) pricing model.

Experts speculate that QuickBooks Desktop Enterprise is the next to go, once the functionality of QuickBooks Online is able to catch up to Desktop’s robust offerings. That said, there is currently no official indication from Intuit that this will happen anytime soon.

How Method can help

If you’re looking to retain your QuickBooks Desktop functionality and gain remote access, consider integrating with Method.

Method ensures you receive the latest critical updates and security patches while automating key workflows, such as:

- Estimating and invoicing,

- Communications.

- Collecting customer payments.

Even after discontinuation, Method stays integrated with QuickBooks Desktop to give you anywhere access and ongoing support.

Recap: Is QuickBooks Desktop being discontinued?

With QuickBooks Desktop discontinued, you need to have a continuity plan in place for your current processes. Whether it’s subscribing before the cut-off date, switching to Enterprise or Online, or migrating to a different accounting software, it’s important to have a strategy ready before it’s too late.

Remember that:

- Intuit will stop selling new subscriptions for QuickBooks Desktop Pro Plus, Premier Plus, Mac Plus, and Desktop Enhanced Payroll after September 30, 2024.

- Existing subscribers of these QuickBooks versions can continue to renew their subscriptions beyond the cut-off date. This means you also still have time to purchase subscriptions for them if you are not yet signed up.

- For the time being, Intuit will also continue to provide security updates, product updates, and support for these existing Desktop subscriptions.

- QuickBooks Desktop Enterprise will not be affected by this discontinuation and will remain available for purchase and support.

QuickBooks Desktop discontinued FAQs

How do I know what QuickBooks Desktop version I’m currently using?

To check your QuickBooks Desktop version, press the F2 key or Ctrl+1 on your keyboard to open the “Product Information” window. Here, you’ll see your product name, product number, license number, version, and release information.

What if I am not currently on a supported version of QuickBooks Desktop?

If you’re not currently on a supported version of QuickBooks Desktop, you won’t have access to live technical support, security updates, payroll processing, and other integrated features like online banking and payments.

If you want these features, you’ll need to upgrade to a supported version as soon as possible, or consider transitioning to QuickBooks Online or QuickBooks Desktop Enterprise. If these features are unimportant to you, you can stay on your unsupported version.

Can I renew a suspended QuickBooks Desktop Plus subscription?

Yes, you can renew a suspended QuickBooks Desktop Plus subscription, provided you do so before the discontinuation cut-off date. If your subscription has been suspended due to non-payment or other issues, you will need to reactivate it to regain full access to your data and features.

Here are the steps to renew a suspended subscription:

- Open QuickBooks Desktop and log in with your admin credentials.

- Go to the Settings menu, then select “Subscriptions and billing.”

- Find your QuickBooks plan and select “Resubscribe.”

- Enter the updated billing information and confirm your payment details.

You will have a grace period of 30 days to renew your subscription after receiving the final notice of suspension. If your subscription remains unpaid after this period, you will only have view-only access to your data for a limited time

How long do I have to resolve any billing or payment issues?

You have until the discontinuation date, September 30, 2024, to resolve any billing or payment issues related to QuickBooks Desktop.

With QuickBooks Desktop discontinued, see how Method helps your business stay afloat.