Today, you’ll get some clarity on a common question — should I switch from QuickBooks Desktop to Online?

In the next few paragraphs, you’ll get guidance on how to make this decision. That said, it’s important to preface things by saying that the answer really depends on how your business is set up and operates.

Keep reading to learn the:

- Scenarios where you should stay on QuickBooks Desktop.

- Top reasons businesses make the switch to QuickBooks Online.

- New subscription option for QuickBooks Desktop.

Let’s get started!

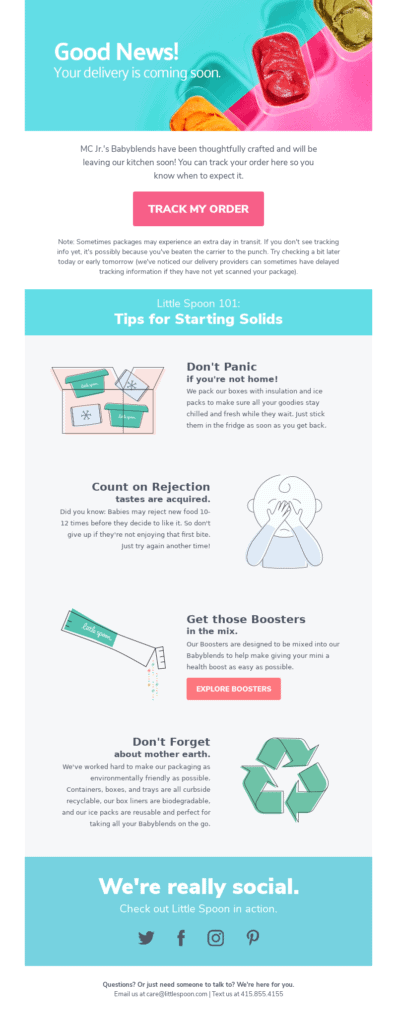

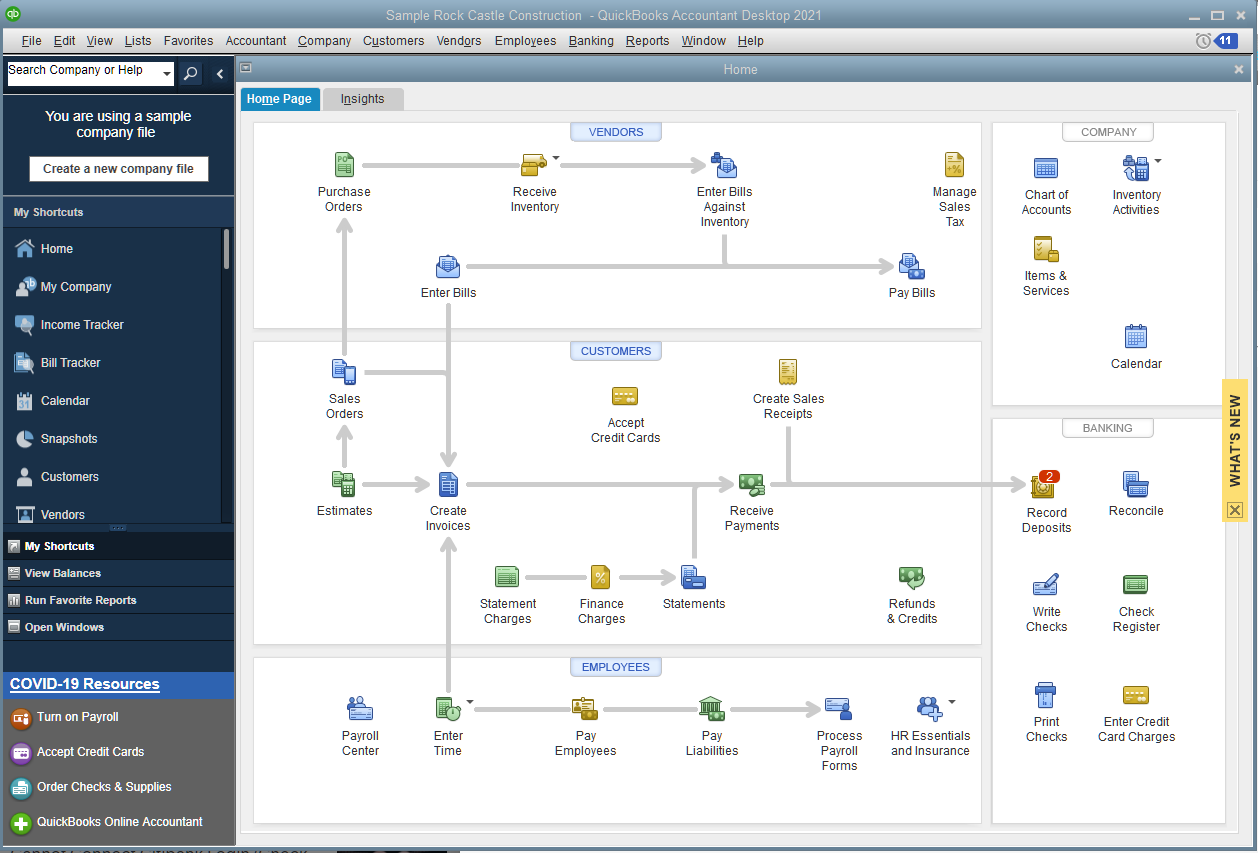

What is QuickBooks Desktop?

Image credit: QuickBooks Desktop

Before answering the question, “Should I switch from QuickBooks Desktop to Online?” let’s get to know QuickBooks Desktop a bit better.

QuickBooks Desktop is a popular accounting software that helps businesses manage their finances and perform tasks like:

- Report generation.

- Payroll handling.

- Inventory tracking.

- Tax management.

QuickBooks Desktop offers different versions to meet specific needs:

- QuickBooks Desktop Pro: perfect for small businesses.

- QuickBooks Enterprise: suited for larger enterprises with complex accounting demands.

QuickBooks Desktop stores all your data on your computer for a traditional, hands-on approach to financial management. Whether you use Mac or Windows, it offers a full suite of tools to handle your accounting processes and the needs of your customers.

Benefits of using QuickBooks Desktop

Using QuickBooks Desktop comes with many benefits:

- All-in-one tool: From basic accounting workflows to managing your entire company file, QuickBooks Desktop makes sure you keep everything on track from a centralized space.

- Feature-packed: QuickBooks Desktop is loaded with a range of features to address diverse business needs.

- Easy reporting: The software gives you a clear snapshot of your business with customizable reports and crucial data like your profit and loss statements.

- Safe and efficient: QuickBooks Desktop boosts productivity and keeps your data secure — all while letting you keep an eye on your products and services.

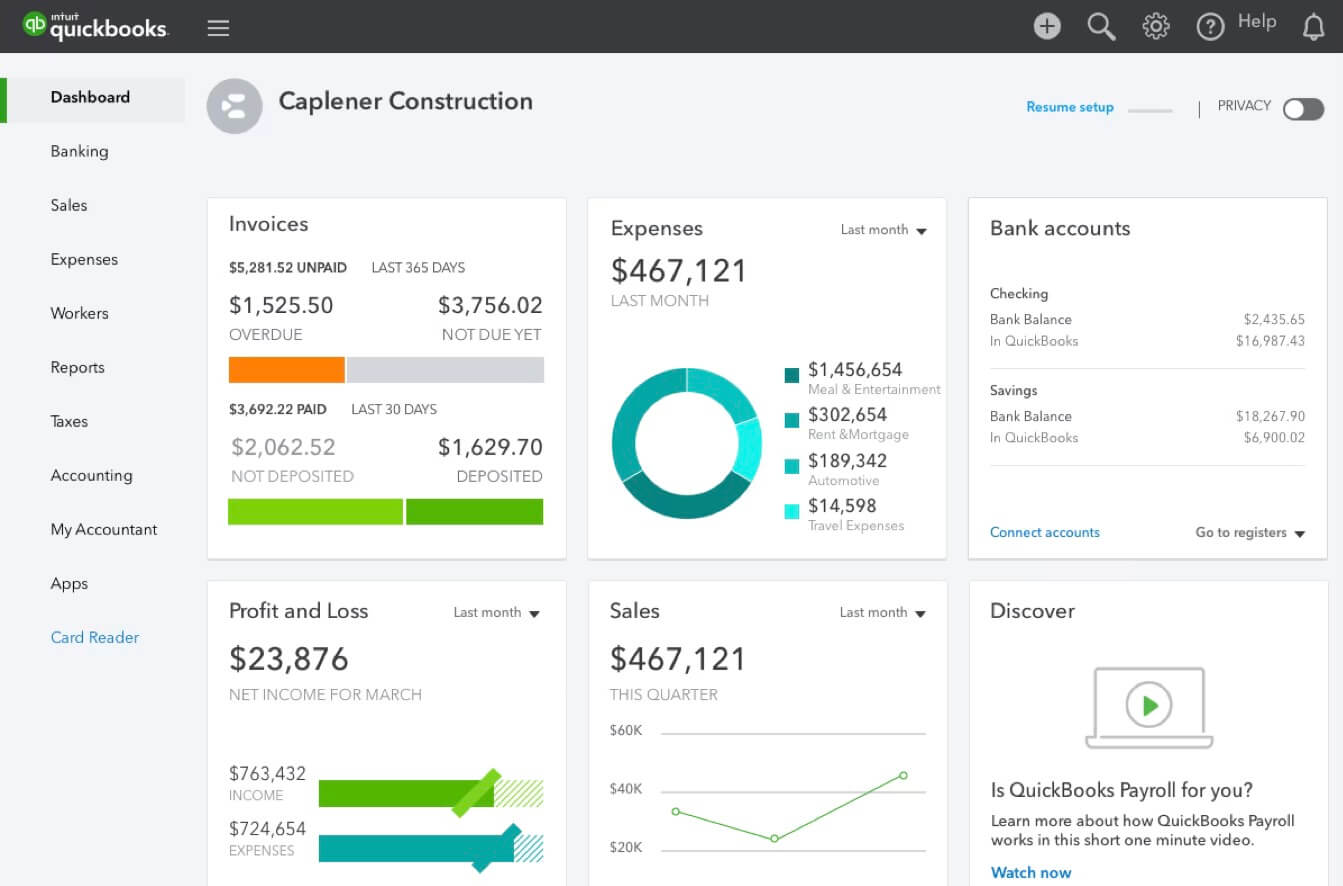

What is QuickBooks Online?

Image credit: QuickBooks

Let’s take a closer look at QuickBooks Online before answering, “Should I switch from QuickBooks Desktop to Online?”

QuickBooks Online is a cloud-based accounting software that improves your business’ financial management. It’s designed to cut down the time you and your employees spend on tasks like:

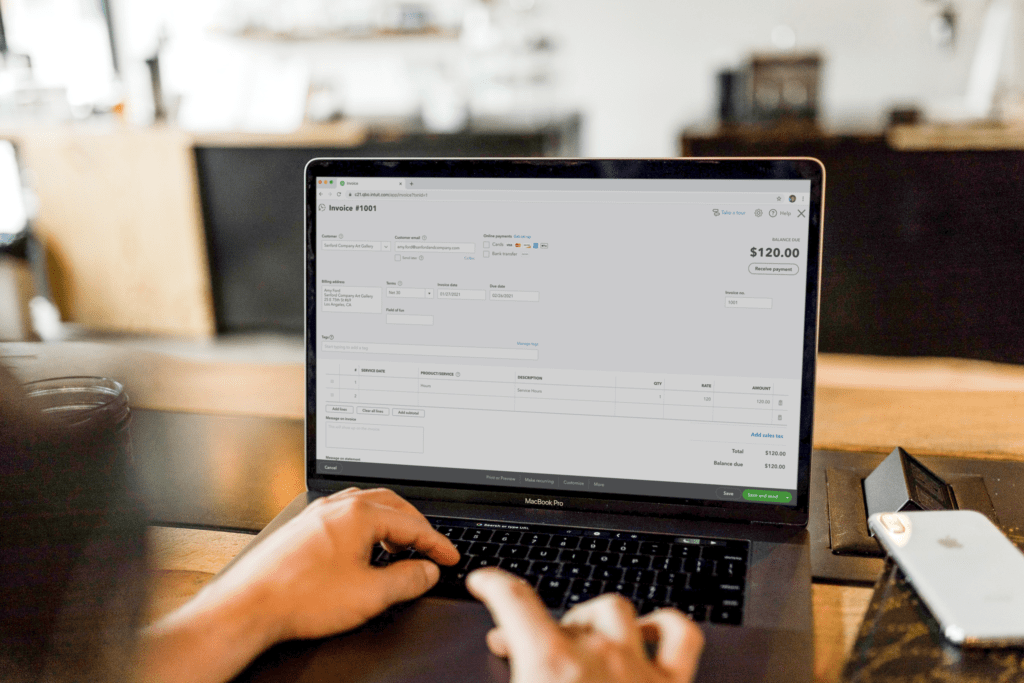

- Bookkeeping and invoice creation.

- Customer and supplier management.

- Expenses and budget handling.

- Sales and cash flow tracking.

Best of all, QuickBooks Online is easy to access from anywhere, any time. However, keep in mind that it requires an internet connection unlike QuickBooks Desktop.

Benefits of using QuickBooks Online

As with QuickBooks Desktop, using QuickBooks Online comes with unique benefits:

- Accessibility: Manage your finances from any corner of the world. This lets you keep your budget and supply chain on track — whether you’re in the office or on the go.

- Automatic updates: No need for tricky installations or updates. Using QuickBooks Online means more time to focus on profit generation and less on tech issues.

- Multi-user access: Collaborate in real time with your team, which makes it simpler to monitor cash flow and share important insights.

- Automatic backups and security: Your financial data backs up automatically and securely to QuickBooks Online, so you don’t have to worry about losing crucial information.

- Simplified invoicing: Online’s automated invoices make managing your finances easier and more accurate.

Get started with your free trial of QuickBooks Online here.

Should I switch from QuickBooks Desktop to Online?

Now that we’ve explored both options, let’s tackle the big question: “Should I switch from QuickBooks Desktop to Online?”

Before making the decision on moving from QuickBooks Desktop to Online, it’s essential to weigh the pros and cons of each option and conduct a comparison of features and functionality. Plus, you need to consider the time and money it costs to make the switch.

While QuickBooks Desktop has robust capabilities, QuickBooks Online offers the advantage of accessibility. To determine the best fit for your business, analyze your specific needs and goals.

Let’s look even closer at the differences between these options so you make the most informed decision for your unique workflows.

QuickBooks Desktop vs. QuickBooks Online: What is the difference?

To answer the question, “Should I switch from QuickBooks Desktop to Online?” let’s take a look at what sets them apart.

The main differences between QuickBooks Desktop and Online are:

- Technical and operational aspects.

- Growth and adaptability.

- Financial factors.

- Accessibility.

Let’s look into these areas closer.

Technical and operational aspects

To start, let’s explore the technical and operational differences between QuickBooks Desktop and Online:

- Version updates: QuickBooks Online automatically updates more frequently than Desktop. In contrast, QuickBooks Desktop requires manual updates, and upgrades come out few and far between.

- Data storage: QuickBooks Online stores your data in the cloud for online access, while Desktop stores it locally. Consider your preference between these two different approaches in terms of data security and privacy.

- Automatic backups: QuickBooks Online provides automatic backups, unlike Desktop, where you’ll need to perform backups manually.

- Remote access: QuickBooks Online allows for remote access, unlike Desktop, which requires additional remote software for on-the-go functionality.

- Integration: While both software versions have designated app marketplaces, QuickBooks Online provides better integration options than Desktop. It offers broader compatibility with third-party apps and easier implementation.

Growth and adaptability

Next, let’s dive into the growth and adaptability differences between QuickBooks Desktop vs. Online:

- Scalability: QuickBooks Desktop is more scalable than Online, especially for large-sized businesses. QuickBooks Enterprise in particular handles complex operations and seamlessly aligns with long-term business plans and scalability.

- Industry-specific tools: When it comes to specific industry needs, both QuickBooks versions offer tools to meet the accounting method and requirements of multiple industries. These include tools for sectors that range from manufacturing to non-profit organizations.

- Customization: When it comes to reporting and customization options, Desktop has more features than Online. These features are advanced and let you personalize the solution for better alignment with your operations.

Financial factors

Now, let’s explore how QuickBooks Desktop and Online vary when it comes to financial aspects.

In terms of subscription pricing vs. one-time purchase, they follow different approaches. For most, QuickBooks Online’s monthly subscription model is more cost-effective than Desktop’s one-time purchase approach, which also includes optional yearly upgrades.

Accessibility

Lastly, let’s discuss how QuickBooks Desktop and Online differ in terms of accessibility:

- Remote access: QuickBooks Online offers better accessibility than Desktop, as you can use it on any device, provided there’s adequate internet reliability and speed. Online is also easier to use than Desktop due to its user-friendly interface and simplified screen navigation.

- User access: QuickBooks Online supports more users simultaneously than QuickBooks Desktop. This means multiple users can access data without the need for additional licenses.

- Support options: Support options vary between QuickBooks Online and Desktop. For example, Online users may depend on web tools for technical support and assistance, whereas Desktop users may rely more on phone and email support.

Product and security updates

QuickBooks Desktop usually rolls out updates once a year. These updates require manual installation and sometimes come with additional costs if you’re upgrading features.

Intuit also releases security patches periodically to ensure your system remains up to standards. Although existing QuickBooks Desktop users still receive continued support for products, it’s important to note that as of September 30th, 2024, certain versions are being discontinued from support and security updates.

In contrast, QuickBooks operates on a cloud-based model, which means you do not need manual updates for your software. Intuit automatically applies:

- Product enhancements.

- New features.

- Security updates.

Cloud-based products like QuickBooks Online also include advanced encryption and continuous security monitoring to safeguard your data against threats.

These differences are what make tackling the question, “Should I switch from QuickBooks Desktop to Online?” tough.

QuickBooks Desktop to Online: When it doesn’t make sense to switch

To help you answer the question, “Should I switch from QuickBooks Desktop to Online?” let’s explore situations where a switch is not the best fit.

The first major checkpoint in this decision is to evaluate the current features you use against what’s available in the QuickBooks Online platform and app ecosystem.

While QuickBooks Desktop and Online share some features and functionality, they are not a like-for-like replacement.

Here are the features native to QuickBooks Desktop that are not available “out of the box” in the Online versions:

- Inventory tracking and automated reordering points.

- IIF import files.

- Custom fields on invoices and bills.

- Job progress invoicing.

- Job costing.

- Sales orders.

If any of these features are part of your workflow today, you may need to get creative and dig deeper into the nitty-gritty of the QuickBooks Online offering.

For example, let’s look at custom invoice fields in QuickBooks Online. While the capability exists, it does so in a more limited capacity than in QuickBooks Desktop.

As a result, you need to think about the level of customization your QuickBooks invoices need and include this in your decision to move from QuickBooks Desktop to Online.

In other cases, such as inventory tracking, you will need to invest in a third-party application from the QuickBooks Online app store to unlock the functionality.

Now, it’s important to note that installing third-party applications is not necessarily a bad thing. You should instead view this as an opportunity to extend the power of QuickBooks Online and get the exact functionality you need.

In some cases, the combination of QuickBooks Online and third-party applications results in a solution that goes well beyond the functionality of QuickBooks Desktop and provides you with a more powerful tool.

When looking at apps as part of your decision to move from QuickBooks Desktop to Online, you should consider the following questions:

- Does the app meet (or exceed) the QuickBooks Desktop features you use today?

- Does the incremental cost of the app justify the impact it will have on your business?

- Can you import your historical data from QuickBooks Desktop into this new app?

If you answered, “Yes” to these questions, switching to QuickBooks Online might meet your specific needs around:

- Legal compliance.

- Payroll.

- Time tracking.

Limitations of QuickBooks Desktop

Answering the question, “Should I switch from QuickBooks Desktop to Online?” becomes easier when you understand the limits of QuickBooks Desktop.

Mobility

When it comes to mobility, QuickBooks Desktop restricts you a bit. For vendors and products on the move, the ability to migrate or convert data is essential.

That’s where Desktop falls short compared to Online, which enhances accessibility and mobility. Online is more mobile-friendly than Desktop in almost every way.

Multiple-user access

QuickBooks Desktop is limited in collaboration and multi-user access. It doesn’t easily allow for remote access. Plus, assessing finances as a team may require additional licenses.

Automatic updates

QuickBooks Desktop users may find themselves missing out on the latest features.

Unlike QuickBooks Online, QuickBooks Desktop lacks automatic updates and backup functionality. This means you’ll need to manually install updates to stay current.

Integration with online apps

QuickBooks Desktop is limited in its integration with third-party apps.

This can slow down your workflow and result in missed opportunities for productivity-enhancing features.

Backup

QuickBooks Desktop lacks automatic data backups, which makes data security and privacy a concern.

In contrast, QuickBooks Online provides automatic backup and recovery options to minimize risk.

User interface

QuickBooks Desktop has a different user interface than the more modern QuickBooks Online. This impacts the learning curve and training needed for users to adapt.

That’s why getting to know the transition and onboarding process is key when starting with QuickBooks Desktop.

Diving into feedback from current QuickBooks Desktop users, as well as user reviews and testimonials will guide your decision if you’re leaning towards Desktop.

Subscription model

Lastly, QuickBooks Desktop has a different pricing model than QuickBooks Online. QuickBooks Online requires a subscription, while QuickBooks Desktop requires a one-time purchase.

Although a one-time purchase avoids recurring payments, it also involves a higher initial investment. This can be a strain for small businesses just starting out.

On a related note, it’s also wise to understand QuickBooks Desktop’s cancellation and refund policies, as they affect your software’s overall cost and flexibility.

When you might choose QuickBooks Online vs. Desktop

Now that we’ve covered the key factors when asking, “Should I switch from QuickBooks Desktop to Online?” let’s review why businesses are making the switch.

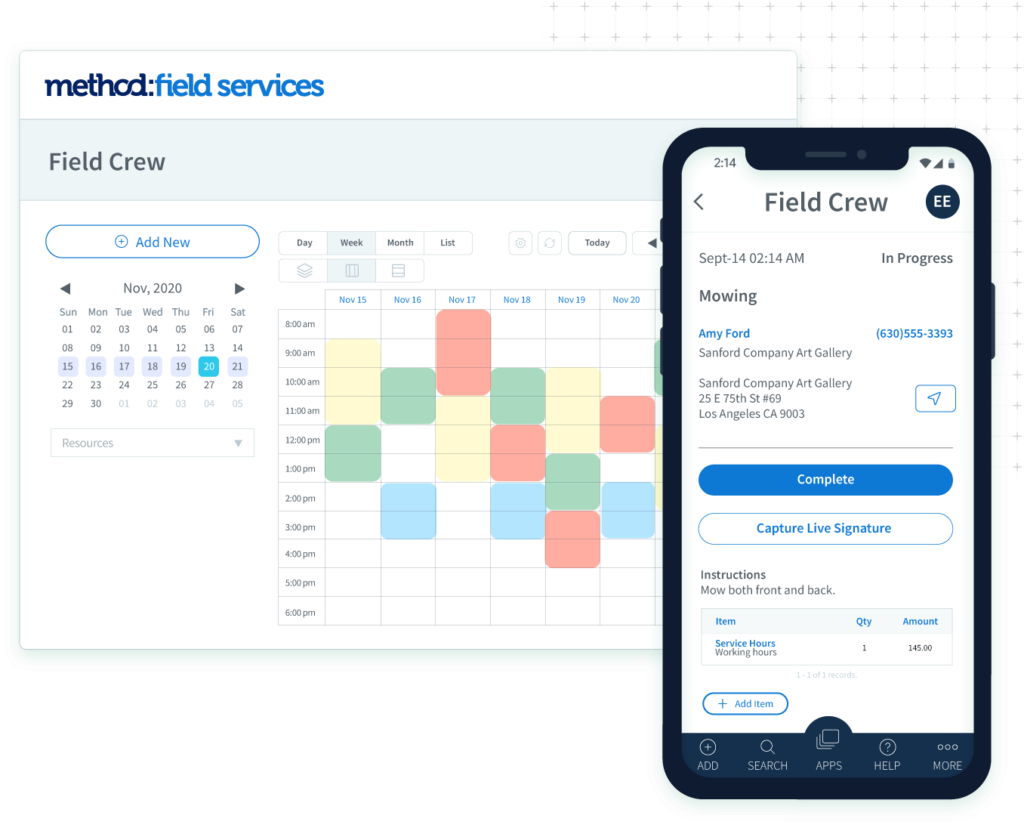

1. Improved workflow and automation

Switching to QuickBooks Online enhances back office accounting with automation that is more efficient than Desktop.

The real game-changer here is that QuickBooks Online offers better accessibility than its desktop counterpart. This means you can tap into a range of automation opportunities more easily.

Right from the get-go, you’ll enjoy support for two common recurring workflows — invoicing and bank statement imports.

2. The robust app ecosystem

The beauty of QuickBooks Online’s cloud-based architecture lies in how it integrates better with third-party apps than QuickBooks Desktop. This means you can easily connect with a range of other solutions to enhance your business operations.

Plus, QuickBooks Online has more features than QuickBooks Desktop through its more extensive app store. Whether you need specific point solutions or full-fledged QuickBooks CRM integrations, these tools free up time by reducing manual, repetitive work.

3. Access from any location, on any device

As is the case with any cloud product, you no longer need to worry about hardware compatibility or having the latest and greatest technology to run your business applications with QuickBooks Online.

It’s cloud-based, unlike QuickBooks Desktop. So, all you need is a device with a browser, and you have access to your data!

This also means you do not need to manage any local installations or “helper” applications for third-party tools — which are often a point of friction for businesses getting set up or migrating to new hardware.

Because QuickBooks Online runs on Intuit’s servers and databases, Intuit also manages the hardware and its redundancy. This saves you from the worry of managing a local QuickBooks Desktop file. Not to mention, it’s more cost-effective than maintaining your own hardware.

Subscriptions for QuickBooks Desktop

QuickBooks Desktop Pro or Premier

As of the September 30 stop-sell, QuickBooks Desktop Pro and QuickBooks Premier versions are no longer available to purchase in the United States. This decision marks a significant change in Intuit’s strategy as they focus more on cloud-based solutions and subscription models.

This does not affect existing Desktop customers, who can continue to use their software and renew it after September 30th. It’s also important to note that Intuit is continuing support for these versions for current subscribers. This includes providing:

- Security updates.

- Product updates.

- Technical support.

QuickBooks Desktop Enterprise

QuickBooks Desktop Enterprise continues to be available and supported to all users. It isn’t impacted by the QuickBooks Desktop stop-sell decision. If you have a larger business with more complex needs like deeper inventory management and advanced functionality, upgrading to a QuickBooks Enterprise subscription may be worth considering.

Can you transfer data from QuickBooks Desktop to Online?

If you’re considering a switch to QuickBooks Online, the good news is that transferring data from QuickBooks Desktop to Online is possible. With specific tools and guidance, it’s a straightforward process.

Is migration right for you?

For existing QuickBooks Desktop users, the decision to migrate to Online is a tough one. It’s important to remember that the stop-sell affects only new sales of specific QuickBooks Desktop products in the U.S., including:

- Pro Plus.

- Premier Plus.

- Mac Plus.

- Enhanced Payroll.

If you’re an existing customer, you can continue to use it and renew it — and you’ll still receive updates and support from Intuit.

But consider your business’ specific needs. For example, if you require advanced inventory management, QuickBooks Enterprise might be a better option.

In the same way, the comprehensive features and cloud accessibility convenience of QuickBooks Online could offer a more useful accounting solution.

What converts and doesn’t from QuickBooks Desktop to Online

You can convert most of your essential financial data to QuickBooks Online, including your:

- Company information.

- Chart of accounts.

- Customer and vendor details.

- Transactions.

This ensures smoother operations and minimal disruption to your accounting processes.

Unfortunately, some data and features may not transfer directly due to differences between the platforms. This includes:

- Certain custom financial reports.

- Any transaction types.

- Advanced inventory details.

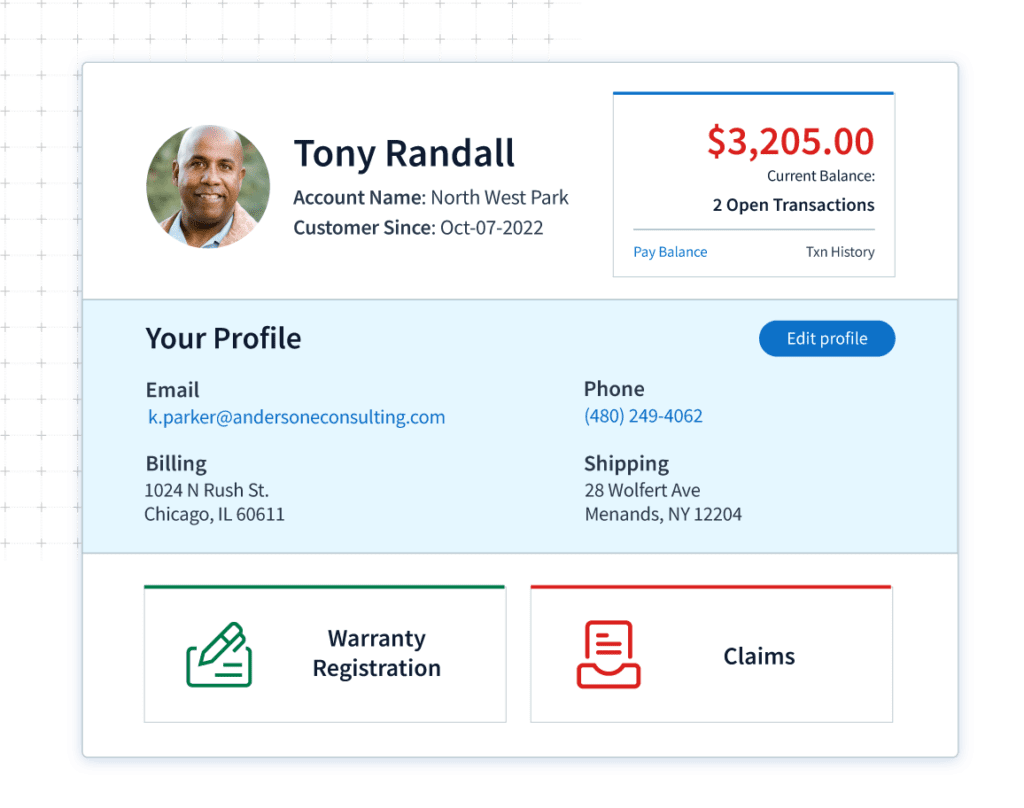

How Method helps with your transition

If you have a Method account connected to your QuickBooks, Method is proactively offering guidance and support to ensure a seamless shift. This includes:

- Personalized support: Method’s team is ready to assist with accounts remapping to retain functionality and data integrity.

- Transition tools: Using migration tools and Method’s expertise, rest assured that your data transfer is complete and accurate.

- Educational resources: Method provides additional resources, including webinars and help center articles, so you have all the information you need on migration process and best practices.

You can transfer your data from QuickBooks Desktop to Online. To do this:

- Start by logging in as an admin to the company file you want to import.

- Navigate to the Company menu and select “Export Company File to QuickBooks Online.” This jumpstarts the data conversion process.

- Click on “Get started.”

- Select the destination by clicking “Select destination.”

- Sign in to your QuickBooks Online account, and you’re on your way to seamless data transfer.

So, there’s no need to worry about your desktop data when considering, “Should I switch from QuickBooks Desktop to Online?”

Is it hard to switch from QuickBooks Desktop to QuickBooks Online?

You may wonder whether switching is a challenging task when asking, “Should I switch from QuickBooks Desktop to Online?”

The answer is no. It’s not hard to switch from QuickBooks Desktop to QuickBooks Online. Intuit has simplified the process to make it as easy as possible. You can find detailed steps on the QuickBooks website for importing your information into QuickBooks Online.

Migration tools and support to get started

Intuit provides a QuickBooks Migration Tool that transfers data from Desktop to Online. This tool guides you through the process and automatically moves data like your:

- Company file.

- Accounts.

- Transactions.

- Customer and vendor details.

The tool simplifies the process to make it accessible even if you have limited technical expertise.

If you’re integrated with Method CRM, transitioning to QuickBooks Online requires a couple of additional steps to ensure that all linked data and custom workflows continue to operate smoothly. You’ll have access to personalized support and solutions to remap your account and ensure a smooth transition.

QuickBooks Desktop vs. Online: Key takeaways + some bonus reading

Deciding to switch from QuickBooks Desktop to Online is not as straightforward of a choice as you may have thought.

The beauty of this decision, though, is that both platforms are very similar in terms of core functionality. This means that the factors you need to consider are more around the nuances of how you ultimately use QuickBooks on a day-to-day basis.

Start your free 30-day QuickBooks Online trial and get 30% off your subscription during your first year.

For some further reading, check out how Method:Partner Victoria Cameron evaluated the switch, as well as her top tips for making the transition!

Should I switch from QuickBooks Desktop to Online FAQs

Why are companies switching from QuickBooks Desktop to QuickBooks Online?

More and more companies are making the switch from QuickBooks Desktop to QuickBooks Online, and here’s why:

- Accessibility: QuickBooks Online offers the flexibility to access financial data from anywhere, any time. Also, it is more accessible on mobile devices than Desktop.

- Automatic updates: QuickBooks Online is continuously updated, unlike Desktop. It automatically implements the latest features and security patches, sparing you the hassle of manual backups and updates.

- Scalability: As businesses grow, their needs change. QuickBooks Online makes it easier to scale up, as it offers a number of plans that grow with your business.

- Integration with other apps: QuickBooks Online integrates with a wide range of business applications to centralize your operations.

- Improved collaboration: Cloud-based accessibility makes it simpler for teams to work together efficiently, regardless of their location.

In a nutshell, companies are switching to QuickBooks Online for its convenience, accessibility, and ability to adapt to growing business needs. That’s why more business owners are asking the question, “Should I switch from QuickBooks Desktop to Online?”

Do accountants prefer QuickBooks Desktop or QuickBooks Online?

Accountants’ preferences vary, and there’s no one-size-fits-all answer. Some prefer QuickBooks Desktop, while others prefer QuickBooks Online:

- QuickBooks Desktop: Accountants who prefer QuickBooks Desktop appreciate its robust features, customizability, and ability to work offline. With more features than QuickBooks Online out of the box, it’s ideal for those who have complex accounting needs.

- QuickBooks Online: Accountants like QuickBooks Online as it offers real-time collaboration, internet accessibility, and automatic updates. It’s ideal for users who value mobility and teamwork.

The choice really depends on your unique needs!

Can users still use QuickBooks credit card processing features with QuickBooks Online?

Yes, QuickBooks Online supports credit card processing directly within the platform. It’s easier to use than other systems, as it offers a simplified way to manage credit card payments for your business.

Should I move clients from QuickBooks Desktop to Online?

Moving clients from QuickBooks Desktop to Online depends on their specific needs. QuickBooks Online offers cloud-based software access and automatic updates, which makes it suitable for clients requiring flexibility and real-time collaboration. Consider your clients’ business size, industry needs, and the features they rely on before making a decision.

Does QuickBooks Online sync with QuickBooks Desktop?

QuickBooks Online and QuickBooks Desktop are separate products and do not sync directly with each other. Data migration tools are available to transfer information from Desktop to Online, but continuous, real-time syncing between the two platforms is not supported.

Strengthen your QuickBooks workflows today with a free trial of Method.

Image credit: Prostock-studio via Adobe Stock